Highlights

- Haranga Resources is acquiring the Lincoln Gold Project in California, a site with historic production of ~3.4moz of gold.

- The Lincoln Project is fully permitted for mining and exploration with over AUD 90 million already invested.

- Haranga plans 1,500–2,500m of underground drilling at the Lincoln-Comet deposit to establish a JORC-compliant resource and extend exploration to high-priority zones.

- The company commenced a termite mound sampling campaign at the Saraya Uranium project and applied for a permit extension to 2028.

- The company raised AUD1.14 million in a tranche 1 placement.

Haranga Resources Limited (ASX:HAR; FRA:65E0) advanced its position in the North American gold sector during the March 2025 quarter through progress on the strategic acquisition of the Lincoln Gold Project in California. With a rich production history and a prime location along the prolific Mother Lode gold belt, the company believes that the project offers significant development potential.

During the quarter, the company also progressed infill termite mound sampling at the Saraya Uranium project and lodged a permit renewal application.

Acquisition of Lincoln Gold Project

In March 2025, Haranga announced executing a binding share sale agreement with Seduli Holdings (Australia) Ltd to acquire 100% of the equity of Seduli Sutter Operations Corporation, the owner of the Lincoln Gold Mine (Lincoln Gold Project) located in Sutter Creek in California, the US.

The project spans 5.8 km along the historic Mother Lode and covers 322 hectares. Located within the Jackson-Plymouth segment of the Mother Lode, this zone has contributed nearly half of the belt’s total historical gold output. The project area itself has produced approximately 3.4 million ounces of gold.

The company is due to seek shareholder approval during its annual general meeting on 28 May 2025.

Resource Estimations and Metallurgy

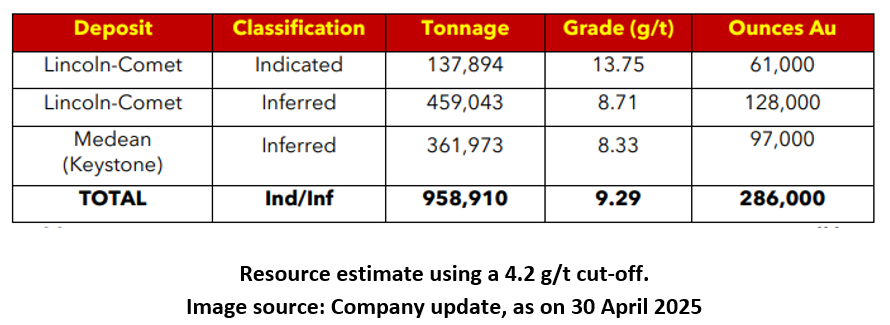

Eleven resource estimations have been completed at the site, with the most recent in 2015 classifying most of the deposit as "inferred" due to drill hole spacing and historical data limitations.

Recent surface and underground drilling results will be included in upcoming mineral resource updates.

Metallurgical testing has shown variable recoveries from 64% to 99%, based upon the processing techniques and the presence of coarse particulate gold.

The Lincoln Gold project holds all three major permits required for underground mining, ore processing, and exploration. Over AUD 90 million has already been invested in infrastructure.

Next Steps & Exploration Program

As part of due diligence, 250 samples were sent to an independent lab in Nevada to support database validation and resource re-evaluation.

Haranga plans 1,500–2,500m of underground diamond drilling at the Lincoln-Comet deposit for a JORC-compliant estimate, followed by step-out drilling and high-priority target testing at South Spring Hill and Medean veins.

The company intends to define approximately +1 million ounces of gold and launch a mine plan for large-scale production.

Progress at Saraya Uranium Project

A termite mound sampling campaign was initiated targeting 20,000 samples in 2025. The aim is to complete seven remaining infill grids, refine existing anomalies, and identify targets for auger drilling.

Furthermore, during the quarter, a renewal application for the Saraya permit was submitted, requesting a three-year extension to 4 June 2028.

Capital Raise

During the quarter, the company successfully raised AUD 1.14 million through Tranche 1 and issued 22,819,843 fully paid ordinary shares in the placement to sophisticated, professional, and institutional investors.

HAR shares traded at AUD0.048 per share on 05 May 2025.