Summary

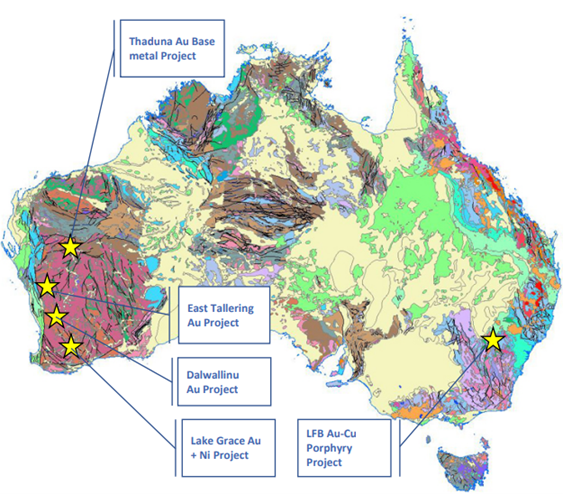

- Sultan owns five projects in Yilgarn craton and Lachlan Fold Belt

- Gold and precious metals project in the established mining neighbourhoods

- Acquisition of LFB project completed in late June

Sultan Resources Ltd (ASX: SLZ), the newest entrant to the Lachlan Fold Belt, with the completion of 100% acquisition of Colossus Metals and its Macquarie Arc Gold-Copper project in the New South Wales.

Sultan recently announced the completion of the acquisition agreement which was signed in March this year. Sultan owns and explores the base and gold metals projects including the Lake Grace Ni-Co-Au project, East Tallering Gold project, Dawallinu Gold project and Thadauna Au-Cu project in the Yilgarn Craton.

Must Read: Sultan’s Key Gold and Base Metals Portfolio in the Yilgarn Craton of WA

Lake Grace is an advanced project stretching over 5 tenements with major separate sub-project areas such as-

- Lake Grace Gold project

- Lake Grace Nickel/Cobalt project

Sultan’s unexplored multi-commodity interests in proven mining districts Source: Company’s Report

Sultan’s strong grounds in the Lachlan Fold Belt

Sultan’s portfolio stretches over 1,272 square-kilometres with high potential Gold, Copper, Nickel and Cobalt in the neighbourhood of recent discoveries. Sultan has focussed on exploring the critical project in the vicinity of established exploration projects and mining operations such as-

- The LFB Au-Cu Porphyry project is located south of Alkane Resources Ltd’s (ASX:ALK) Boda discovery where an intercept of 507 metres at a grade of 0.48 g/t gold and 0.2% copper was struck in 2019. The region is known for established mining operations including Newcrest Mining Limited’s Cadia -Ridgeway Au-Cu operations.

- Thaduna Gold Prospect in the Meekatharra area of Western Australia. The project is adjacent to Lodestar Mineral’s recent Ned’s Creek Gold discovery.

- The Lake Grace Gold project is in the vicinity of Explaurum Limited’s (ASX: EXU) Tampia Gold project with mineral resources of 700-kilo ounces.

Sultan Resources Offers Excellent Returns to shareholders

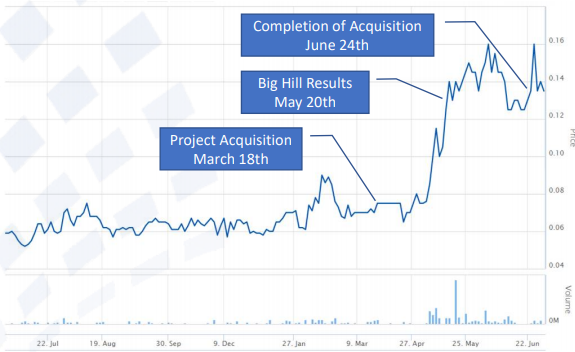

Activities pick up pace: The acquisition of the LFB project was announced on 18 March, the soil and rock chip sample assay results from the Big Hill deposit on 20 May and finally, the acquisition was completed on 24 June 2020.

Source: Sultan

Read Here: Sultan Hits homerun with Gold and Base Metals Projects in Yilgarn Craton and Lachlan Fold Belt

With the acquisition completed and now advancing on further exploration projects to carry out the maiden drilling program in 2020 itself.

Strong Financial footing: Sultan holds cash reserves of $2 million and is well placed to advance on the further exploration activities planned at the Lachlan Fold Belt projects. With the acquisition completed and now the company is advancing on further exploration projects to carry out the maiden drilling program in 2020 itself.

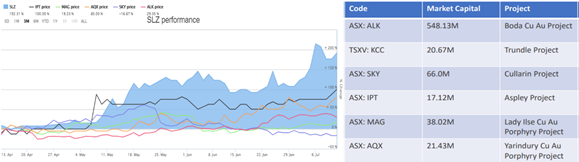

Source: ASX & Sultan Resources

Market gives a thumbs up to Sultan: Sultan closed at $0.18 a share, with a market capitalisation of $10.85 million offering a return of over 200% in the past 3 months (as on 13 July 2020). The strong past performance on ASX is substantiated by events relating to the addition of new LFB projects to the portfolio and strong exploration results. Moreover, Sultan has not only performed on an absolute standalone basis, but it has also outperformed its peers as highlighted in the chart above.

An accelerated exploration program by the established exploration and development team at Sultan to advance on high priority targets with a strong potential to host bulk mineralisation in the Lachlan Fold Belt establish the unique explorer with a strong foundation.

All financial information pertains to Australian currency Unless stated otherwise.