Highlights

- During the September quarter, Viking focused on progressing exploration at its Canegrass Battery Metals Project in WA.

- VKA has now advanced to Stage 2 of the Farm-In Agreement (FIA), to increase its project stake with the right to earn additional 24%.

- Newly discovered zones of vanadium mineralisation have been returned from drilling at the Fold Nose to Kinks South target areas.

- VKA is focused on completion of updated Mineral Resource Estimate for the Kinks Deposit and the Fold Nose Deposit. Maiden MRE is also in pipeline for the Kinks South.

Viking Mines Ltd (ASX: VKA) recently announced its September 2023 quarter report. The period saw major developments across the Canegrass Battery Metals Project.

VKA has built a solid cash position with AU$5.58 million, as of 30 September 2023, up AU$1.45 million over the last quarter.

Canegrass Farm-In: During the quarter, the company focused on progressing exploration at its Canegrass Battery Metals Project, WA. Upon completion of Stage 1 of the FIA, Viking has acquired a 25% equity stake in Canegrass Project.

VKA has now advanced to Stage 2 of the FIA, holding the right to earn additional 24% interest in case the exploration expense of the project touches AU$2 million by August 2024.

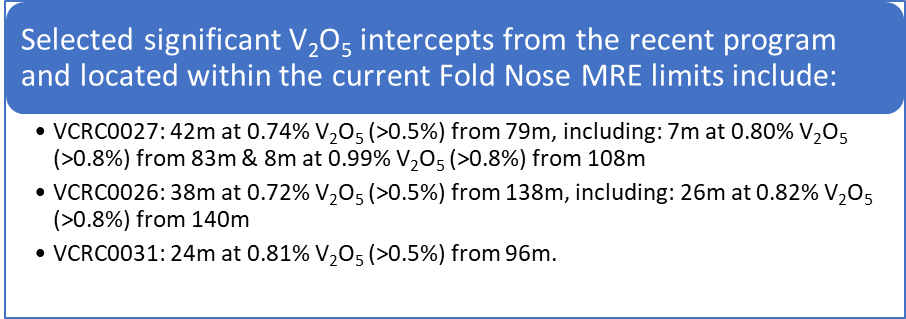

Major 7,500m Drilling Program: VKA drilled total 17 holes over 2,768m across eight target areas, to extend and grow the Inferred MRE for the Fold Nose and Kinks Deposits that has been estimated at 79Mt at 0.64% V2O5.

Thick high-grade zones of vanadium mineralisation were returned from all the target areas.

Data source: company update

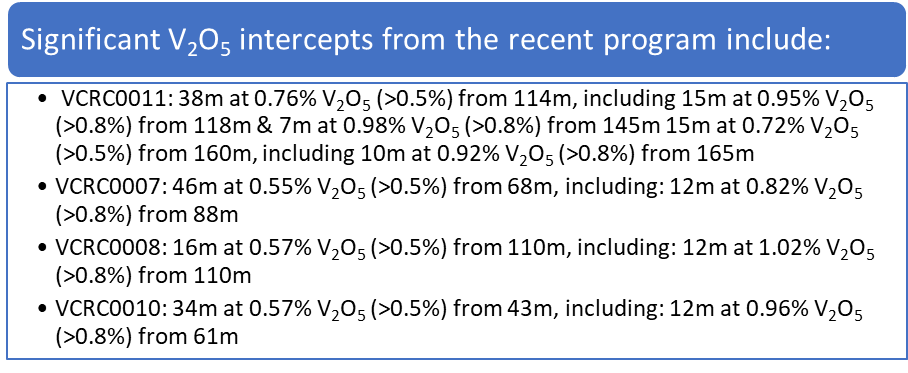

Total seven holes for 1,099m were included in the recently completed drilling program at the Kinks MRE target area.

Data source: company update

As per the company, all holes drilled in the West Block are above the current MRE average grade of 0.57% V2O5. The results for many holes regularly exceeding 0.7% V2O5 (above a 0.5% cut off).

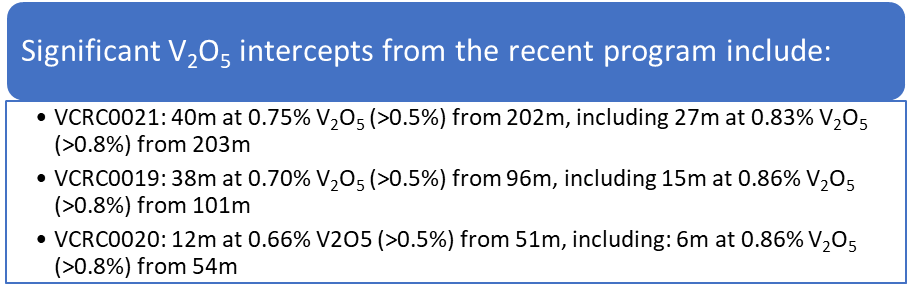

Numerous consistent thick zones of vanadium mineralisation have been returned from drilling at the Kinks South target along a 1.5km strike length. The Kinks South target brings with it a substantial opportunity for VKA to expand the mineral resource base, targeting a high-grade component >30Mt >0.9% V2O5.

Total 17 holes were drilled for 2,730m. Also, more than 1.5km strike of VTM horizon identified in outcrop mapping and geophysics was tested. Into the Kinks South target, total 18 holes have been drilled over 2,892m.

Data source: company update

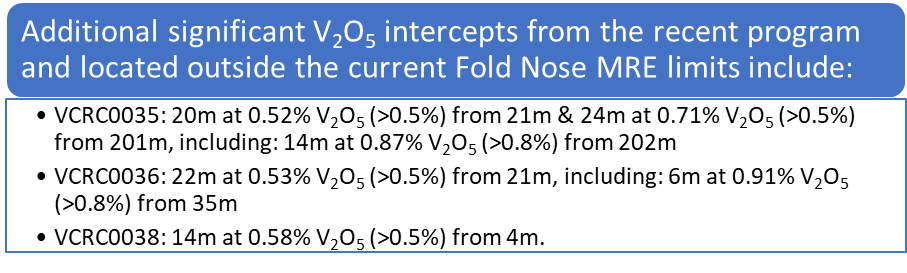

Newly discovered zones of vanadium mineralisation have been returned from drilling at the Fold Nose to Kinks South target area, validating the hypothesis that VTM mineralisation continues between the MREs at Kinks South and Fold Nose.

The results highlight an opportunity for Viking to widen the resource base with further drilling. The target has been identified to have high potential to host vanadium within the target VTM horizon, as per magnetic geophysics, rock chip sampling and field mapping.

Metallurgical Testwork Results: Metallurgical testwork on hole VCRC0006 (17m at 0.98% V2O5) achieved 90.9% recovery into magnetic concentrate grading 1.44% V2O5, 60.3% Fe & 10.6% TiO2.

Data source: company update

What’s next?

VKA has hired services of MEC Mining to revise JORC MRE for the Kinks Deposit and the Fold Nose Deposit. It will also undertake a maiden MRE for the Kinks South Target Area.

Viking is focused on undertaking major developments at the Canegrass Project, including interpretation of drilling results from campaigns completed in the June and September quarters.

To produce V2O5 flake from a magnetic concentrate, VKA plans to undertake further testwork. Meanwhile, the company intends to review certain projects which it is targeting to acquire to scale up substantial shareholder value.

VKA shares traded at AU$ 0.009 midday 1 November 2023.