Highlights

- Reverse circulation drilling at Leviticus (located within MGV’s Cue Gold Project) returns new high-grade mineralisation

- New mineralised position is outside the current Mineral Resource Estimate (MRE) and open pit design

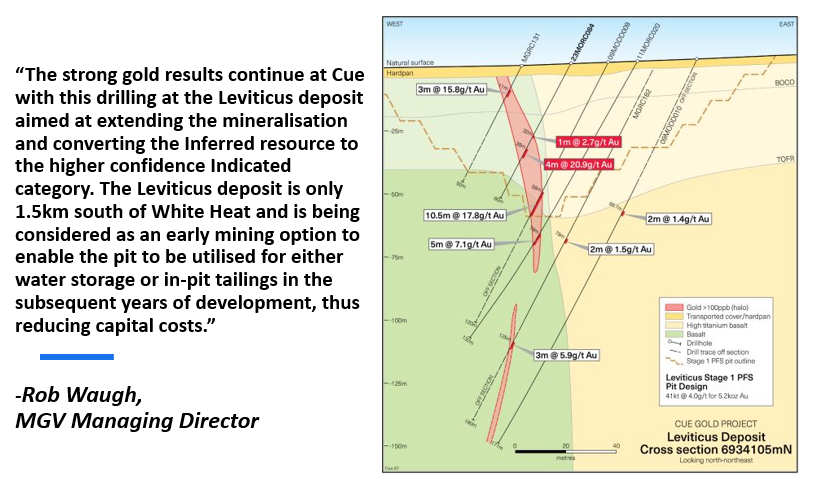

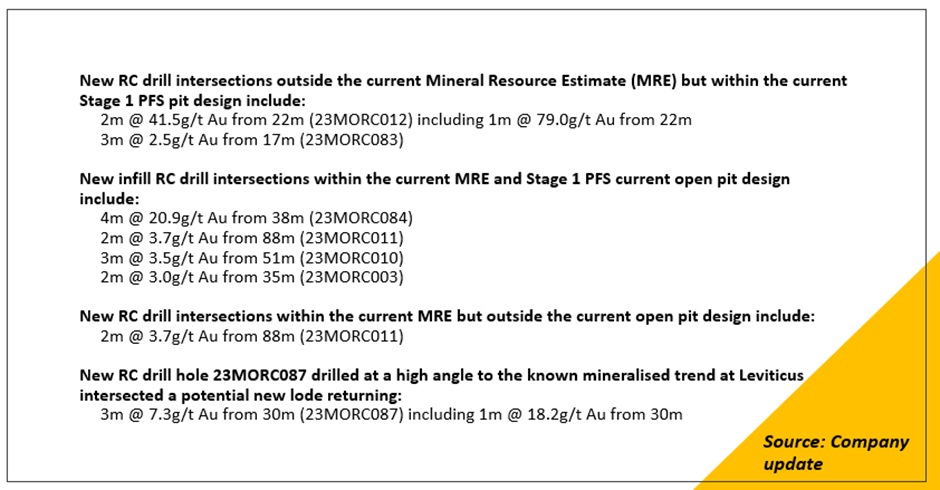

- Infill intersections within the current MRE and the Stage 1 PFS open pit design include 4m @ 20.9g/t gold from 38m and 3m @ 3.5g/t gold from 51m

Australian gold exploration company Musgrave Minerals (ASX:MGV) -- developing its fully owned flagship Cue Project (Gold) in WA's Murchison region -- has announced new high-grade mineralisation at the Leviticus deposit. Leviticus is located at the Cue Gold Project, and the latest high-grade intercepts have been reported after reverse circulation drilling and assay results.

Musgrave also reports that intersections outside the current MRE include 2m @ 41.5g/t gold from 22m (including 1m @ 79.0g/t Au from 22m), and 3m @ 2.5g/t Au from 17m.

Source: Company update

MGV shares jump ~7%

MGV shares traded at AU$0.235 (market cap over AU$133 million) at the time of writing on 23 May 2023, up nearly 7% from the last close.

More

Notably, the deposit's total MRE is 42kt @ 6.0g/t Au (Gold) for 8koz gold (Inferred). The new assay results have now been reported after RC drilling at Musgrave’s WA-based asset. Musgrave states the results are a combination of infill and extensional holes and they demonstrate high-grade nature of the mineralisation at the deposit. In the latest drill program, 46 reverse circulation holes (totalling 2,799 metres) were completed, which include both infill and extensional.

Infill drilling's aim was to convert the resource within the Stage 1 PFS open pit design into the Indicated category. The extensional drilling, Musgrave states, has the potential to add tonnes for the Stage 2 PFS. The current drill activity has extended mineralisation at the Leviticus deposit, with a potential new lode detected at drill hole 23MORC087. Further drilling would be done to find out the strike and dip potential.

The recent drilling at Leviticus establishes continued high-grade prospectivity. More details are in the below picture.

Musgrave informs that the 23MORC087 hole is outside Stage 1 PFS and current open pit design. The new mineralised position (high grade) is open in all directions. It is hosted within the favourable high titanium basalt unit that hosts the below two deposits.

- Break of Day (797kt @ 10.2g/t Au for 262koz gold)

- White Heat (185kt @ 11.0g/t Au for 65koz gold)

Musgrave, which is planning follow up drilling, expects that new discoveries and mineralised lodes can “further enhance” the project’s economics.

Source: Company update

About Cue Gold Project

The project is approximately 30km south of the Cue township (Murchison, Western Australia). The current MRE totals 12.3Mt @ 2.3g/t Gold for 927koz gold. The company is progressing further project studies. This advancement is based on a development scenario that involves a standalone mining and processing operation. Musgrave released the Stage 1 PFS in April this year with five-year LOM producing 337koz at an AISC of AU$1,315/oz. The initial analysis shows the project is technical and financially robust.