Highlights

- Haranga has raised AU$500,000 via a convertible loan facility from existing and major shareholders.

- Funds will be used to advance the Ibel South Gold Project, continue Saraya Uranium exploration, and explore new opportunities.

- At the Saraya Uranium Project, the company has already defined a 17.6Mlbs U3O8 indicated & inferred JORC mineral resource @ 550 ppm.

Haranga Resources Ltd (ASX:HAR, FRA:65E0) has raised AU$500,000 through the issue of a convertible loan facility to major and existing shareholders.

The funds will support the company’s resource exploration initiatives, including advancing its wholly owned Ibel South Gold Project in Senegal to a “drill-ready” stage and continuing auger drilling at the Saraya Uranium Project. The funds will also help explore new opportunities in the gold and clean energy sectors.

The AU$500,000 loan facility includes AU$445,000 from a sophisticated investor affiliated with the lead manager, CPS Capital Group, and AU$55,000 from non-related parties.

Terms of the Convertible Loan

The convertible loan, along with any accrued interest, will be converted into shares, contingent upon receiving prior approval from shareholders. The conversion price will be determined based on the price at which the company conducted its most recent capital raising prior to the issuance of a conversion notice, with a 20% discount.

If the loan and accrued interest are not converted into shares before the specified time, they must be repaid either on the maturity date of three months, or earlier if the lender provides written notice due to an event of default.

CPS Capital Group Pty Ltd (CPS) served as the lead manager for the capital raise and will receive fees of 3% + GST of the amount drawn down under the raise.

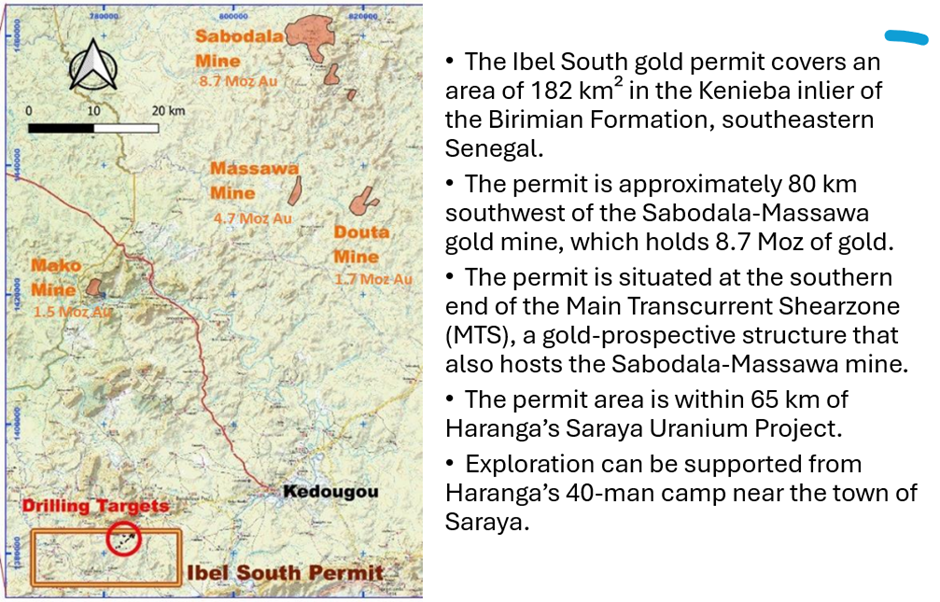

Aircore drilling planned for Ibel South Gold Project

Data and image source: Company update

Recent exploration efforts at the project revealed highly anomalous gold values of up to 180 parts per billion (ppb), with the most significant concentrations in termite mound samples reaching 545 ppb and 643 ppb. These results have outlined a 2.5 km long northeast-trending gold anomaly, and its structural setting is considered highly prospective target for further exploration.

Notably, no previous drilling has been conducted within the perimeter of the Ibel permit. Haranga Resources has applied for drilling access and anticipates launching a 2,000m AC drilling program in 4Q 2024. A Senegalese contractor has already been identified for this project.

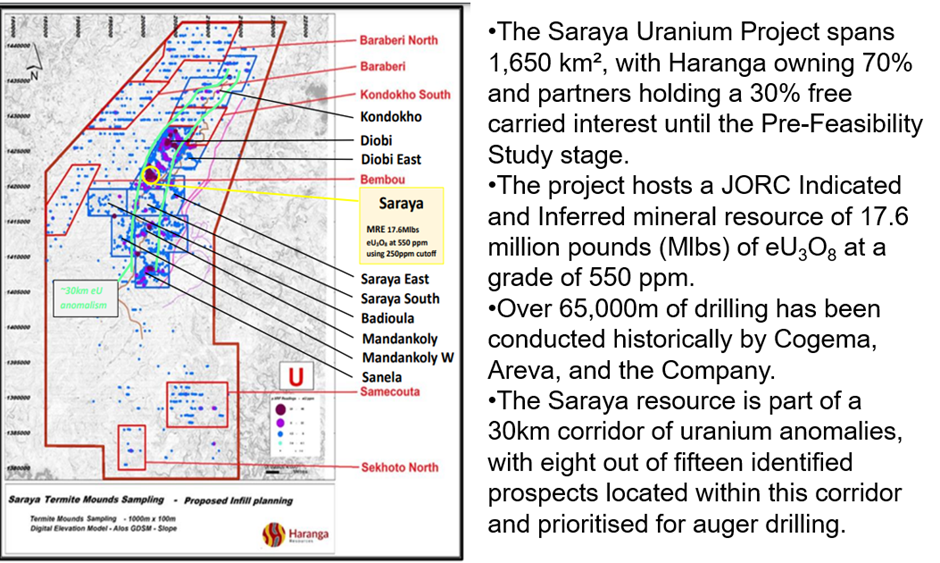

Auger Drilling at Saraya Uranium Project

Data and image source: Company update

To date, 16 regional uranium anomalies have been defined including Saraya, primarily through termite mound sampling (TMS). Nine of these anomalies have been infilled and are prepared for auger drilling. The drilling aims to identify uranium sources below laterite cover and determine the orientation for future RC drilling.

Furthermore, auger drilling at the Sanela prospect has been completed and has identified uranium anomalism under laterite cover, which will be followed up through planned RC drilling.

The company continues to focus its strategy on the gold and clean energy sectors, including ongoing exploration in Ivory Coast and Burkina Faso for gold, as well as advancing its Saraya Uranium Project in Senegal.

HAR shares were trading at AU$0.055 each at the time of writing on 5 November 2024.