Highlights

- FY23 saw Empire Resources progressing well on its Penny’s Gold Project and Yuinmery Project in Western Australia.

- During FY23, ERL completed 8,671m of aircore (AC) drilling at its Penny’s Gold Project, demonstrating the project prospectivity.

- Reverse circulation (RC) drilling at the Yuinmery Project delivered encouraging copper and gold results.

ASX-listed exploration and development company, Empire Resources Limited (ASX: ERL) is progressing well on its four highly prospective projects across Western Australia - the Yuinmery Project, the Penny’s Gold Project, the Barloweerie Project, and the Nanadie Project. The ASX-listed company has its focus centered on growing its asset value through direct exploration at its projects and tapping value accretive investment opportunities to achieve business goals.

Project Location Map

Project Location Map

Image source: company update

The recently released annual report for the twelve-month period ended 30 June 2023 highlights the developments undertaken primarily across the Penny’s Gold Project and Yuinmery Cu-Au Project. The period saw drilling campaigns across the two projects delivering encouraging outcomes.

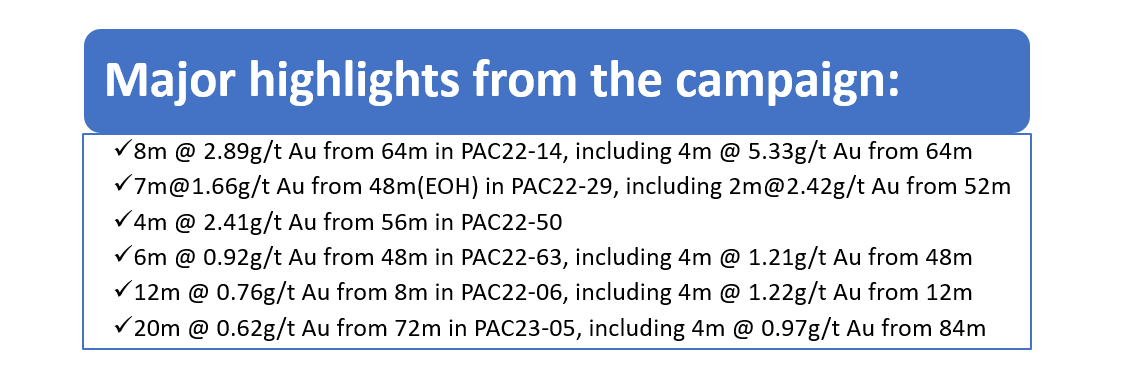

- Penny’s Gold Project (WA) – drilling demonstrates project prospectivity

During the year, Empire completed 8,671m of aircore (AC) drilling at the project. The drill results highlighted the project’s prospectivity as well as potential for additional economic gold mineralisation discoveries comparable to the nearby high-grade Penny’s Find Gold Mine.

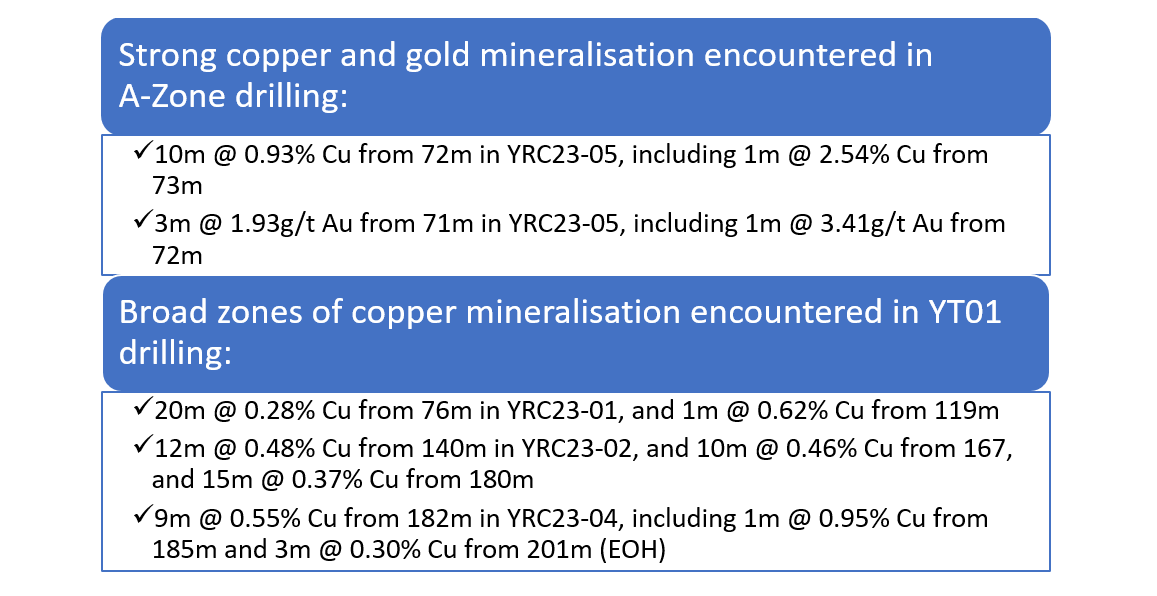

- Drilling at Yuinmery Project -delivers copper and gold mineralisation

The company wrapped up a 924m reverse circulation (RC) drilling campaign at Yuinmery during FY23. The drilling targeted extensions to the recently discovered YT01 prospect as well as delineate shallow high-grade copper-gold extensions to A-Zone.

According to the company, A-Zone is emerging as an exciting deposit with continued near surface high-grade Cu-Au mineralisation. Its YT01 prospect is turning into a huge tonnage Cu system. Overall, recent developments hint at a potential discovery of economic Cu-Au mineralisation at the project site, says the company.

The company remains well funded to undertaken further exploration across its project portfolio.

ERL shares last traded at AU$0.005 on 13 September 2023, with ERL's market cap over AU$5.56 million.