Highlights

- Raiden Resources has executed a binding earn-in/option letter agreement with Velocity Minerals in regard to its Zlatusha project, Bulgaria.

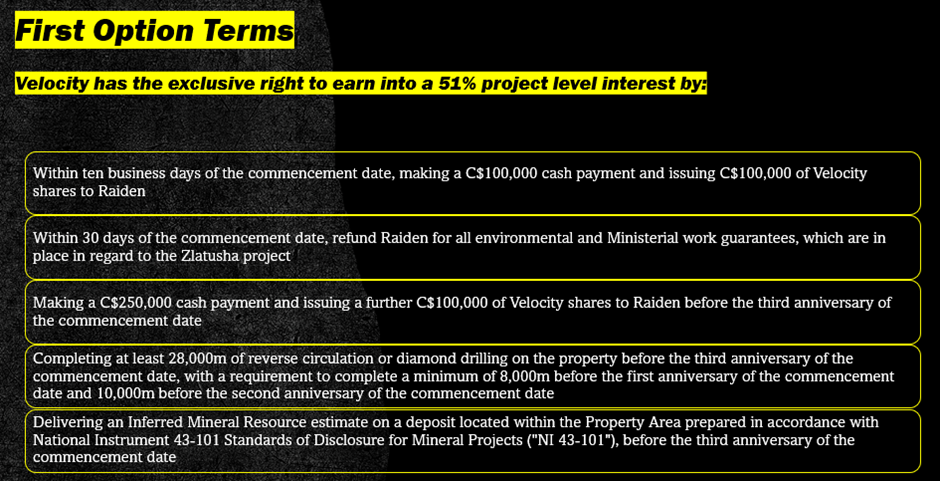

- Under the agreement, Velocity gets the exclusive option to earn up to a 75% interest in the project, by making staged cash and stock payments to RDN, undertaking a minimum amount of drilling and defining technical milestones.

- According to Raiden, with this agreement, the company will have a greater focus on its flagship project, Mt Sholl Ni-Cu-PGE deposit, in Australia.

Raiden Resources Limited (ASX:RDN) and Velocity Minerals have executed a binding earn-in/option letter agreement in regard to the former’s 100%-owned Zlatusha project in Bulgaria.

The project, covering an area of 195km2, sits within the mineral endowed Cretaceous Western Tethyan orogenic belt. The Zlatusha licence lies within an established porphyry copper-gold/epithermal belt located between the Timok Magmatic Complex and the Panagyrishte Belt, both of which are considered world class Cu-Au districts.

As per the terms of the agreement, precious metals and copper explorer Velocity holds the exclusive option to earn up to a 75% interest in the project. In exchange, Velocity is required to make staged cash and stock payments to RDN, undertake a minimum amount of drilling and define technical milestones.

The companies will negotiate for the execution and delivery of a definitive property option agreement within 30 days of the execution and delivery of this Letter Agreement, following which Velocity will seek TSX-V approval.

Data source: Company update, © 2023 Krish Capital Pty. Ltd.

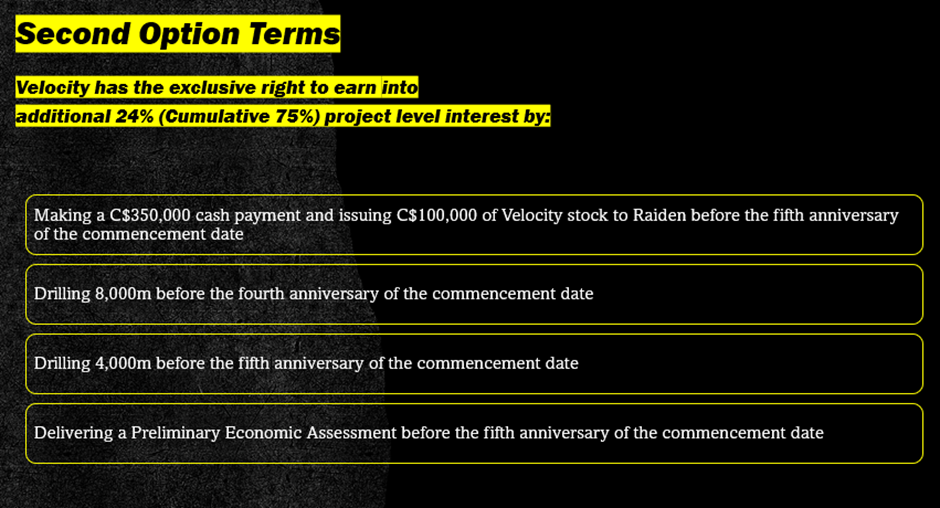

If the requirements of the First Option are met by Velocity, both the companies will join hands to form a Joint Venture. As per the signed agreement, Velocity will get the exclusive right to earn 24% project level interest (total 75%) through the “Second Option”. However, in case Velocity is unable to fulfil the terms of the First Option, it will fail to earn any interest and 100% of the project will be retained by RDN.

Data source: Company update, © 2023 Krish Capital Pty. Ltd.

In case Velocity is unable to fulfil the conditions as stated in the Second Option, its ownership shall remain at 51%. However, in case Velocity earns into a 75% position, RDN may co-finance its portion of further expenditure to maintain its position.

If any of the two firms dilutes below a 15% interest in the JV, there will be conversion of the interest to a 1% NSR. This will give the sole right to the majority party. However, there will be no obligation to purchase down 0.5% of the royalty for C$1.5 million.

Management commentary

According to Raiden, with this agreement the company will have a greater focus on its flagship project, Mt Sholl Ni-Cu-PGE deposit, in Australia. RDN will utilise the proceeds from this transaction to conduct further studies and activities at the Mt Sholl project.

Data source: Company update, © 2023 Krish Capital Pty. Ltd.

Moreover, the ASX-listed company is in discussions to sell or enter partnerships in relation to its other non-core assets. This is expected to generate further capital for the company while maintaining exploration and discovery upside in these projects, highlights Ljubojevic.

RDN shares traded at AU$0.005 on 25 January 2023.

_09_03_2024_01_03_36_873870.jpg)