Highlights

- FYI has regained 100% of the HPA project and holds strong commitment to advance its development-related activities.

- Also, the firm retained HPA project data, information as well as its IP during the quarter.

- FYI is building another development strategy and a schedule for the revised small-scale production and demonstration facility.

- A 17-day production run of high quality HPA was completed successfully during the quarter to produce samples for targeted end-users.

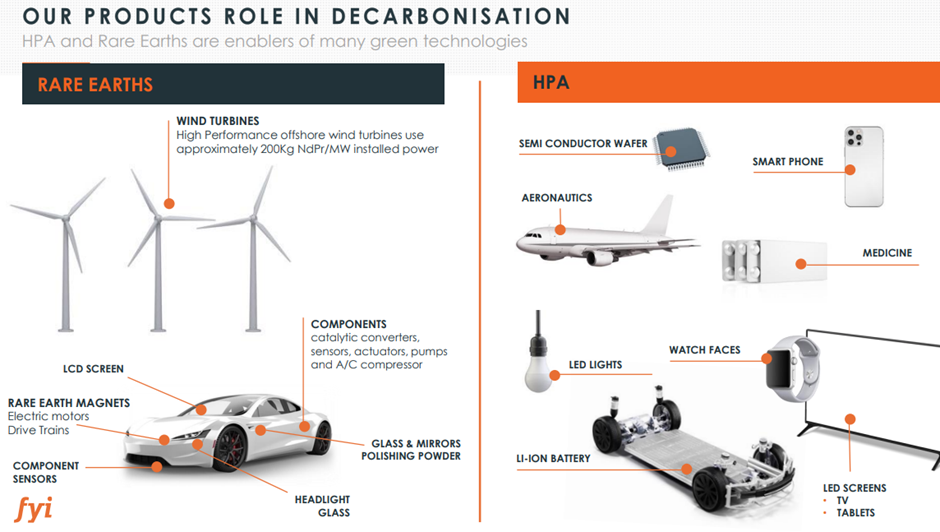

One of the emerging resources technology company and critical minerals developer, FYI Resources Limited (ASX: FYI FSE:SDL OTC:FYIRF) has been up and running for innovations that can help build a sustainable future. It is focussed to position itself as a major player in the high-quality critical minerals production space.

Presently, the company is involved in developing a world-class integrated High Purity Alumina (HPA) Project in Western Australia. In its recently released report for the March 2023 quarter, it has put forth details of all operational updates for the project. Let’s have a closer look at the key developments!

Revised HPA Development Schedule

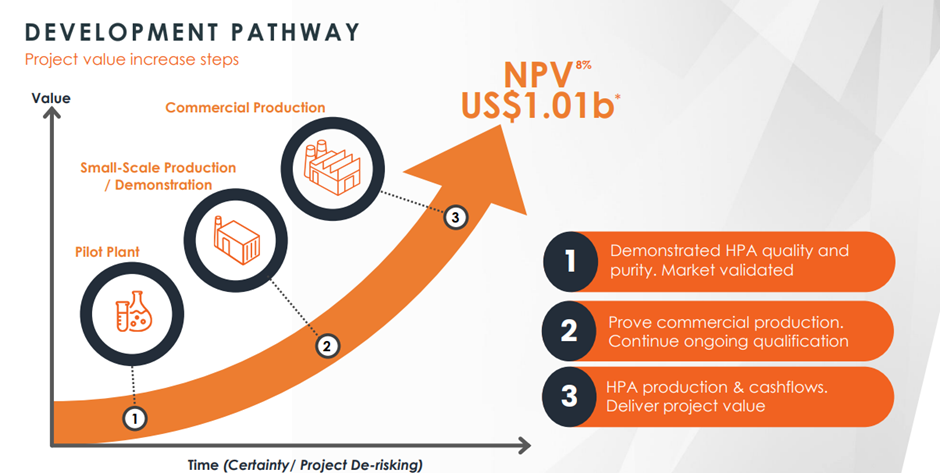

The company has won back 100% ownership of the High Purity Alumina (HPA) project. With it comes along the opportunity to mark and achieve a commercial outcome consistent with FYI’s 2021 DFS (Definitive Feasibility Study).

At present, the firm is working on another development strategy as well as the schedule for the revised small-scale production and demonstration facility. This will include the process improvements and optimisations marked over a period of past 18 months. During this period, there were activities of development, such as the learnings from the ongoing product marketing and customer outreach activities.

HPA production campaign for targeted end-users

HPA production campaign for targeted end-users

A 17-day production run of high quality HPA was completed successfully during the quarter to produce samples for targeted end-users. The collected samples were then sent to labs for purity and quality analysis.

In a bid to boost its network of reputable customers in the niche markets, FYI is targeting particular market segments for HPA offtake arrangements.

Environment Social Governance (ESG)

FYI has tagged ESG as a fundamental principle to its business model. According to the company, managing risks and opportunities relating ESG is highly significant for the company’s license to stay operational as well as for making its business stronger in the market.

The firm is aware of its responsibilities as an emerging low carbon producer for its HPA projects as well as its ESG obligations via adopting the UN Sustainable Development Goals (SDGs) as framework to achieve long term sustainability. During the quarter, the firm moved ahead on its ESG path and continued making efforts for a better world by giving back to the community, innovating responsibly, decreasing environmental impact and helping carbon reduction for future generations.

During the quarter, the company undertook many ESG activities, such as reviewing FYI’s HPA process waste management processes and conducting a review into setting FYI’s greenhouse gas (GHG) inventory to have an understanding of its carbon footprint.

The company also had its focus on HPA process GHG emissions, land use and key biodiversity areas and water consumption and recycling for HPA process.

Other developments post March quarter

- In April, FYI announced its entry into the rare earths sector with the execution of a heads of agreement for the staged acquisition of Minhub Operations.

- FYI revised and re-engineered the development schedule to amplify the commercial production of its HPA project.

- FYI Resources also secured a 15% increase in the total product output for HPA in the pilot plant production campaign.

FYI’s plan for the June quarter

In the ongoing quarter, the company has concentrated its focus on developing further ESG disclosures, pay equality, governance body composition, and diversity and inclusion.

The Task Force on Climate Related Financial Disclosures gave certain risk and strategy recommendations which are presently being reviewed. They will be integrated in the overall risk management framework and processes of the firm.

FYI shares register 15% growth in one month

The company’s share price gained more than 15% in the past one month. The stock traded at AU$0.12 midday on 24 May 2023, with market capitalisation of AU$42.12 million.