Highlights

- Vanadium Resources has marked a major milestone with the completion of a successful DFS, underpinning the development of its world-class asset.

- The highly positive study outcomes confirm that the Steelpoortdrift Project is well-positioned to become the next major vanadium producer globally.

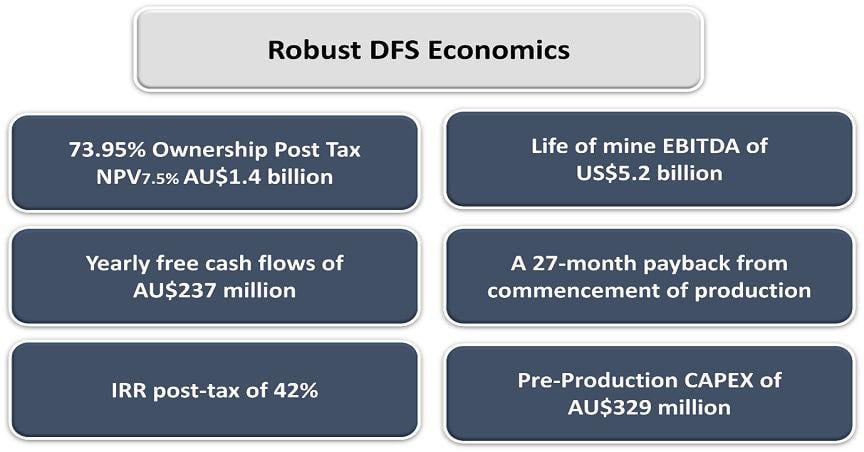

- The DFS delivered a net present value (100% ownership) of AU$1.9 billion.

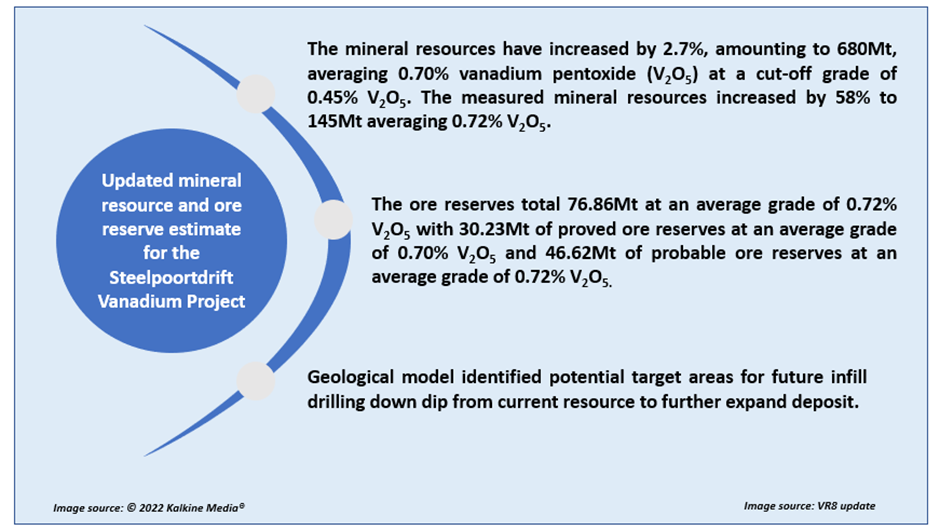

- The updated Mineral Resource and Ore Reserve estimate for the Steelpoortdrift Project as part of the DFS has boosted confidence levels at the Measured Mineral Resource category.

Vanadium Resources Limited (ASX: VR8; DAX: TR3) has updated on the completion of an independently prepared Definitive Feasibility Study (DFS) on its world-class Steelpoortdrift project.

Moreover, the company shared an updated Mineral Resource and Ore Reserve estimate for the project, completed as part of the DFS.

DFS points to robust project economics

The company has completed the study with flying colours, doing an outstanding job in demonstrating the financial and technical viability of its 73.95% held Steelpoortdrift Project in the Limpopo Province of South Africa.

The study has concluded that the Steelpoortdrift project is robust and economically feasible to produce a total of 484,000t of V2O5 flake over 25 years. The project has a net project value (NPV) 7.5% of US$1.21 billion.

The DFS has also demonstrated that there is potential for further optimising project economics through the addition of focused value engineering studies identified to lower project costs, boost the Life of Mine to more than 100 years, improve earnings potential and further lower impacts on the environment.

Key DFS highlights

- Further LOM of up to 67 years readily accessible in the designed open pits within a low environmental and social impact inclusion zone

- At current throughput rates, the life of mineral resources in open pit is more than 180 years

- It is projected that final flake product grades are to be more than 98.0% V2O5 with the potential to produce more than 99.0% V2O5 product through the conventional SRL process

- Sensitivity analysis was carried out and demonstrated a robust project at a range of downsides such as at flake prices up to US$4.60/lb or at an increase in Opex by more than 150%

- It is anticipated that a renewable energy solar plant will result in a 34% reduction in carbon emissions and carbon tax

Commenting on the DFS result, the company’s Executive Chairman, Jurie Wessels said, “The DFS validated our previous studies and that it returned financial numbers proximate to those previously attained despite an environment of peak inflation.”

According to the company’s CEO, Eugene Nel, most of the project costs, including opex as well as capex are being procured locally. This minimises inflationary effects in these areas to nearly 5% for both compared to the PFS.

“It is our belief that the project outcomes deliver the values required to progress this project into construction phase and to become the next major Vanadium producer globally. We are excited to progress this project for the benefit of all stakeholders”, said Nel.

Updated Mineral Resource and Ore Reserve estimate for Steelpoortdrift

The updated Mineral Resource and Ore Reserve estimate for the Steelpoortdrift Project resulted in a re-interpretation of the geology, an enhanced block model, Life of Mine plan and revised Mineral Resource and Ore Reserve statements.

VR8 shares were trading at AU$0.100 midday on 5 October 2022.