Highlights:

- Empire Resources has restarted aircore drilling at its Penny’s Gold Project.

- The campaign targets to test the lateral and strike extents of the mineralisation identified during the September 2022 campaign.

- Highly encouraging results from 1m re-split aircore composites included:

- PAC22-14: 6m @ 3.73 g/t Au from 64m including 1m @ 8.47 g/t Au from 65m and 1m @ 6.06 g/t Au from 67m

- PAC22-29: 2m @ 4.45 g/t Au from 51m including 1m @ 5.49/t Au from 51m

- PAC22-50: 3m @ 2.37 g/t Au from 56m including 1m @ 5.14 g/t Au from 56m

- PAC22-10: 1m @ 1.89 g/t Au from 62m

- PAC22-31: 1m @ 1.82 g/t Au from 91m

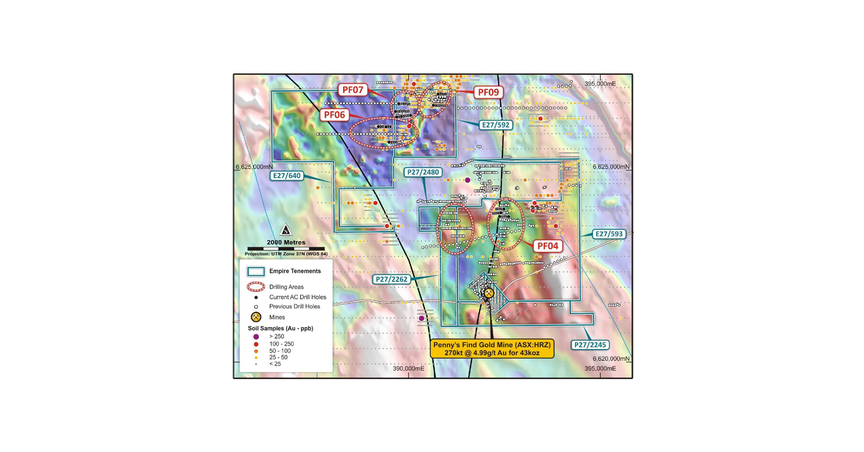

Empire Resources Limited (ASX:ERL) has updated on the recommencement of circa 3,500m aircore (AC) drilling at its fully owned Penny’s Gold Project.

The drilling campaign aims to test the extents of the mineralisation which was encountered during drilling undertaken in September 2022. The project targets are located adjacent to and along the strike of Penny’s Find Gold Mine, which has a resource estimate of 270,000t at 4.99 g/t Au for 43,000 oz.

The company expects to complete the drilling campaign in two weeks with laboratory assays anticipated in the following six weeks.

Overview of Penny’s Gold Project

In September 2022, Empire Resources completed drilling 69 aircore holes for 5,269m. The assay results of the program were positive with presence of multiple anomalous and high-grade gold, arsenic across the site.

Sampling

From few selective composite aircore intervals having more than 0.40 g/t Au, 1m re-split samples were collected by geological staff of Empire Resources in December 2022. The results of the 1m re-split sampling reinforces the tenor of gold mineralisation encountered and improves targeting of future drilling.

PF09 Prospect - Drilling at PF09 targeted historic MMI anomalies within a structural corridor interpreted from aeromagnetic data to be subparallel to the Penny’s Find Shear Zone.

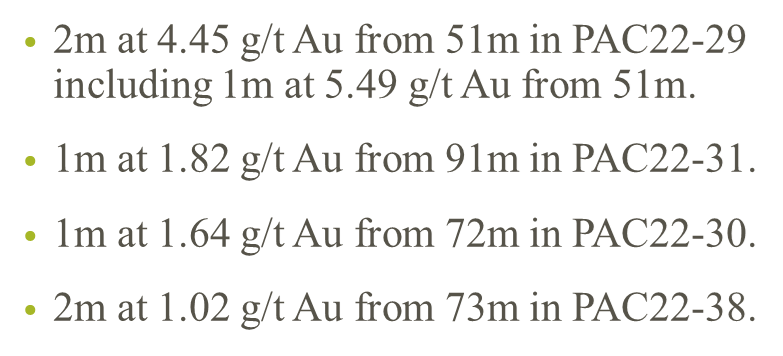

The latest results from samples of 1m re-split collected from select original aircore drilling composites in December 2022 are:

Data: ERL Update

Basalt with a local fine spinifex texture was intersected at PF09 prospect with a weathering profile range of 40-100m thickness.

Drillhole PAC22-26 contained residual gold in saprolite while the drillholes PAC22-27, PAC22-29 to PAC22-33 hit anomalous gold at interface of fresh rock. It is also believed that a strong arsenic anomaly (120-3,252ppm) is associated with anomalous gold at fresh rock interface.

PF06 Prospect – Previously interested historic MMI anomalies and anomalous gold were the targets of the latest drilling campaign. The results of 1m re-split samples that were collected in December 2022 include:

Data: ERL Update

Basalt with a local fine spinifex containing domains of mafic schist was intersected by drilling and was found to be similar to that of PF09 prospect.

The arsenic anomaly (80-1,463ppm) at PF06 is weaker than observed at PF09 prospect.

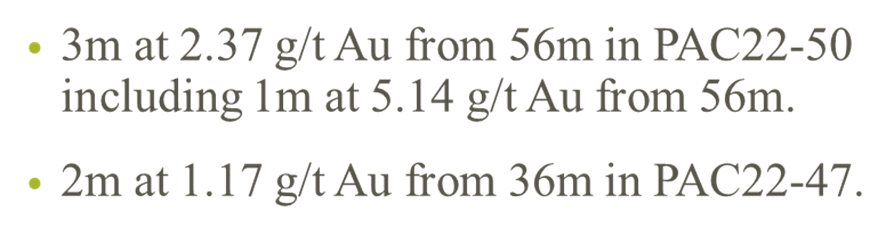

PF07 Prospect - The aircore drilling targeted historic MMI anomalies at PF07 prospect were found to be coincident with an extension to the Penny’s Find Shear Zone after interpreting aeromagnetic data.

The results of 1m re-split samples that were collected in December 2022 include:

Data: ERL Update

Basaltic rocks with mafic schist domains were also intersected by drilling with thickness of the weathering profile ranging 30-130m. The arsenic anomaly at PF07 prospect was patchy and strong (200-2,563ppm).

The shares of Empire Resource Limited were trading at AU $0.007 midday on 9 January 2023.