Highlights

- Surefire Resources has secured a loan drawdown facility of up to AU$500,000 from Vargas Holdings Pty Ltd.

- The expiry date of the company’s ATM subscription agreement with Acuity Capital has been extended to 31 January 2029.

- The company plans to issue an additional 80 million shares to Acuity, pending shareholder approval.

Surefire Resources NL (ASX:SRN), a mineral exploration company based in Western Australia, has secured a loan drawdown facility of up to AU$500,000 from Vargas Holdings Pty Ltd. The funds will be used for the company’s general working capital needs.

In addition, Surefire has negotiated an extension with Acuity Capital for its At-the-Market (ATM) subscription agreement, previously referred to as a Controlled Placement Agreement. The expiry date has been extended from 31 January 2026 to 31 January 2029.

Funding Boost with AU$500,000 Loan

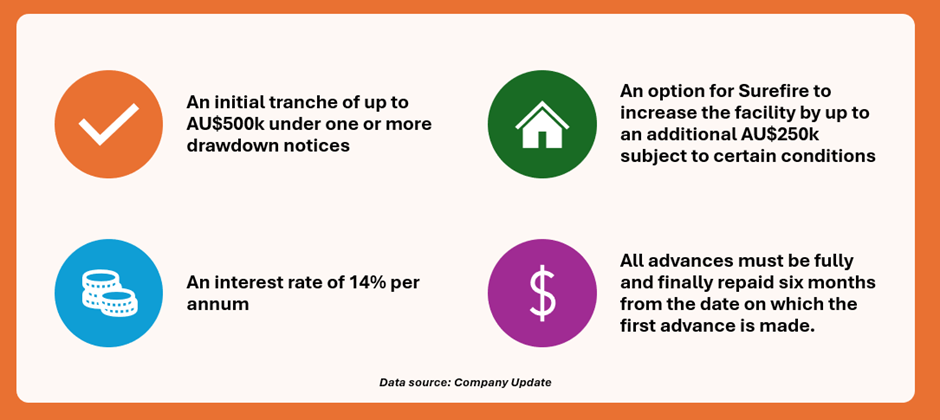

Vargas Holdings Pty Ltd is associated with Mr Vladimir Nikolaenko, Surefire’s Executive Chairman. The agreement with Vargas for the loan facility encompasses the following:

Although this facility agreement provides the company with additional funding, the board continues to explore further financing options for future operations.

Extension of ATM and Increase in Collateral Shares

Surefire’s ATM was initially established with an expiry date of 31 December 2020, allowing for up to AU$2 million in standby equity capital. It was first extended to 31 January 2023, then to 31 January 2026, and is now to 31 January 2029. To date, Surefire has not used the ATM to raise capital.

Furthermore, Surefire plans to increase the number of shares held as security by Acuity Capital under the ATM (subject to shareholder approval). If approved, the company will issue an additional 80,000,000 shares to Acuity at nil cash consideration. It will increase the number of shares held as security against the ATM to 100,000,000 (Collateral Shares).

It is important to note that Surefire is not obligated to utilise the ATM, and there are no fees or costs related to the extension.

The share price of SRN was AU$0.0050 at the time of writing on 29 October 2024.