Highlights

- ASX-listed Fiducian Group, listed under ticker FID, is a financial services organisation offering financial planning, funds management and investment

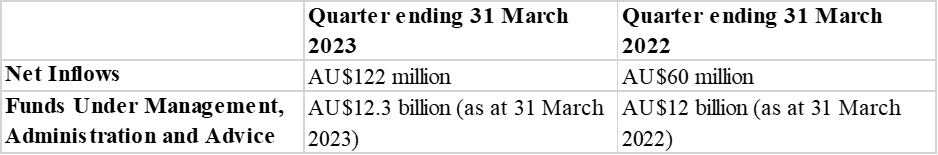

- FID has performed better in terms of net inflows during the quarter ended March 2023 vis-à-vis the March 2022 quarter

- Funds Under Management, Administration and Advice figure was AU$12.3 billion as at the end of March 2023 quarter

ASX-listed financial services company Fiducian Group Ltd (ASX: FID) has released the quarterly cash flow report of its operations for the quarter ended 31 March 2023. Notably, the Australian owned and operated company has performed better in terms of net inflows in the Fiducian platform as compared to the previous corresponding period (quarter ended March 2022).

Further, FID's year to date (YTD) figure for net inflows has also been higher as compared to the previous corresponding period (March 2022 YTD).

Image source: Company website; Data source: FID ASX announcement dated 21 April 2023

FID's net inflows rise

The company has reported net inflows of AU$122 million in quarter ended March 2023 vis-a-vis the figure of AU$60 million for the quarter ended March 2022. With respect to YTD figures, the net inflows were AU$279 million for March 2023 YTD vis-à-vis AU$223 million during March 2022 YTD. Fiducian Group has also added that the net inflows for the March 2023 quarter included AU$49 million (AU$92 million for YTD) from Independent Financial Advisers.

The Funds Under Management, Administration and Advice also showed improvement from AU$12.3 billion as at 31 March 2023 as compared to AU$12 billion as at 31 March 2022. FID's cash and cash equivalents at the end of March 2023 quarter stood at over AU$14.99 million (over AU$18.38 million for March 2023 YTD).

Source: FID ASX announcement dated 21 April 2023

The company's shares traded at AU$6.020 at the time of writing on 27 April 2023, with a market cap over AU$189 million.