Highlights

- Italy has historically relied heavily on imported natural gas, with the country now seeking to increase domestic production

- The domestic gas market has become more favourable, both in terms of pricing as well as in securing regulatory approvals

- Po Valley Energy has assets in Italy, which place it well within the domestic natural gas production scene

Before the conflict in the Ukraine, Italy relied on the overseas market for as much as 90% of its natural gas supply. Italy does not have nuclear capability to meet energy needs, and only two coal plants are in operation. There is little doubt that the country is increasingly looking inward to meet its energy requirements. Against this backdrop, the Australian Securities Exchange listed natural gas player Po Valley Energy (ASX: PVE) is positioning itself in the attractively priced Italian domestic market.

PVE has over two decades of experience in the sector, and its broad portfolio of natural gas fields in Italy is a big advantage. Let us know more about Po Valley’s opportunities in Italy’s natural gas market and the company’s operations.

Source: PVE Investor Presentation

Favourable environment

As stated earlier, Italy has mostly relied on imported natural gas due to scarcity of domestic production. Now, the government is looking to cut its reliance on imports, particularly from Russia. It is estimated that gas imports from Russia are to be reduced by approximately 29 bcm each year, beginning from 2022. Former Prime Minister Mario Draghi, who is also a prominent economist, has commented that Italy must increase domestic production because this would make things more "manageable" and "cheaper".

Separately, according to a report cited by Po Valley in its recent Investor Presentation, domestic gas price in Italy spiked more than 10 times since the beginning of the market changes. To be specific, the increase was from approximately €0.2/scm to approximately €2.20 /scm. In December last year it averaged approximately €1.25 /scm. As a result of shortages and price surge, regulatory environment in Italy has become favourable for domestic producers claims the Company.

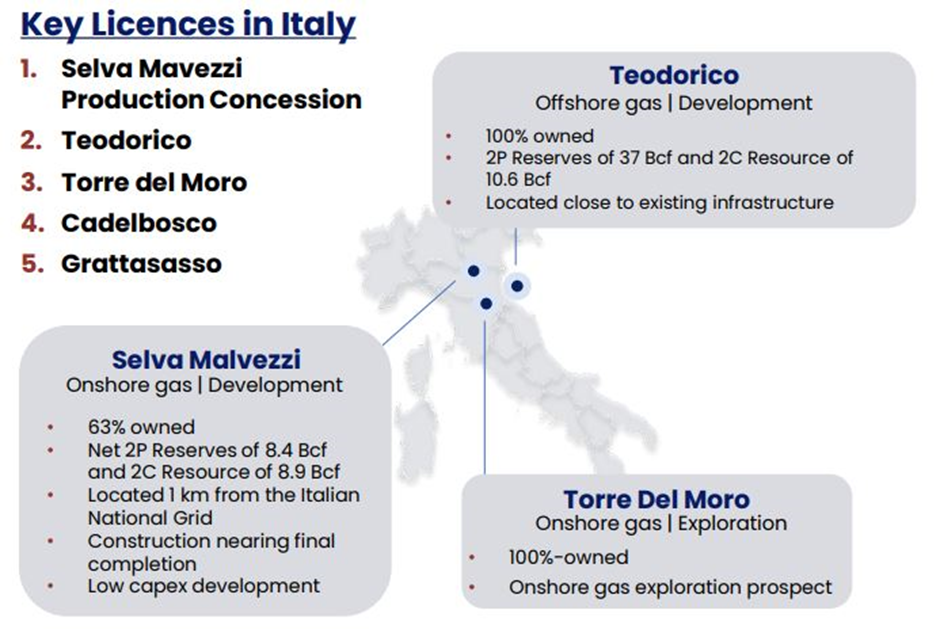

Po Valley's Italy portfolio

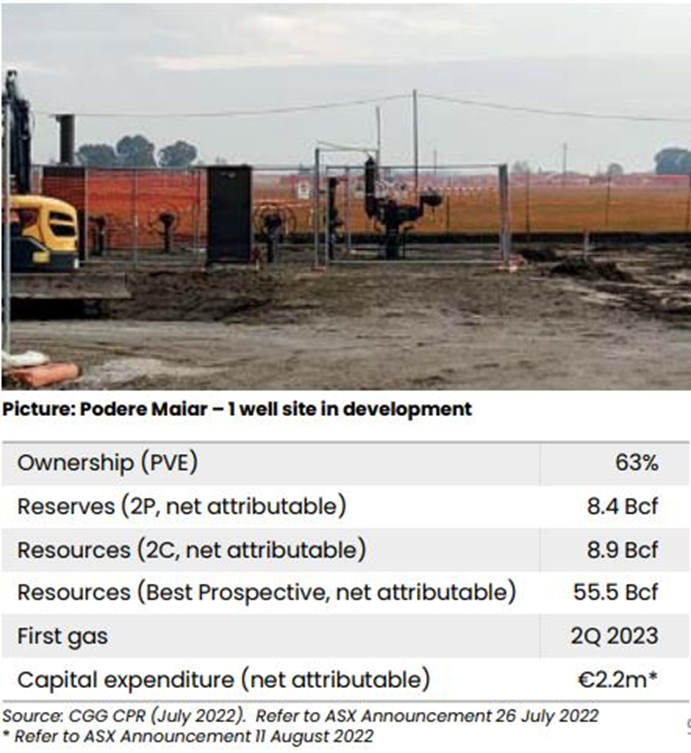

The ASX-listed company’s Selva Malvezzi – Podere Maiar 1 (PM-1) well is in Po Plain (eastern part), Italy. The final production concession was received in July last year, while the Environmental Impact Assessment approval had come in April 2022. In a drilling program, Po Valley intersected two identified gas reservoirs -- C1 (flow rate of 129,658 scm/d), and C2 (flow rate of 148,136 scm/d).

Source: PVE Investor Presentation

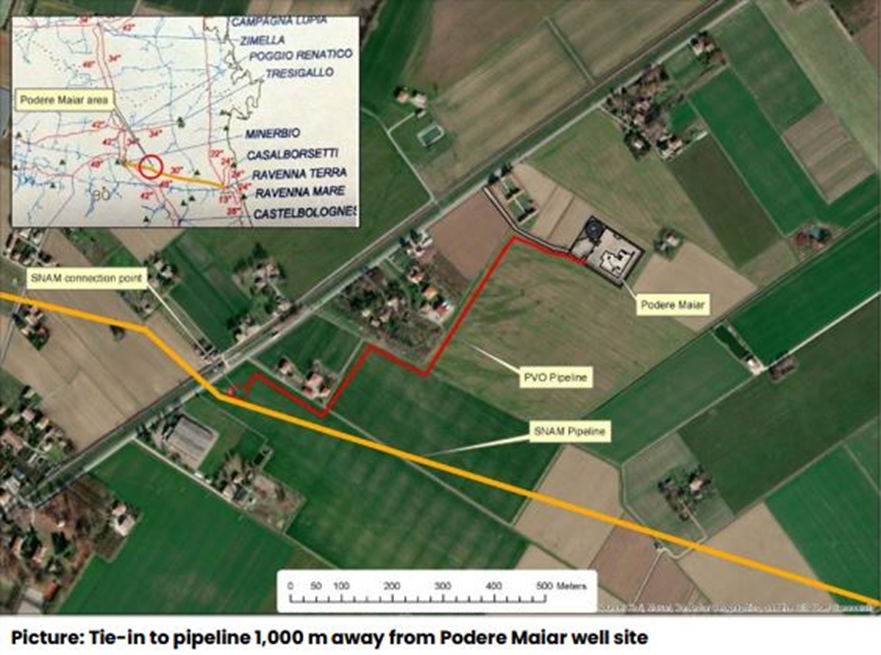

PVE is building a gas plant and pipeline on site to connect to the SNAM grid. Notably, SNAM SpA owns the connection to the domestic gas grid, and gas from PM-1 of PVE meets the grid requirements with minimal processing. PVE has stated that Selva is a “repeatable and proven low-cost” gas play. An offtake agreement has been signed with BP Gas Marketing Limited (subsidiary of BP International) for supply of gas from PM-1.

Source: PVE Investor Presentation

PM-1 plant has a base production capacity of 150,000 scm/d, and PVE states that this capacity can be easily increased. Operating costs are estimated to be nearly €0.6MM/year. Under the BP agreement, the company would supply over 37,000,000 standard cubic metres of gas.

The other licences held by PVE's Italy subsidiary PVO include AR94PY (offshore Adriatic, Northern Italy), Torre del Moro (having the Torre del Moro gas prospect), and Cadelbosco [Zini (Qu-B), Zini (Qu-A), Canolo (Qu-A) and Canolo Pliocene gas prospects].