Highlights

- Musgrave Minerals (ASX:MGV) is one of the leading gold explorers and emerging developers in Australia.

- The company has released its financial report for the six months period ended 31 December 2022 which saw advancements in exploration of mineral tenements to progress to development in the near to mid-term.

- MGV made new discoveries at Amarillo and Waratah during the period and expects to report further resource growth this year.

- Musgrave intends to complete a Stage 1 Prefeasibility Study (PFS) later this month and to continue to ascend the gold resources through discovery and extensional drilling.

- Evolution Mining Ltd has fulfilled the Earn-In milestone securing a 75% equity interest in the Cue Joint Venture.

- Evolution have wrapped up numerous phases of aircore and diamond drilling with positive results at the West Island prospect.

An active Australian gold explorer and emerging developer, Musgrave Minerals Ltd (ASX: MGV) has released its half-year financial report stating advancement in exploration of mineral tenements to progress to development in the near to mid-term.

During the six months period ended 31 December 2022, the company continued to undertake significant development study works including further metallurgical and geotechnical assessments, heritage surveys, surface and ground water management studies, processing and infrastructure assessments, mining optimisation studies, preliminary underground assessment, waste rock management, tailings facility assessment and flora and fauna studies.

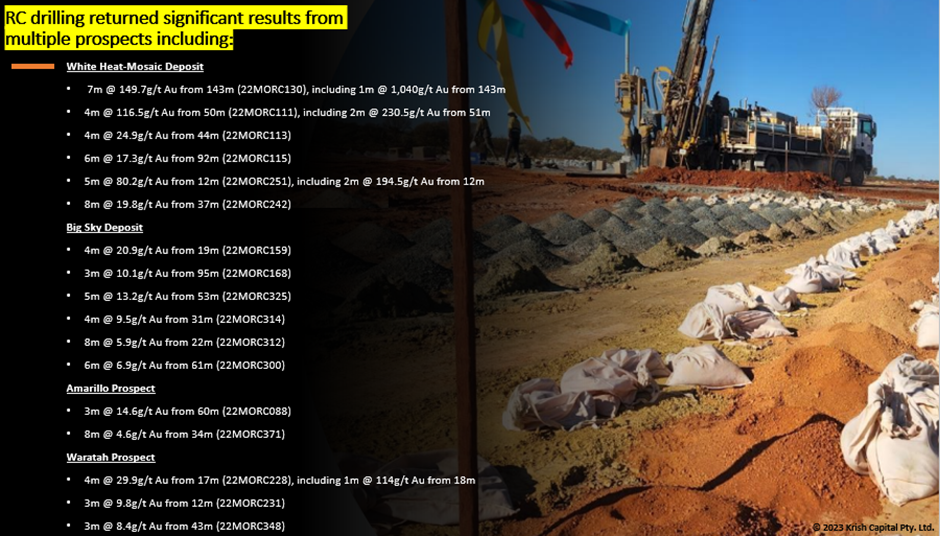

Also, MGV conducted development and production studies on existing resources to seek extensions of areas held and to seek out new areas with mineral potential. The company has got evaluating results from geophysical surveys, surface sampling, and drilling campaigns undertaken during the period.

Image source: MGV update

Exploration success at Cue Gold Project

In the recent times, Musgrave Minerals has been focusing on its Western Australia based Cue Gold Project. The project hosts significant gold mineralisation including the high-grade Break of Day and Lena Mineral Resources and has a current Mineral Resource Estimate of 12.3Mt @ 2.3g/t Au for 927koz gold. A subset of this resource is the Break of Day High-Grade Trend (982kT @ 10.4g/t Au for 327koz Au).

During the period, MGV made new discoveries at Amarillo and Waratah and expects to report further resource growth in the ongoing year. In late March 2023, Musgrave intends to complete a Stage 1 Prefeasibility Study (PFS) and to continue to ascend the gold resources through discovery and extensional drilling. The high-grade, near-surface nature of the gold mineralisation along the Break of Day trend is the primary focus for the Stage 1 PFS.

Data and image source: MGV update

A look at developments at Evolution JV

Evolution Mining Ltd has fulfilled the Earn-In milestone securing a 75% equity interest in the Cue Joint Venture. The JV spans across a select area of Lake Austin and surrounds on the Cue Project.

Evolution have successfully concluded several phases of aircore and diamond drilling with positive results at the West Island prospect. Now, the company is conducting exploration at the site.

Recent diamond drilling results include:

- 3.5m @ 16.2g/t Au from 366.0m (22CUDD007)

- 2.0m @ 66.0g/t Au from 438.0m (22CUDD008)

- 6.0m @ 6.4g/t Au from 385.5m (22CUDD012)

- 1.0m @ 74.2g/t Au from 410.0m (22CUDD016)

- 11.5m @ 8.7g/t Au from 235.5m (22CUDD021)

- 7.0m @ 5.2g/t Au from 393.0m (22CUDD021)

How’s MGV positioned in terms of capital?

Musgrave Minerals was successful in raising AU$8 million (before costs) through a placement of 40,000,000 fully paid ordinary shares at an issue price of AU$0.20 per share to corporate, institutional, professional, and sophisticated investors.

A Share Purchase Plan (SPP) was undertaken subsequent to the placement which raised AU$2,117,000 and issued 10,585,000 new fully paid ordinary shares. During the period, total 3,450,000 unlisted options were exercised, raising AU$360,525 in cash.

At 31 December 2022, MGV capital structure included 591,207,949 fully paid ordinary shares and 25,870,000 unlisted options at different exercise prices and expiry dates.

The Company holds 12.5 million ordinary shares in Legend Mining Limited together with 1,308,750 ordinary shares in Cyprium Metals Ltd.