Highlights

- Tempest Minerals has launched a non-renounceable rights issue to raise approximately AUD 1.47 million before costs.

- Funds will support the development of the Yalgoo Project and additional gold exploration efforts.

- The offer may result in the issuance of up to 367.26 million new shares and 91.82 million options.

Tempest Minerals Ltd (ASX:TEM) has announced a non-renounceable rights issue aiming to raise approximately AUD 1.47 million (before costs). The funds raised will be directed towards the advancement of iron ore exploration and development at the Yalgoo Project, as well as ongoing gold exploration initiatives.

Entitlement offer details

Under the terms of the entitlement offer, eligible shareholders can subscribe for one new share for every two shares held, at an issue price of AUD 0.004 per share, representing a discount of 9.5% to the 5-day volume-weighted average price (VWAP) of AUD 0.00438.

For every four new shares subscribed for, shareholders will secure one free-attaching option. These options are exercisable at AUD 0.01 each, expiring on or before 31 May 2027. The offer is expected to result in the issuance of up to approximately 367.26 million new shares and 91.82 million new options.

The record date to determine eligibility for the offer is 14 May 2025.

Lead Manager Appointment and Fees

Cygnet Capital Pty Limited has been appointed as the lead manager for the offer. Cygnet will receive a 6% fee on the capital raised. Additionally, subject to shareholder approval, Cygnet will be issued up to 28.04 million unlisted options, representing 6% of the new shares issued, with the same terms as those offered to participating shareholders.

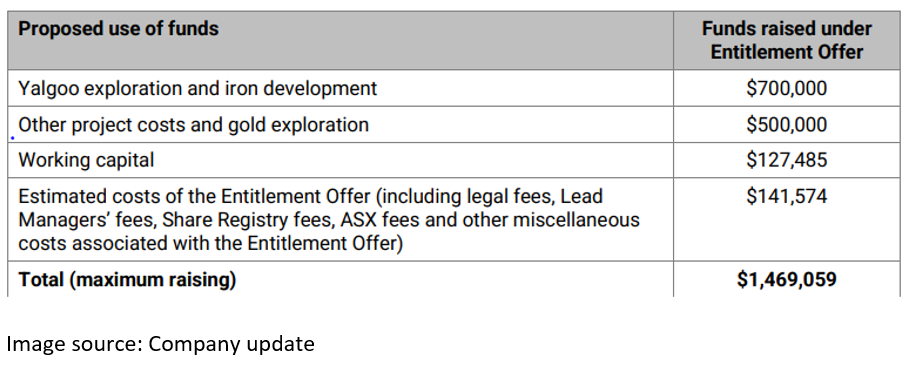

Use of funds

The company intends to allocate the proceeds from the capital raise as follows-

TEM shares traded at AUD 0.004 per share on 8 May 2025.