Highlights

- ASX-listed FYI Resources is an emerging critical minerals company.

- The company envisions to become a leading supplier of High Purity Alumina (HPA).

- FYI has roped in a renowned global engineering firm for its project.

- The Australian Government has already included HPA in the National Critical Minerals list.

- With the soaring demand for EVs, the demand for HPA is expected to grow exponentially.

As the global transition towards clean energy is accelerating, the demand for critical minerals is also witnessing a spike.

The use of critical metals continues to surge due to their strong demand across various sectors. These metals are considered the building blocks of technologies essential for modern-day.

Many of these metals are crucial for clean energy, aviation, national defense, space research, and other high-tech applications.

In the current upbeat settings, Australia’s FYI Resources Limited (ASX:FYI; OTCQX:FYIRF; FSE:SDL) is committed to make its mark as a leading supplier in the HPA market. The company is developing a world-class integrated HPA project.

Australia gears up to become critical minerals powerhouse

Globally, Australia holds a strategic foothold when it comes to the supply of tantalum, nickel, rutile, zircon, and other key critical minerals. However, it is yet to tap this opportunity as many of its vital minerals end up in the pile of discarded tailings.

The Australian government has upgraded its strategy to make the best use of these minerals, aimed at boosting its foothold in the global critical minerals sector to help address demand in the coming years.

In the first quarter of 2022, Australia’s Federal Government included HPA to the National Critical Minerals list. The development is expected to offer lucrative growth opportunities to the country’s critical mineral players.

The government has committed to inject AU$200 million in the Critical Minerals Accelerator Initiative, aimed at aiding strategically significant projects at challenging points in their development.

FYI taps opportunities with world-class integrated HPA project

FYI operates its HPA project in the Western Australian region. The company aims to set up an installed annual HPA capacity of approximately 8,000Mt. To achieve this milestone, the company has joined hands with Alcoa, which is a leading producer of alumina, globally. Alcoa has committed an investment of US$243 million towards the development of the project.

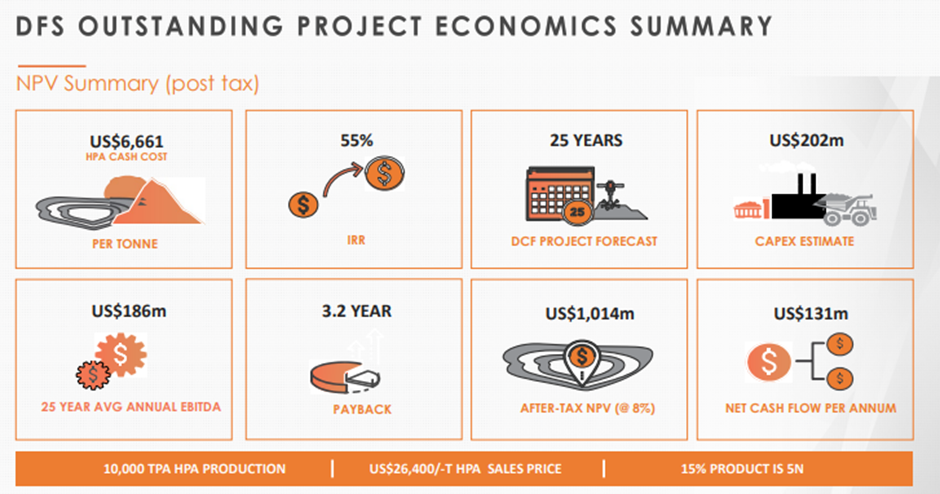

The Definitive Feasibility Study (DFS) on the project has resulted in excellent financial metrics with an IRR of 55% and a payback period of just 3.1 years. The project is expected to generate a net cash flow of US$131 million annually.

Image source: company update

To know more about the project development, click here.

Moreover, the company has roped in a leading global engineering firm for its project. Hatch Engineering, a respected multidisciplined engineering group expert in the minerals processing field, will facilitate engineering studies for the HPA demonstration plant.

FYI has highlighted that its HPA project had been attracting Tier-1 support and project funding. The company has a well-timed strategy to meet the forecasted increased demand for HPA.

HPA: A boon for modern high-tech applications

The inclusion of HPA in the country’s critical minerals list highlights the growing importance of these minerals in modern high-tech applications, as well as in a lower carbon future.

Given its distinctive chemistry and physical characteristics, HPA has wide applications across various sectors. Alumina is used as a base in the manufacturing of sapphire glass, phosphors, and substrates for applications such as LEDs.

In addition to this, the crucial metal is used in the ceramic coating of separator membrane in high-energy-density batteries, including lithium-ion cells used in electric vehicles (EV). With 300 million plus electric vehicles projected to hit roads by 2030, as per the 2050 Net Zero Emissions scenario (according to the International Energy Agency’s forecasts), the demand for HPA is expected to rise exponentially.

FYI shares were trading at AU$0.165 midday on 19 September 2022.