Highlights

- Jindalee Resources had partnered with POSCO Holdings (NYSE:PKX) earlier this year for joint research at McDermitt

- The metallurgical testwork is finished and acid leaching with beneficiation has emerged as the most suitable processing method

- Now, the Bureau of Land Management of the US has notified the company that Exploration Plan of Operations for McDermitt is deemed complete

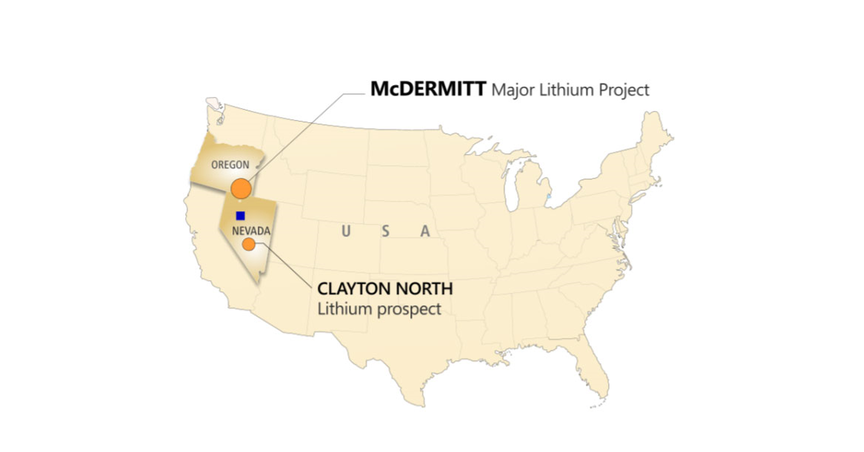

ASX-listed pure play lithium (Li) company Jindalee Resources Limited (ASX: JRL), which is developing its flagship McDermitt project in North America, has informed about the "steady progress" at its US-based lithium asset.

In the last development, JRL has been notified by the Bureau of Land Management (US) that the Exploration Plan of Operations for McDermitt has been deemed complete.

This comes in the backdrop of Jindalee having signed in February 2023 a Non-Binding Memorandum of Understanding with Korea's POSCO for joint research for optimisation of processing of McDermitt's ore.

Source: Company update

Permitting

Jindalee has been notified by the Bureau of Land Management (US) about the deemed completion of the Exploration Plan of Operations. Notably, JRL had submitted this in August last year, with additional information provided earlier this year. The Bureau of Land Management will now invite public comment (as a part of the environmental review process or separately).

The final decision on the National Environmental Policy Act assessment, which is likely to be finalised within 12 months, would be made a part of the Exploration Plan of Operations.

Another big development is that the Bureau of Land Management and the Oregon Department of Geology and Mineral Industries have given their nod to accept surety bonds, which can take place of cash reclamation bonds presently lodged against the Project. This shall return up to US$120,000 in cash to Jindalee. The use of surety bonds would also trim down the cash outlay for further bonding required at the time of final approval of the Exploration Plan of Operations.

Metallurgical Testwork – POSCO

A Non-Binding Memorandum of Understanding was signed by Jindalee earlier this year with NYSE-listed Korean conglomerate POSCO Holdings. It is pertinent to note that the latter company is a major lithium producer and supplies cathode active materials to US automaker General Motors. The joint research by the two companies will assist in optimising the flowsheet for processing ore from the Project. The testwork is entirely funded by POSCO.

Results from the first phase -- a large composite sample was sent to POSCO’s research facility in March this year -- will be available by July this year. Commercialisation of the McDermitt Project would also be jointly evaluated by POSCO and Jindalee after the finalisation of the testwork.

Metallurgical Testwork – Jindalee

Fluor, which had finalised the review of all metallurgical testwork at the McDermitt Project, has determined that the acid leaching with beneficiation method is the most optimum processing method, thanks to lowest operating costs and best financial result. Additionally, further testwork -- separate from POSCO's testwork -- to refine the preferred flowsheet and back a pre-feasibility study is underway and is expected to be completed before the end of this quarter.

Shares of JRL on the ASX closed at AU$2.17 (market cap over AU$118 million) on 17 May 2023.