Highlights

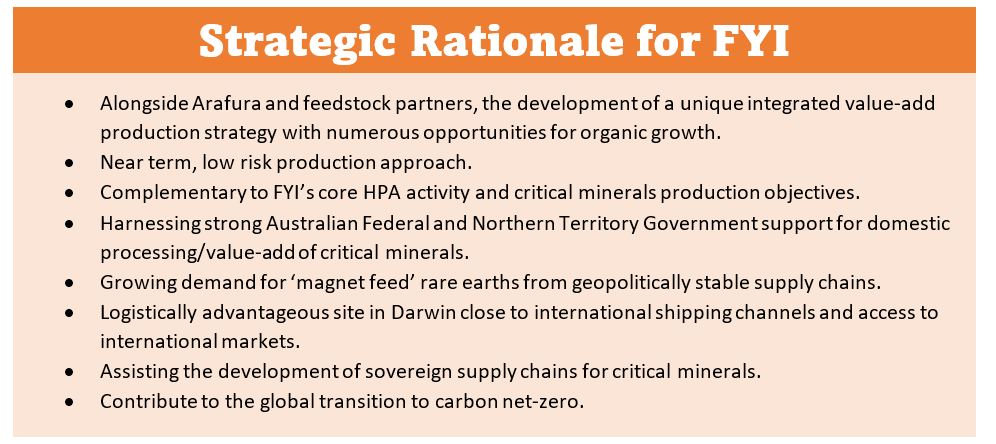

- FYI Resources has outlined its plans to enter the rare earths sector as it has executed a heads of agreement for the staged acquisition of Minhub Operations Pty Ltd (MOPL).

- MOPL has separately entered into a non-binding Co-operation Agreement with Arafura Rare Earths, wherein Arafura has the option to elect to earn up to 50% in the Minhub Project.

- The strategy of the MOPL falls in line with the Federal Government’s Critical Minerals Policy, and AU$30 million grant awarded to Arafura under the Modern Manufacturing Initiative Collaboration Stream in March 2022.

In the latest announcement, Australia's emerging critical mineral developer FYI Resources Limited (ASX: FYI) revealed its plans to enter the rare earths sector as it has executed a heads of agreement for the staged acquisition of Minhub Operations Pty Ltd (MOPL), which has separately entered into a non-binding Co-operation Agreement with Arafura Rare Earths Limited (ASX:ARU) (Arafura).

An overview of Minhub Operations

Image source: Company website

The prime objective behind establishment of MOPL was to develop, construct, and operate a mineral processing plant in Australia to facilitate the development of rare earth rich mineral sands deposits.

Currently, MOPL is aiming to finalise partnerships with present and potential mineral sand producers through agreements for technical cooperation. The feedstock agreements by MOPL is a condition precedent to signing the formal share purchase agreement.

Minhub and Arafura Co-Operation Agreement

MOPL and Arafura have inked a non-binding Co-operation Agreement, wherein Arafura has the option to elect to earn up to 50% in the Minhub Project by giving pro-rata funding for the Minhub Project Feasibility Study and informing MOPL that it intends to develop the facility jointly with MOPL post the Feasibility Study is completed, most likely in 2024.

Subject to a Development Decision being finalised, Arafura and MOPL would develop a partnership structure in which the parties would pursue development of the Minhub Project and agree their respective ownership interests based on the ratio of funding committed to the Minhub Project by both parties, besides finalising the terms of an agreement necessary to give effect to the partnership structure.

Under the Co-operation Agreement, Arafura has the first right of refusal to purchase xenotime and monazite from the Minhub Project for further downstream processing at its Nolans Project. Arafura and MOPL will also jointly investigate options for further processing of heavy rare earths sourced through the Minhub project. MOPL is also working with several emerging mineral sands projects to supply rare earth feedstock to Nolans via their processing facility. MOPL will act as project manager through the Feasibility Study and the Minhub Project’s development phases and will be responsible for operating the processing facility once in production.

Standpoint of the govt on MOPL

The strategy of MOPL falls in line with the Federal Government’s Critical Minerals Policy, as well as with the AU$30 million grant awarded to Arafura under the Modern Manufacturing Initiative Collaboration Stream in March 2022.

Under this stream, grant funding is given to some transformational projects creating and facilitating collaborative developments, including the proposed partnership between MOPL and Arafura. The development of the Minhub Project is also being facilitated by the office of the Northern Territory Major Projects Commissioner.

FYI’s outlook for the coming quarters

Anticipating completion of the Feasibility Study by early 2024, MOPL will continue to hold technical work and offtake discussions with feedstock partners. FYI is also looking forward to establish binding commercial arrangements between MOPL and Arafura, post confirmation of a Development Decision by Arafura.

The company has to finalise the site and seek permits for the Minhub processing facility in Darwin. The discussions with potential rare earth customers will continue and a customer outreach program will also be outlined. The company is also looking forward to starting ESG practices for the Minhub strategy.

Stock price gains 50% in a month

The company’s share price has jumped by over 57% in the past one month. The stock traded at AU$0.110 midday on 09 May 2023, with market cap of over AU$40 million.