Highlights

- KRR advanced drilling programs at Tennant Creek in FY24, focusing on Iron Oxide Copper Gold (IOCG) deposits.

- Key drilling sites include the Langrenus and Kurundi prospects.

- The company committed AU$2 million for exploration at high-potential sites.

- Drilling at Langrenus intersected ironstone and iron-altered zones in areas previously unrecorded areas.

- KRR ended FY24 with a cash balance of nearly AU$4 million.

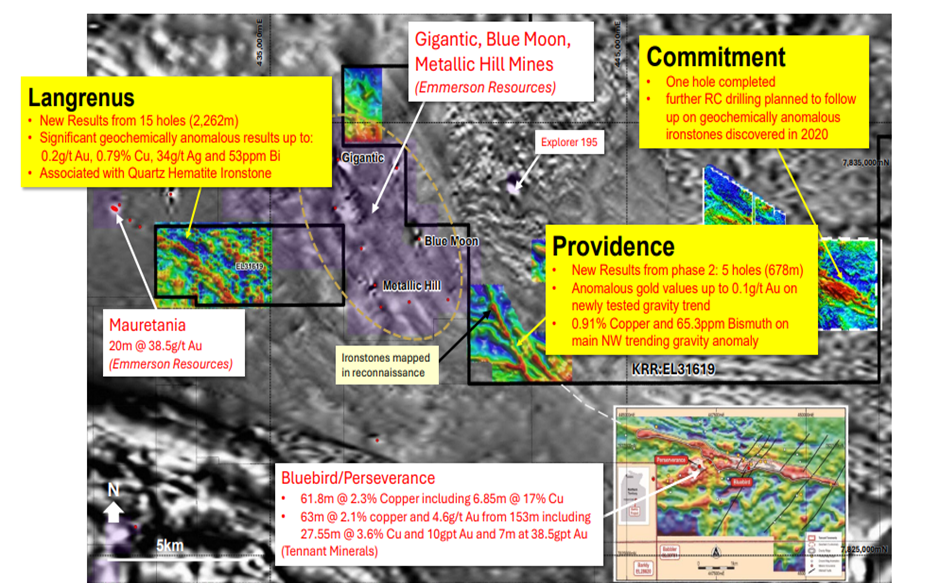

King River Resources Limited (ASX:KRR) has released its annual report for the year ended 30 June 2024, highlighting its exploration and geophysical activities at the Tennant Creek Project. The project’s 18 tenements are held by KRR’s subsidiary, Treasure Creek Pty Ltd, covering approximately 6,641 km2 and being prospective for gold and copper.

During the 2024 financial year, KRR conducted drilling programs at the Langrenus Prospect, targeting Iron Oxide Copper Gold (IOCG) deposits, and at the Kurundi Prospect for gold.

The company had allocated AU$2 million to advance exploration at high-potential sites, including Rover East, Tennant East, Barkly, and Kurundi, identified through a 2023 geophysics program that highlighted promising IOCG zones. These efforts focused on multiple targets along geological and geophysical trends, some linked to known high-grade copper and gold deposits, such as Rover, Bluebird, and Mauretania.

Drilling Highlights and Progress

In May 2024, KRR announced the commencement of 10,800m RC drilling across 61 holes at 13 prospects, initially focused on the Tennant Creek East area, beginning with the Langrenus prospect, followed by Commitment and Providence. The program aims to build on last year's discoveries of significant mineralisation.

By early June 2024, drilling at Langrenus was completed, covering 1,824m across 11 holes, with around 1,300 samples collected and sent to the laboratory for testing.

By late June 2024, the company reported that drilling across Providence, Langrenus and Commitment had intersected several ironstone and iron altered zones in areas previously unrecorded.

In September 2024, the company released assays for the Langrenus and Providence Prospects. Initial drilling at Langrenus included 15 RC holes, covering 2,262m. The drilling results revealed concentrations of up to 0.2 g/t Au, 53 ppm Bi, 206 ppm As, 93 ppm Sb, 178 ppm Co, and 3.8 ppm Ag, all associated with a broad quartz hematite structure.

Image source: Company update

Additionally, 0.79% Cu, 48 ppm Bi and 34 ppm Ag were detected in strongly iron-altered siltstones located near TTRC072. The company intends to conduct further investigations to assess the orientation and extent of this newly identified geochemically anomalous structure.

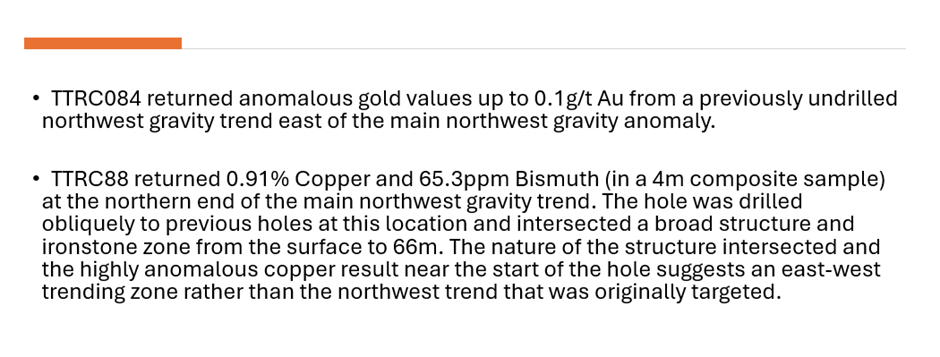

The results from the phase 2 RC drilling at Providence for 678m returned substantial geochemical anomalies-

Data source: Company update

The company plans to conduct additional work at Providence.

Cash Position and Deferred Payments Overview

At year-end, the company reported a cash balance of AU$3,935,830, including proceeds from staged cash payments from ASX-listed Tivan Limited.

Last year, Tivan acquired KRR’s Speewah Mining Pty Ltd for AU$20 million, structured as a AU$10 million cash payment and AU$10 million in Tivan shares. By the end of the previous financial year, KRR had received AU$5 million in cash, with the remaining balance restructured in February 2024.

Under the revised terms, Tivan will make an initial AU$1 million payment following a successful capital raising in Q1 2024, with additional payments based on subsequent capital raises.

As of 30 June 2024, the company has received AU$2 million and an additional AU$1.6 million in July 2024, leaving AU$2.4 million in deferred cash consideration outstanding.

KRR shares traded at AU$0.009 apiece at the time of writing on 24 September 2024.