Highlights

- Lithium Australia (ASX:LIT) made significant progress in the battery space in Q1 FY23.

- Envirostream closed battery recycling partnerships with Battery World and LG Energy Solution, as well as saw an increase in its collection of end-of-life batteries.

- VSPC witnessed continued work on a pre-qualification pilot plant engineering study.

- LIT had a cash balance of AU$13.6 million and investments in listed equities of AU$5.7 million at quarter end.

- The period saw a placement of AU$12.1 million (gross of fees).

Lithium Australia Limited (ASX:LIT) has reported a busy September 2022 quarter for its wholly owned subsidiaries Envirostream Australia Pty Ltd and VSPC Pty Ltd.

During the period ended 30 September 2022 or Q1 FY23, Envirostream signed agreements to collect and process spent batteries. Also, the national leader in mixed battery recycling, as reported by LIT, saw a significant jump in the collection of end-of-life (EOL) batteries.

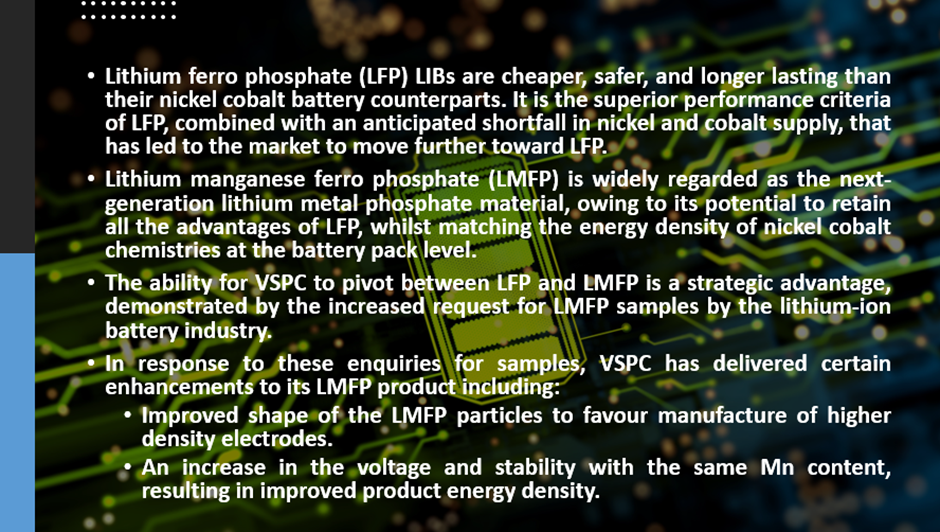

VSPC is focused on the research and production of high-purity, high-performance battery materials including lithium ferro phosphate (LFP) and lithium manganese ferro phosphate (LMFP) cathode powders. The period saw continued work on a pre-qualification pilot plant (PQPP) engineering study.

What’s more, LIT roped in Mr Simon Linge as its new CEO, effective on or before 1 January 2023.

Envirostream sees new agreements, increased EOL battery volumes

Envirostream is committed to recovering critical metals from EOL batteries and providing sustainable solutions for their disposal. The recycled metals are used in the manufacturing of new LIBs.

Source: LIT update

During the reported period, the company executed a battery recycling services agreement with Battery World Australia Pty Ltd. As per the agreement (effective from 1 August 2022), the company will offer battery recycling services for participating Battery World Franchise sites across Australia, thus allowing Envirostream to collect spent batteries from more than 110 stores.

Also, the company executed an agreement with LG Energy Solution (LGES) to process at least 250 tonnes of LIBs, equivalent to over 5,000 energy storage systems, that LGES will be delivering to Envirostream’s facilities in Melbourne, Australia.

Source: LIT update

The company has felt the impacts of the Australian government-backed battery recycling scheme “B-cycle” as it saw an increase in the collection of EOL batteries since the launch of the scheme in January 2022, as reported by Envirostream.

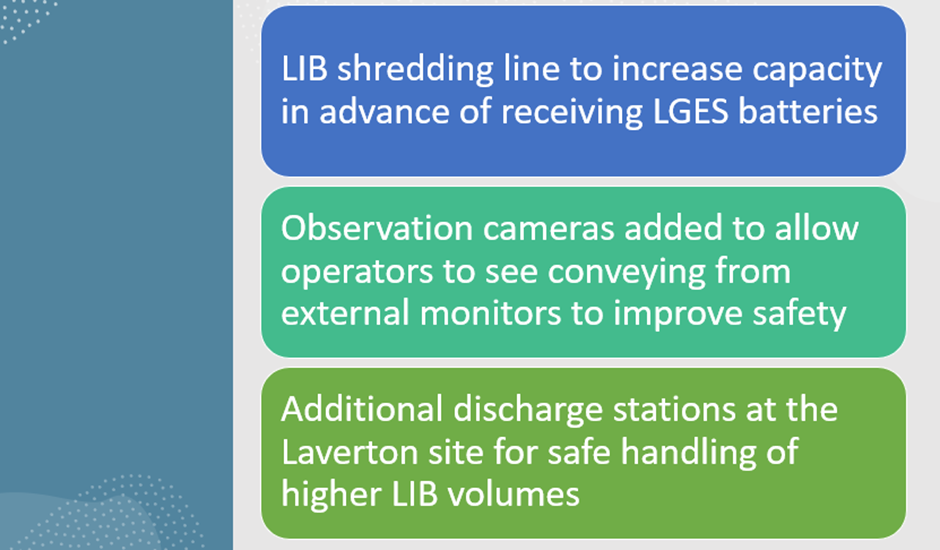

During the quarter, the company advanced technologically with several enhancements installed, as mentioned below:

Source: © 2022 Kalkine Media®, Data source: LIT update

VSPC moves ahead with DFS for LFP manufacturing facility

VSPC, operating a research & development facility (pilot plant) in Brisbane, is focused on finalising a definitive feasibility study (DFS) for an initial 10,000tpa LFP manufacturing facility.

Data source: LIT update

The quarter saw the commencement of a DFS plant capacity assessment study with the outcomes expected to aid a production capacity increase based on a single production train, with this capacity.

Also, the ultra-fine milling test work provided valuable knowledge on milling power requirements and other critical equipment design parameters.

Lycopodium continued work on a pre-qualification pilot plant engineering study, which is on track for completion in early 2023.

The company has also filed an international patent application for the production of iron (II) oxalate. It has dual benefits: lower operating costs and security of supply (as it is majorly produced in China and susceptible to supply chain issues).

Next-generation LieNA® processing technology

The Lithium Chemicals division of LIT is working in collaboration with ANSTO to develop its next-generation LieNA® processing technology. The method is designed to produce high-purity lithium chemicals by refining low-grade or fine spodumene. These chemicals can then be used as direct feed to produce LFP for the currently booming global market for LFP batteries.

The quarter saw the completion of the preparation and water commissioning of other LieNA® pilot plant circuits for pilot plant operation. Also, the formal registration for the LieNA® CRC-P autoclave vessel (five years validity) was received.

Strengthened financial position

LIT closed the quarter with no debt, AU$13.6 million in cash and AU$5.7 million worth of investments in listed equities. The company secured AU$12.1 million via a placement at an issue price of AU$0.065 per share during the quarter.

In essence, the quarter saw both the wholly owned subsidiaries of Lithium Australia making progress in the battery market. The company believes that Australia’s national battery stewardship scheme and the booming electric vehicle space offer major opportunities to Envirostream, which can tap the expected significant jump in spent battery volumes available for recycling. Moreover, LIT says that VSPC has a significant commercial opportunity with the production of LFP cathode powder production.

LIT shares were trading at AU$0.049 in the early hours of 2 November 2022, up more than 4% from the last close.