Highlights

- The period saw completion of maiden drilling program at the Mt Sholl project that intersected high-grade & broad zones of Ni-Cu-PGE sulphide mineralisation.

- The results correlate with historical drilling and indicate that all deposits remain open in multiple directions.

- The company expects finalising modelling of an updated MRE in Q1.

Raiden Resources Limited (ASX:RDN) wrapped up the December 2022 quarter with maiden drilling at its flagship Mt Sholl Ni-Cu-PGE project delivering high-grade results. Mt Sholl is located 22km southeast of Karratha in the Pilbara region of Western Australia.

The company commenced with its maiden diamond drill program at Mt Sholl in mid-September last year, drilling 39 diamond holes for 4,204m between 19 September and 23 October 2022. The drill campaign delivered high-grade & broad zones of Ni-Cu-PGE sulphide mineralisation.

The maiden drilling program aimed to confirm selected historical results, validate the company’s geological model of the deposit, and provide material for initial metallurgical testing. Drilling was focused on three historical deposits, namely A1, B1, and B2.

Drill assays confirm high-grade Ni-Cu-PGE sulphide mineralisation at Mt Sholl

Within all three deposits, the company reported a coherent and continuous body of mineralisation, with impressive Ni-Cu-PGE grades defined from the surface. The company intersected massive, semi-massive, stringer and disseminated mineralisation throughout all 3 deposits drilled. Sulphide mineralisation intersected continues to consist of predominantly fine grained pyrrhotite, chalcopyrite and pentlandite.

The mineralisation remains open in multiple directions and to depth at the three deposits. The prospective contact between the layered intrusive host rocks of all three deposits and the surrounding country rock extends along strike and at depth currently defined mineralisation.

Data source: company update

The company highlights that historically defined EM targets which remain undrilled, indicate potential for further massive sulphide mineralisation along B2 southern strike, and defined EM target on the A1 deposit remain undrilled and indicates potential depth extensions of the deposit.

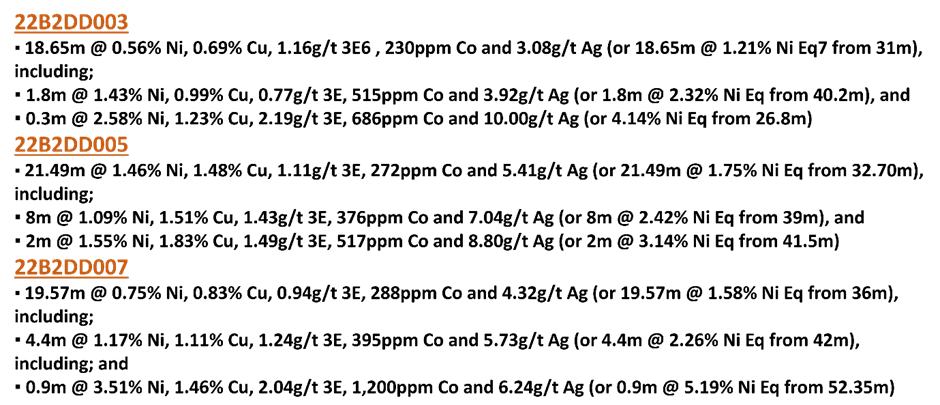

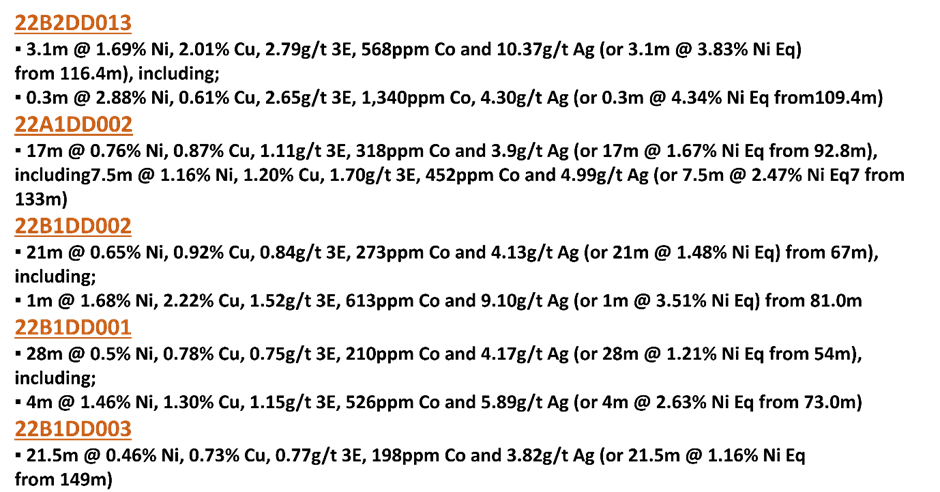

Few of the notable intercepts

Data source: company update

Updated MRE expected in Q1

Modelling of an updated mineral resource estimate (MRE) under JORC (2012) is underway and is anticipated to be finalised in Q1 2023. Moreover, the company is gearing up to commence metallurgical evaluations and optimisation work on the available core.

Subsequent to the quarter end, the company entered into an earn-in and cash/script agreement with Velocity Minerals for up to 75% of the Zlatusha project. Raiden is undertaking discussions concerning the divestment of other non-core assets within the Australian and European portfolios.

RDN shares traded at AU$0.005 on 3 February 2023.