Highlights

- Fiducian Group has announced upbeat financial results for the first half of FY24.

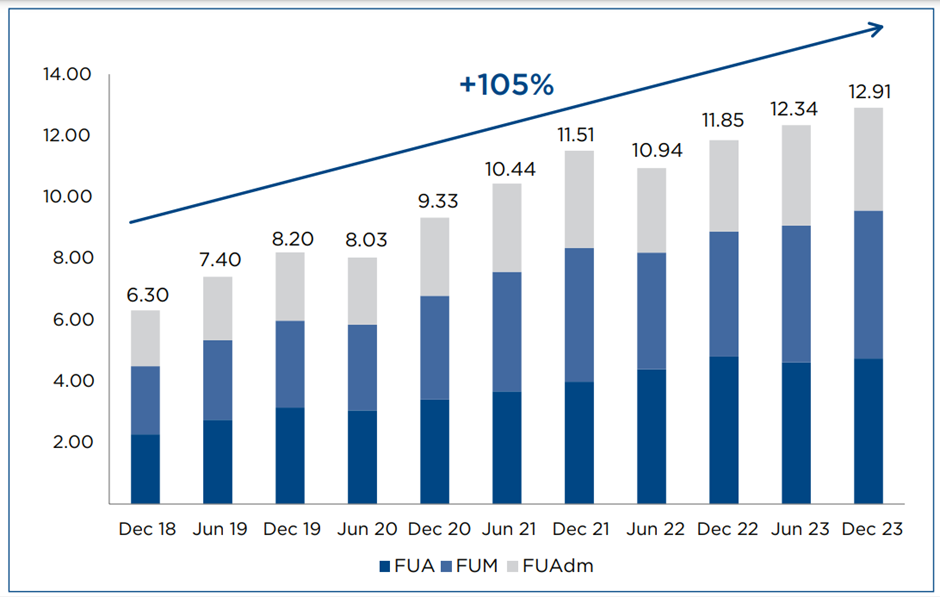

- In 1HFY24, the company recorded a 9% YoY increase in FUMAA, 18% YoY jump in FUM and 10% YoY growth in revenue.

- Underlying net profit after tax grew by 17% over the previous corresponding period.

- In the last five years, FID’s FUMAA has surged by over 105%.

Diversified financial services provider, Fiducian Group Limited (ASX: FID) has released half yearly results (1HFY24) for the period ended 31 December 2024, announcing an interim dividend of 18.20 cents per share. The 100% franked dividend is scheduled for payment on 11 March 2024.

The dividend declaration reflects the company’s upbeat first-half performance, marked by a 9% YoY jump in Funds Under Management, Administration and Advice (FUMAA) to AU$12.9 billion.

During this half, all operating entities contributed to the results. Let’s delve into Fiducian's upbeat half-yearly performance.

Key financial metrics for 1HFY24

- Operating revenue increased by 10% YoY to AU$39 million.

- Underlying NPAT surged by 17% YoY to AU$8.2 million and statutory NPAT increased by 23% YoY to AUD 6.84 million.

- Funds under management (FUM) increased by 18% YoY to AU$4.8 billion and funds under advice stood at AU$4.7 billion.

- Platform administration, providing wrap administration for investment and superannuation services, registered 13% YoY growth to AUD 3.4 billion.

105% growth in FUMAA over the last five years

Over the last five years, FUMAA has increased by over 105%. The company attributes consistent growth to strong inorganic and organic inflows. The growth in FUA as part of FUMAA highlights the recent acquisition of PCCU (People’s Choice Credit Union). The company expects this acquisition to drive future performance.

Image source: company update

Core Fiducian platform

The Core platform focuses on aligned advisers’ requirements including investment menu comprising manged accounts and Fiducian funds, over 60 external managed funds, and customised shares and term deposits.

From aligned financial advisers, net inflows were AU$121 million in 1HFY24. Almost 100% of inflows are invested via the company’s platform and in multi-manager funds. Both franchised and salaried networks contributed to the net inflows.

Non-aligned IFA market

Auxilium is a low-cost value proposition which aims at disrupting the current disruptor platforms through wide product menu, in-house technology, quality services and advanced reporting capabilities.

Five badges are gaining momentum for external dealer-groups. The company is receiving significant response from users regarding services, product offering and features.

Shares trade higher

Following the company update, FID shares traded at AU$6.400 on 12 February 2024, reflecting an increase of 9.4% from the previous close.