Highlights

- Maiden 2,250m reverse circulation (RC) drilling campaign has been started at Hermes prospect within Xanadu Gold Project.

- The program follows review of historical data and rock chip sampling programs at Hermes.

- Platina has also received cultural heritage clearances for the upcoming Xanadu West RC and Xanadu Deeps diamond drilling campaigns.

Platina Resources Limited (ASX: PGM) has initiated a maiden 2,250m RC drilling campaign at its Western Australia-based Xanadu Gold Project, targeting the Hermes prospect.

The company decided to conduct the campaign after successful completion of a review of historical data and rock chip sampling programs at Hermes.

The prospect, sharing a similar mineralisation style, sits on the same fault structure that hosts the nearby Olympus gold deposit (1.4 Moz Mt). Hermes has a 1km strike length and is open in both directions. Most of the Hermes’ mineralisation is present in a central corridor consisting of numerous parallel zones identified in outcrop.

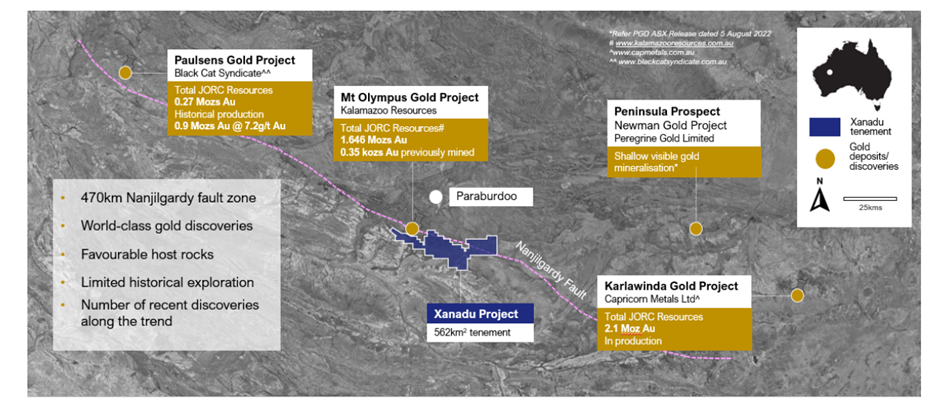

Xanadu Project lies within a regional scale structural setting – 1.44Moz Au nearby

Image source: Company update

So far, most of the times shallow drilling programs have been completed at Xanadu. One historical gold heap leach operation has also been conducted at the site. According to the firm, Xanadu Gold Project holds great appeal because of the occurrence of economic grade gold drill intercepts. Even these intercepts have not been followed up till date with any systematic exploration program.

Platina has also received cultural heritage clearances for the upcoming Xanadu West RC and Xanadu Deeps diamond drilling campaigns.

PGM shares jump over 11%

PGM shares were trading 11.54% higher at AU$0.029 at the time of writing on 07 September 2023, with a market cap of AU$16.2 million. In the last six months, the shares have gained 45%.