Highlights

- Lithium Australia’s subsidiary VSPC is looking to commercialise its patented RC process, which is versatile to manufacture both LFP and LMFP.

- LMFP batteries can offer higher energy density than their LFP counterparts, with no difference in cost of materials input.

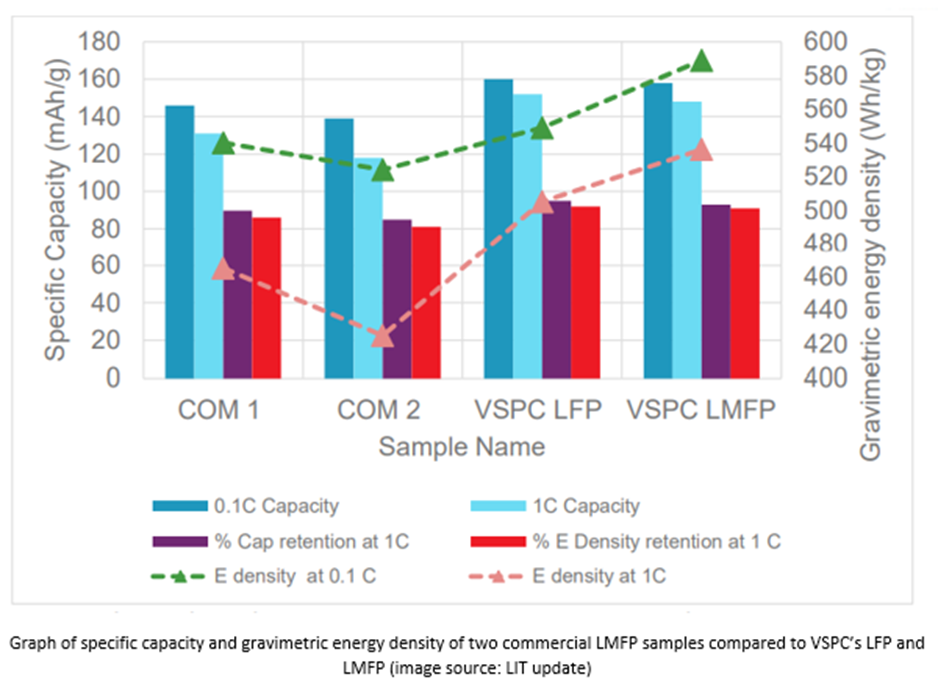

- Benchmarking tests showed that VSPC LMFP is superior to two commercial LMFP samples when comes to energy density and specific capacity.

Lithium Australia Limited (ASX: LIT) has an interesting and major update about its wholly owned subsidiary VSPC Pty Ltd (VSPC), which is on its way to commercialise its patented RC process. This commercialisation is slated to be a major step toward the manufacturing of lithium ferro phosphate (LFP) and lithium manganese ferro phosphate (LMFP) cathode powders at scale.

For the unversed, VSPC makes state-of-the-art materials for e-mobility and energy-storage applications, with stress on processes that nudge toward zero-carbon economy.

LFP lithium-ion batteries (LIBs) are safer, cheaper, and more enduring in comparison with their nickel cobalt counterparts. The superior performance criteria of LFP, along with an expected dip in the supply of nickel and cobalt, has warmed up the market to LFP.

Data source: LIT update

LMFP Batteries: Better bang for same bucks

Theoretically speaking, the energy density of LMFP batteries can go up to 230 Wh/kg, which is 15 to 20 percent higher than that for LFP batteries, with almost no difference in the cost of material inputs.

Incorporating manganese in the LFP chemistry increases the voltage from 3.2 to 4 volts, thereby enhancing the energy density of the battery.

LFP and LMFP: VSPC has the best of both worlds

The ability for VSPC to switch between LFP and LMFP is an advantage of strategic significance, as seen by the increased request for LMFP samples by the LIB industry.

In response to these sample enquiries, VSPC has made several enhancements to its LMFP product and is in the mid of manufacturing LMFP in order to satisfy the most recent such enquiries.

Data source: LIT update

Impressive product development trajectory of VSPC

VSPC has been persistent in its efforts toward optimising its LMFP formulation with an equal proportion of manganese and iron.

The recent advancements made by VSPC include

- Improvement in sphericity of LMFP agglomerates, in turn favouring the manufacture of high-density electrodes.

- Enhancement in the voltage and stability of the high-voltage plateau without changing the Mn content, thereby achieving higher energy density versus previous samples.

- Improved stability for voltage profile and energy density upon repeated, high‑rate cycling.

- Increased energy density of 590 Wh/kg against 550 Wh/kg of VSPC’s high-quality power LFP at 0.1 C for an Mn:Fe ratio of 50:50, with more refinements expected with formulations containing higher Mn content.

- Specific capacity and energy density at 1 C being >90 percent of the 0.1 C value.

- An easily available, low-cost Mn source has been found to function as well as the earlier used expensive Mn source.

- Upon benchmarking, VSPC LMFP came out as better than the two commercial LMFP samples in terms of energy density and specific capacity.

LIT shares were trading 1.78% up at AU$0.057 midday on 06 October 2022.