Highlights

- FYI Resources (ASX:FYI) is developing its high-purity alumina (HPA) project to tap into opportunities in the burgeoning lithium-ion battery market.

- Last year, the company joined hands with Alcoa of Australia to develop its HPA project.

- Under a collaboration with EcoGraf, FYI Resources is developing an HPA-doped carbon coating material for carbon (graphite) anodes.

- The company improved its Environmental, Social, and Governance rating during FY22.

The boom in the electric vehicle (EV) space has driven major shifts in the battery industry on a global level. High-purity alumina (HPA) has the potential to boost the functionality, power yield, and overall safety of battery cells – a critical component of EVs.

HPA, which saw its inclusion in Australia’s critical minerals list during the year 2022, is also used in developing light emitting diodes, artificial sapphire glass products and many other high-tech products. This varied application of HPA is due to its unique characteristics and chemical properties.

FYI Resources Limited (ASX:FYI), an ASX-listed mineral resource company, is focused on developing its innovative HPA project. The company believes that it has a strong financial position, with AU$5,629,660 raised during FY22.

HPA project developments

In its recently released annual report, FYI Resources listed the major developments across its projects for the financial year ended 30 June 2022. The period saw a key development as FYI joined hands with Alcoa of Australia Limited in October last year. The collaboration is aimed at charting a pathway to a future JV for the development of the HPA project. However, this JV is subject to the final investment decisions by both parties.

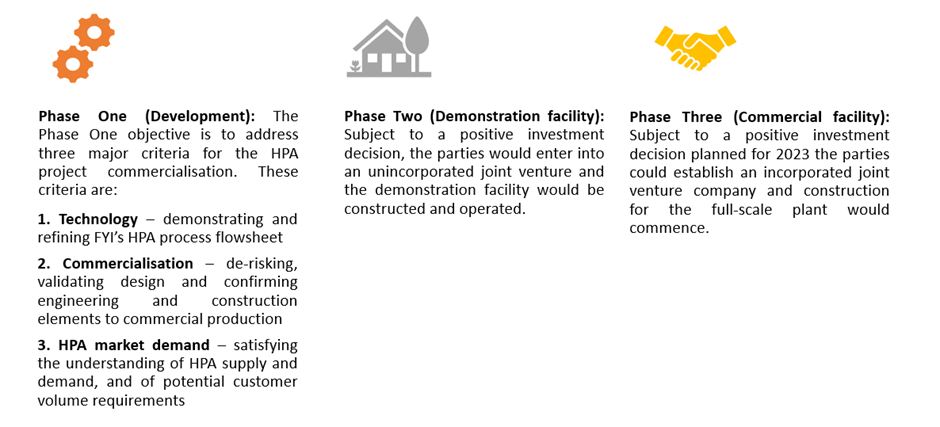

As per the company, project development will take place following a well-defined, three-stage schedule designed to derisk the project and maximise its economic potential.

Source: © 2022 Kalkine Media®; Data Source: FYI update

According to the term sheet, Alcoa will have 65% project equity and contribute US$243 million to the project capital costs. FYI will retain 35% and be essentially funded for the projected cost of US$250 million.

For further insights into the HPA project and updated definitive feasibility study, click here.

Tapping into opportunities in HPA-coated-anode sector

FYI believes a significant market opportunity exists in the United States and Europe with the demand for HPA-coated anodes estimated to increase at 30% per annum. To cash in on this opportunity, the company signed a non-binding memorandum of understanding in September 2021 with EcoGraf Limited (ASX:EGR) to develop an HPA-doped carbon coating material for carbon (graphite) anodes. These coated anodes will find application in the burgeoning lithium-ion battery market.

FYI and EGR will equally fund the technical program designed to produce and evaluate FYI’s HPA coating on EGR’s graphite. This research collaboration will also evaluate the possibility of additional downstream alumina and graphite composites for new battery technologies and materials for clean energy applications and performance optimisation.

The partners recently shared results from latest test work indicating that FYI's high-quality +4N HPA-coated EcoGraf spherical graphite anode outperforms standard industry materials.

To know more about this development, read here

Financial stance

FYI raised AU$5,629,660 during FY22, with AU$325,000 raised in consideration for services provided to the company and the remaining portion coming from the conversion of options to shares.

Additionally, in November 2021, the company (trading under the symbol “FYIRF”) qualified to be upgraded to the premium US-based OTCQX market from the OTCQB market. Furthermore, in February 2022, real-time electronic clearing and settlement of the company’s OTCQX-traded common shares also started.

Sustainability and ESG mission

Developing on its Environmental, Social, and Governance (ESG) mission, the company improved its ESG rating to 21.4 from 23.8. This helped the company obtain a rank of 5 out of 172 (3rd percentile) amongst Diversified Metals Industry peers and 4 out of 34 (10th percentile) in the aluminium subindustry, highlighted the annual report.

This improvement will help the company achieve its ESG mission of becoming a key contributor to a sustainable world by innovating responsibly, giving back to the community, reducing environmental impact, and assisting in carbon reduction for future generations.

FYI shares were trading at AU$0.155 midday on 19 October 2022.