Highlights

- First Au has executed a conditional agreement with PG Exploration Pty Ltd for 100% acquisition of the issued capital of PG Exploration.

- PG Exploration holds four tenement applications in proximity to licences held by some of Australia’s largest lithium companies.

- First Au has also received binding commitments for a placement to raise AU$1.5 million.

ASX-listed gold and base metals exploration company First Au Limited (ASX:FAU) and the owners of PG Exploration Pty Ltd have inked a conditional agreement, wherein FAU will acquire 100% of the issued capital of PG Exploration.

PG Exploration holds four applications for exploration licences and has made a ballot application in the Pilbara region of Western Australia.

Also, First Au has received binding commitments from investors for a two-tranche placement, designed to raise AU$1.5 million. Under the placement terms, ordinary shares will be issued at AU$0.003 per placement share. Every two placement shares are to be accompanied by one free-attaching option with an exercise price of AU$0.012 and expiring 18 months from issue.

An overview of PG Exploration Project

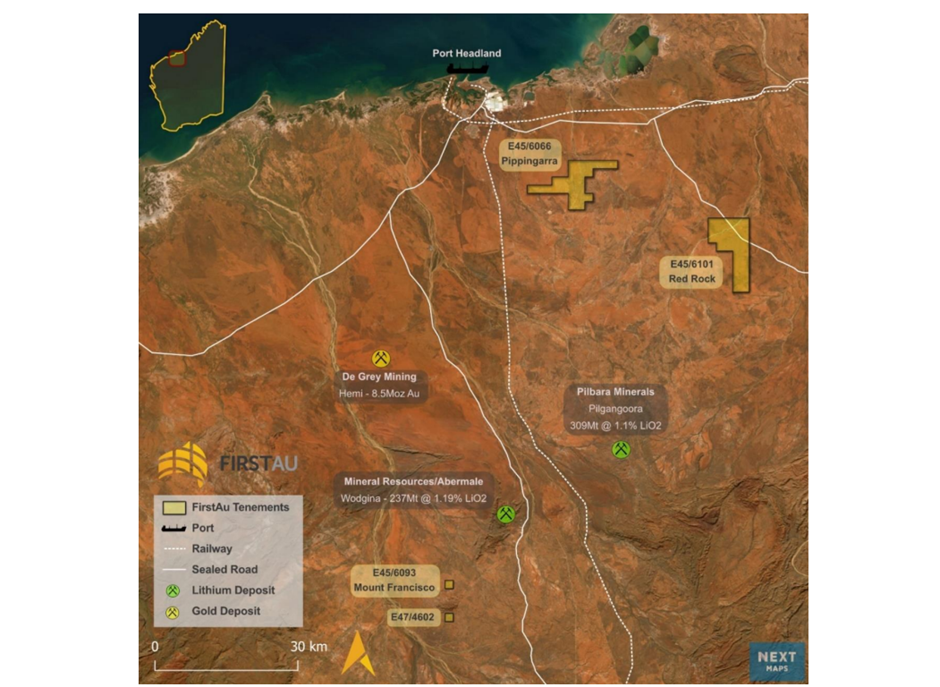

Project locations and major Lithium Mining centes (Image source: company update)

Spanning over 180km2 in the Pilbara region of WA, PG Exploration’s tenement applications are located near licences held by some of Australia’s largest lithium companies in the region such as Mineral Resources/Albermale JV, Sayona Mining (ASX:SYA) and Pilbara Minerals (ASX:PLS). Fortescue Metals Group (ASX:FMG) and De Grey Mining (ASX:DEG) have large tenement holdings in the vicinity of PG Exploration’s applications.

With limited historical exploration, the tenements that are early-stage exploration projects are believed to offer potential upside.

The known outcropping pegmatites and historical lithium rock chip and soil sampling from the Red Rock Prospect and high-grade niobium (Nb) and Tantalum sampling from the southern Mount Francisco tenement highlight the prospectivity of the tenement package.

The sample results suggest

- 249ppm Li20

- 160ppm Li20, 48ppm Ta, 184ppm Cs and 141.5ppm Sn - SP555896

- 136ppm Li20

The Board believes ‘the new acquisition being prospective for lithium, a critical mineral, complements the company’s existing gold projects and has the potential to add value to the company through from exploration and attracting a wider audience of investors’.

FAU’s Exploration Focus

Primary focus: FAU intends to enter into an agreement with the Native Title Parties.

This will allow the tenements to be granted as well as completion of the acquisition of PG Exploration.

The ASX-listed firm will begin planning a comprehensive “boots on ground” exploration program, post completion of the transaction.

Interim focus: FAU plans reconnaissance, including limited sampling and geological mapping, to be able to review and establish its geological interpretation of the area. This will help in identifying the areas of interest for upcoming exploration programs.

Details of the two-tranche placement

- 142,789,991 placement shares will be issued to raise ~AU$430,000 before costs. The proceeds from will be directed to undertake exploration at the existing projects. The funds will also be used for working capital, including meeting the transaction costs.

- 357,210,009 placement shares will be issued subject to shareholder approval to raise around AU$1.07 million before costs. The proceeds will be used to fund exploration at the tenements and the existing projects as well as for working capital.

The company has engaged Peak Asset Management to play the part of the lead manager and corporate advisor of the placement. As per the placement terms, 20 million options (Broker Options) with the same terms as the placement options will be issued to Peak (and/or its nominee(s)). However, this remains subject to the full amount being raised under the placement.

First AU believes that the capital raising program would support its renewed strategic direction and focus outlined in the recently released December 2022 quarterly report. The company plans to commence drilling at Haunted Stream, the primary target at its Victorian Goldfields Project. Moreover, FAU intends to undertake early-stage exploration of the PG Exploration tenements with geological mapping and sampling to test for lithium potential.

FAU shares traded at AU$0.004 on 13 February 2023.