Highlights:

- QX Resources (ASX:QXR) holds highly prospective lithium assets in Western Australia.

- The projects sit in strategic proximity to some of Australia’s largest lithium deposits.

- A maiden RC drilling program was undertaken at the Turner River hard rock lithium project with lithium micas and pegmatites observed in the RC chips.

- The company believes that this development indicates the potential for a much larger target than previously sampled at surface.

Lithium, which holds one of the most premium spots amongst battery metals, is witnessing a never seen before events. Thanks to its surging application in electric vehicle batteries (lithium-ion batteries), the recent period has seen a boom in the price of this soft, silvery-white metal.

The spot prices for lithium hydroxide (delivered to China) skyrocketed during the year and reached its peak of US$74,688 in April. The price cooled slightly and averaged US$70,300 a tonne in August 2022. Even these levels of US$70,000 represent more than an eight-fold increment compared to the January 2021 average, which stood at US$7,984.

As the electric vehicle sales are picking up pace, demand for this metal is likely to boom over the years. The December 2022 edition of the Resources and Energy quarterly report by the Australian government estimates spodumene prices to reach US$4,000 a tonne in 2023 from US$2,700 a tonne in 2022.

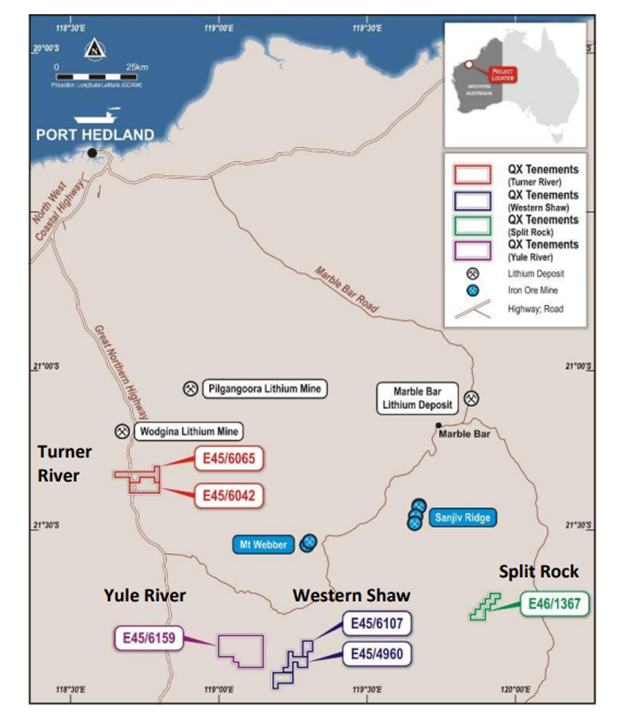

Amid this upbeat scenario, ASX-listed company QX Resources Limited (ASX:QXR) is executing a wide range of exploration activities across its highly prospective portfolio of lithium assets in the tier 1 mining jurisdiction of Western Australia. The company holds lithium projects within the Pilbara region, covering a total area of 355 km2.

QX Resources’ hard-rock lithium projects

The company’s lithium portfolio includes:

- Turner River Project (E45/6042 & E45/6065)

- Split Rock Project (E46/1367)

- Western Shaw Project (E45/4960 & E45/6107)

- Yule River Project (E45/6159)

The projects, which are largely underexplored for lithium, are believed to be prospective for lithium hard rocks. These rocks tend to evolve rapidly from discovery to development to production and thus have a shorter timeline, as highlighted in the company’s October 2022 update.

(Image source: Company update, 31 October 2022)

Recent drilling outcomes boost QXR confidence in its projects

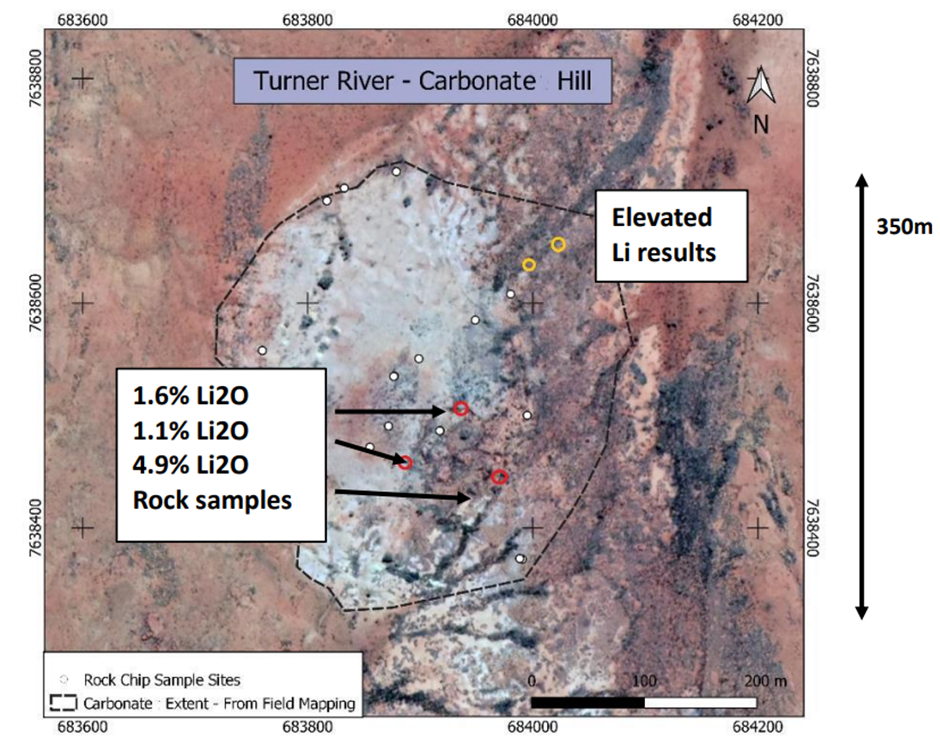

The Turner River project is 15km south of the Wodgina lithium mine, which is one of the largest hard rock lithium deposits globally.

(Image source: Company update, 8 November 2022)

QXR has undertaking a maiden reverse circulation drilling at the project, targeting a total of 1,500 metres. The drilling campaign is designed to target three areas, which also covers the high-grade lithium areas in rock samples. The company has highlighted that the campaign will also target two other pegmatites with anomalous lithium results.

In December, the company updated on encouraging indications of significant areas of potential lithium bearing pegmatites in drill pads and drill chips. The development highlighted the potential for a much larger target than the previously sampled area of high-grade lithium rock chip results.

As the aim of the drill program has been achieved, discussions are underway to extend the drill operation further.

Stock information - QXR shares were trading at AU$0.046 apiece in the early hours of 5 January 2023, up nearly 7% from the last close. The share price has seen an upward movement of more than 53% in the last six months.