Highlights

- Mount Burgess is currently engaged in developing its Kihabe-Nxuu Project in Botswana.

- The project is highly prospective for base metals, battery metals, precious metals, and strategic metals.

- The company is exploring potential for gallium, germanium, and vanadium pentoxide as modern strategic metals at Nxuu Deposit.

Mount Burgess Mining NL (ASX: MTB) is an ASX-listed mining company focused on developing its 100%-owned Kihabe-Nxuu Zn/Pb/Cu/Ag/V2O5/Ga/Ge Project, located in Botswana. The project covers an area of 1,000 sq km and is highly prospective for base metals (zinc/lead/copper), battery metals (vanadium pentoxide), precious metals (silver) and strategic metals (gallium/germanium).

The initial focus is on the development of the Nxuu Mineral Resource (estimated 6 million tonne) because it offers low cost, low risk, shallow basin shaped deposit, with a maximum depth of 62m. Moreover, with the inclusion of vanadium pentoxide, gallium, and germanium alongside zinc, lead, and silver, it would offer a low waste and high ore ratio.

Development at Kihabe and Nxuu Deposits

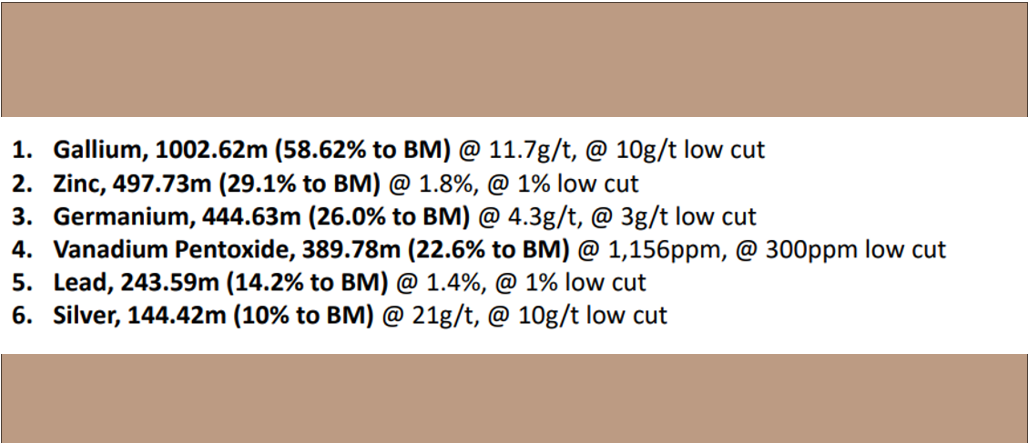

Till date, MTB has advanced the Kihabe and Nxuu Deposits into Indicated/Inferred Mineral Resource Estimates (MRE). Following metal/mineral volumes are part of the combined Indicated/Inferred Kihabe and Nxuu Mineral Resource:

Image source: Company PPT

The company has highlighted that substantial intersections of germanium, gallium, and copper were intersected at the Kihabe Deposit, but they are yet to be included in MRE after undertaking further infill drilling.

The Nxuu Deposit MRE comprises 40 holes which were assayed for germanium, gallium, zinc, lead, silver, and vanadium pentaoxide. The assay results indicated that these holes contained 1,198.5m of mineralised drill core lengths to base of mineralisation.

Combined or Mineralised Intersections (Data source: Company update)

Germanium and gallium are strategic modern metals. With substantial increase in their demand, which need access to imported supply, both of them are now listed as critical metals by the United States Geological Survey.

Gallium – A soft metallic element, gallium has multiple applications such as in semi-conductors and mobile phones, as an additive to generate low melting point alloys and light emitting diodes (LEDs).

The demand for gallium nitride energy saving chips have increased substantially. It is required for –

- Swift expansion of cost effective 5G networks requiring gallium computer chips.

- Wireless charging for EVs, targeting a 96% energy efficiency.

- Ensuring less power loss and seamless connection between grid power storage systems and solar energy.

An estimate by the Fraunhofer Institute System and Innovation Research projects that by 2030, the global production of gallium needs to be six times more than the present global production of nearly 720 tonnes per annum.

Germanium - Germanium is employed in various electric applications, including fibre-optics, infra-red optics, and high brightness LEDs found in automobile headlights and mobile phone lights. It is also utilised in semiconductors for thousands of electric applications, specifically in transistors. Additionally, germanium plays a role in night vision and night targeting technologies. This metal is a significant energy generator in solar panels as it is more effective than silicon-based solar cells.

Vanadium Pentoxide – It is used in the production of Vanadium Redox Flow (VRF) batteries. These batteries assist in storing huge amount of power for longer duration.

Mount Burgess is presently conducting a metallurgical testwork to define best routes for Ga/Ge recovery from high percentage oxide mica concentrates.