Highlights

- Permit-wide targeting work has been completed over the Zlatusha Project.

- Raiden’s joint venture (JV) partner Velocity Minerals plans to undertake 3,000-metre diamond drilling in the second quarter of 2024.

- As per the JV agreement, Velocity Minerals can earn maximum 75% interest in the Zlatusha Project.

Raiden Resources Limited (ASX: RDN) has informed about the completion of permit-wide targeting exercise across the Zlatusha Project, Bulgaria, by its JV partner Velocity Minerals.

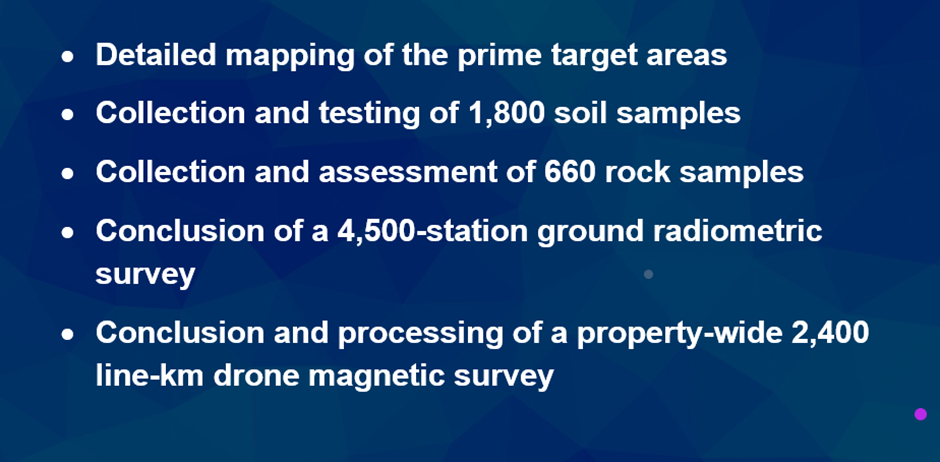

To date, following work has been concluded at the project area-

Data source: Company update

The magnetic survey led to the identification of target areas for further assessment through comprehensive mapping and geochemistry.

With this development, precious metals and copper explorer Velocity intends to undertake a 3,000-metre diamond drilling programme in the second quarter of 2024.

Details of the joint venture agreement and Zlatusha Project

Raiden holds 100% ownership in the Zlatusha Project, which covers 195 km2 and lies in the Cretaceous Western Tethyan orogenic belt. The company had acquired this project owing to the presence of prospective geology, including the presence of Cu-Ag mineral occurences, epithermal and porphyry copper related alteration systems and cretaceous arc magmatic rocks

The potential of the permit came into light when Bulgarian State agencies carried out geological mapping, sampling, trenching and diamond drilling in the area. From 1998 to 2000, additional exploration took place under Balkan Minerals and Mining, involving surface sampling and drilling.

As per the agreement, Velocity Minerals can earn maximum 75% interest in the project. To earn up to 75% interest, the company is required to complete a PEA study and make CA$1 million in cash and stock payments to RDN.

RDN shares closed at AU$0.026 apiece on 20 February 2024.