Highlights

- SRN’s Managing Director recently presented at the Paydirt Battery Minerals Conference

- The company is progressing with off-take discussions from its Victory Bore Project, with focus on the lucrative Vanadium market

- Currently, the Victory Bore Project is in Pre-Feasibility stage and metallurgical and other studies are also progressing

- There is also scope of High Purity Alumina (HPA), the total global demand of which was between 60,000 tpa and 80,000 tpa in 2022

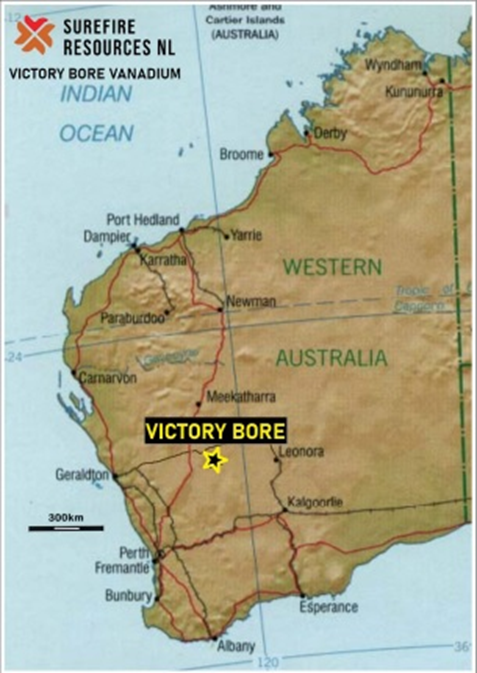

Australia's listed mineral exploration company Surefire Resources (ASX: SRN) recently attended the Paydirt Battery Minerals Conference held in March 2023. Paul Burton, the company's Managing Director, discussed the ongoing developments at the company and focused primarily on SRN's Victory Bore Deposit. Victory Bore is Surefire's battery and critical minerals focused project in Western Australia.

The Project -- which is going through its Pre-Feasibility stage -- is located in close proximity to already existing critical infrastructure. Notably, Surefire's other interests -- magnetite project with up to 1B tonnes of high grade Iron, and SRN's Gold Project (both in Western Australia) -- are also significant for the company's future growth.

Below are the major elements that were presented during the Paydirt Battery Minerals Conference.

Capital and management

Surefire is backed by a strong experienced team with Paul Burton, a geologist and mineral economist, as its Managing Director, Vladimir (Roger) Nikolaenko, an exploration, project evaluation, development veteran, as the Executive Chairman. Michael Povey, a mining expert, and Roger Smith, an operations expert with numerous past proprietary company directorships are the non-executive directors.

The company’s cash stands at AU$2.8 million, and notably, it has nil debt.

About Victory Bore Project

Source: SRN Presentation dated 22 March 2023

Surefire states that its fully-owned Project -- located 400 km from the Geraldton Port -- has excellent metallurgical characteristics. There is high concentration grade of +1.43% Vanadium Oxide (V2O5). The Project's Total resource base, according to the latest Presentation, stands at 1,003 Mt (megatonne) @ 0.20% to 0.39% Vanadium Oxide to 1,511 Mt @ 0.39% to 0.43% Vanadium Oxide.

Described as "world-class" by Surefire Resources, the Project is one of Australia's biggest Vanadium and Battery mineral deposits. As per the company the Victory Bore project has potential of over 3 billion pounds of contained Vanadium Oxide and high purity Alumina (HPA) Aluminium Oxide. Other key features include nil exposure to cover rock, saleable Fe/Ti concentrate, synergies with worldwide Vanadium producers, and the high purity alumina potential.

Besides, the company is progressing with off-take discussions, with its primary focus on the lucrative Vanadium market, where there is an uptick in demand with no new producers entering the supply side. Additionally, the >10 km strike provides Surefire a huge scope for resource expansion.

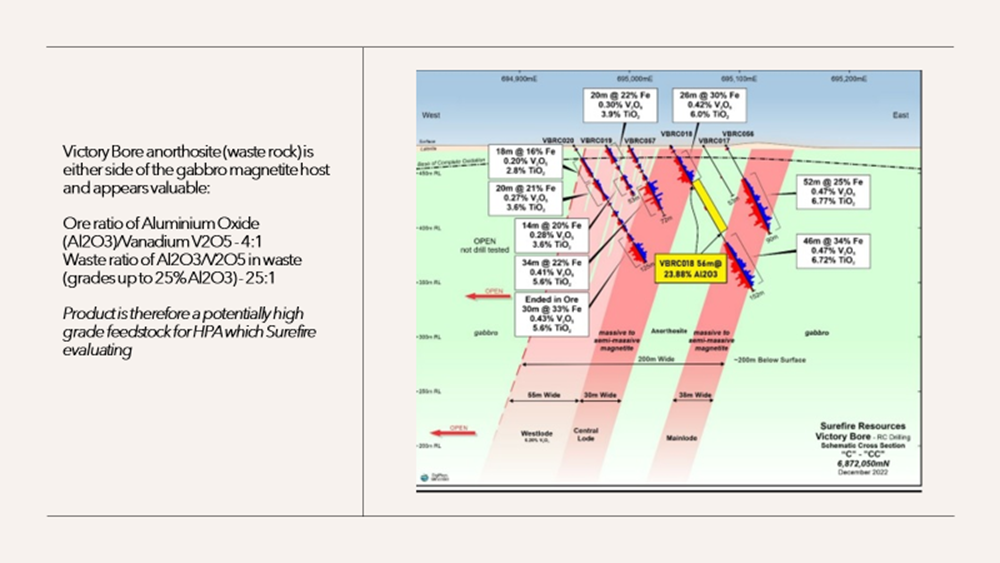

Source: SRN ASX announcement dated 21 March 2023

Pre-Feasibility stage

Surefire has stated that the resource at Victory Bore comprises two thick holes of vanadiferous magnetite in Gabbro (magnetite host) open (at depth over 160 metres, and strike over 10 km). The waste rock anorthosite is at either side of Gabbro and SRN mentions it to be valuable. More information on ore ratio and waste ratio is in the below picture.

Source: SRN Presentation dated 22 March 2023

Besides, the company targets the Pre-Feasibility stage’s completion by mid-end 2023. The focus is on extraction of Vanadium, which has applications in the battery sector, from the concentrate. SRN has further stated that metallurgical and other studies are also progressing.

Vanadium Flow batteries (30%) and Li-ion batteries (60%) dominate the battery market, which is predicted to grow immensely by 2025. Moreover, a breakthrough flow battery cell configuration by Georgia Tech engineers has the ability to reduce the size and cost of entire flow batteries.

High Purity Alumina (HPA)

Notably, High Purity Alumina presently sells at over US$20,000 per tonne and the company is evaluating this potential at Victory Bore. Lave Blue has been appointed by SRN for commencement of testwork. It is mentioned that the total global demand of HPA last year was between 60,000 tpa and 80,000 tpa, with annual growth estimated to be between 13.5% and upwards of 20%. HPA finds applicability in LED replacement lighting, CO2 emission separators, li-ion battery cells and other industries.

Next steps

Surefire states that highly positive outcomes are likely after the Pre-Feasibility stage completion and it will then assess Vanadium Oxide extraction for producing VE. As stated earlier, offtake discussions have already begun.

SRN's shares traded at AU$0.021, with a jump of over 10.5%, at the time of writing on 23 March 2023.