Highlights

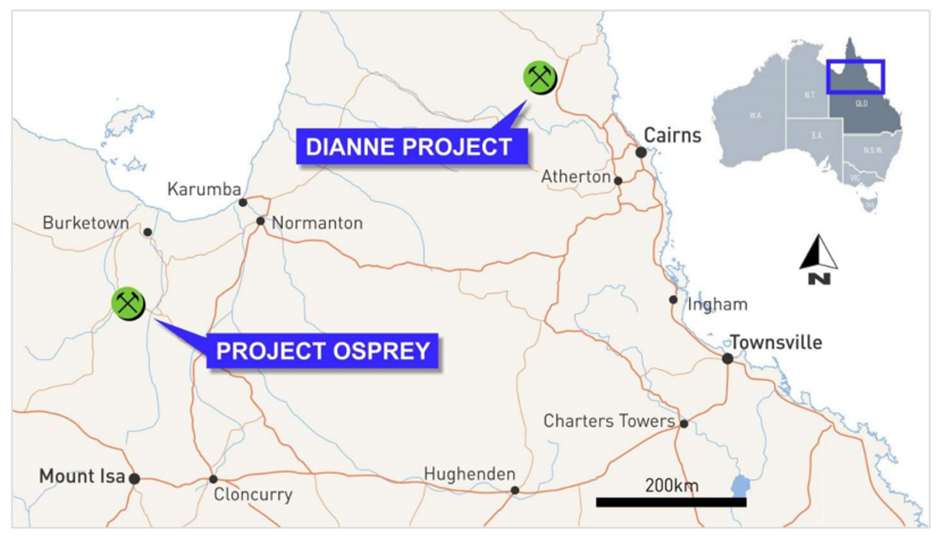

- Revolver Resources has secured AU$550,000 in short-term loans for the Dianne Copper Mine restart.

- An ATM equity arrangement with Alpha Investment Partners provides access to up to AU$3 million.

- The company targets a final investment decision for Dianne in H2 2024 and aims to begin copper cathode production in H2 2025.

Revolver Resources Holdings Limited (ASX:RRR) has announced new working capital funding arrangements designed to support its project finance initiatives for restarting the Dianne Copper Mine.

The Australia-based mineral exploration company has secured short-term loan facilities totalling AU$550,000 from several private parties. In addition, Revolver Resources has established an At-The-Market (ATM) equity arrangement with Alpha Investment Partners Pty Ltd, which provides access to up to AU$3 million in standby equity capital over a period of up to two years.

Key workstreams for the Dianne project are progressing towards a positive Final Investment Decision (FID) in the second half of 2024. The company aims to start LME-grade copper cathode production by the second half of 2025.

The capital arrangement provides bridge funding while advancing comprehensive development finance initiatives, including the recent Memorandum of Understanding (MoU) with the China Copper Industry Investment Alliance (CCIIA) and ongoing negotiations.

Image source: Company update

Additionally, the company has announced that the previously disclosed convertible note facility with Obsidian Global GP, LLC will not be moving forward. No drawdowns or Revolver share issuances were executed under this facility.

Shares of RRR were trading at AU$0.050 at the time of writing on 13 September 2024.