Highlights

- Empire Resources sailed through the three-month period ended 30 June 2023 with some major developments at its Yuinmery project site.

- During the quarter, the company received assays for the RC drilling campaign that was completed at Yuinmery Project in February 2023.

- The assays delivered strong copper and gold mineralisation in A-Zone and broad zones of copper mineralisation in YT01.

- The company ended the quarter with over AU$1.01 million in cash.

ASX-listed exploration and development company, Empire Resources Limited (ASX: ERL) had a positive ride through the three-month period ended 30 June 2023. During the quarter, the company advanced activities across its Yuinmery project with encouraging drill assays.

What’s more, the company remains well funded with over AU$1.01 million in cash at the quarter end.

In this article, we have listed some key updates from the recently released June 2023 quarterly report to let you understand the company’s current areas of development.

Excellent results from Yuinmery copper-gold drill campaign

During the quarter, the company received assays for the 924m reverse circulation drilling program that was completed at its Yuinmery Project in February 2023.

The drill campaign was conducted on the basis of previously reported Cu-Au assays for two pyrite-chalcopyrite sulphidic zones at the YT01 prospect and the A-Zone prospect.

Both prospects are positioned along strike of ERL’s Just Desserts deposit, which boasts a current JORC 2012 Resource of 2.52Mt @ 1.31% Cu & 0.49g/t Au.

High-grade copper and gold mineralisation at A Zone Prospect

High-grade results were returned from previous drilling at the A-Zone prospect. Since restricted exploration has been done at the prospect since 2011 and mineralisation is open in all directions, further drilling may allow expansion in the scale potential of the prospect.

The YRC23-05 hole drilled in February 2023 intercepted multiple zones of mineralisation, as highlighted below:

Data source: company update

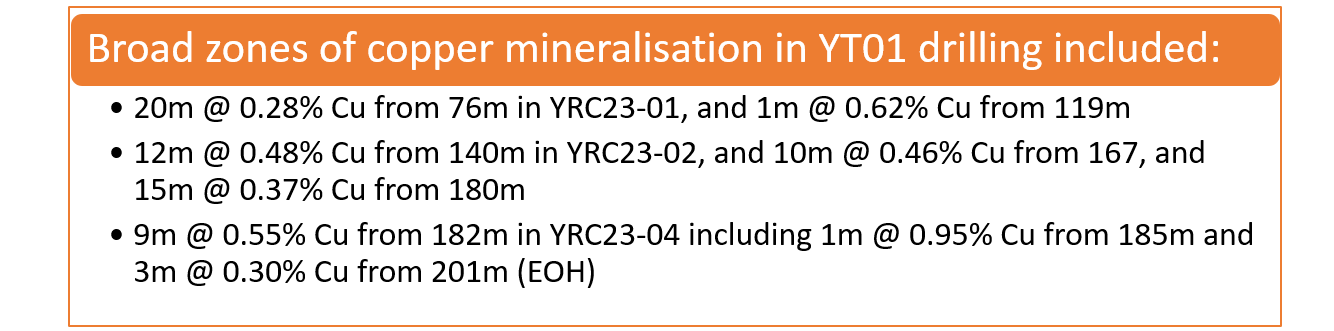

Broad zones of copper mineralisation in YT01 Prospect

The drilling campaign was performed to investigate the sulphide mineralisation presence within the fresh rock.

The drilling results indicate that the YT01 prospect is developing into a large tonnage bulk copper system, says the company.

Latest drill assays are as follows:

Data source: company update

As more testing of this mineralised zone is required, the company has started drill planning for future campaigns.

Penny’s Find Royalty

During the June quarter, Horizon Minerals secured funding and the significant approvals essential for underground development of its Cannon Project that is based at about 33km south of Penny’s Find Gold Mine. According to Horizon, the development of the Penny’s Find Gold Mine would follow Cannon.

This is significant as Empire is eligible for royalty payments on gold production from the Penny’s Find Gold Mine that goes up to 5% of Au recovered up to 50,000 oz and 2.5% on gold produced above that amount.

ERL shares traded at AU$0.005 on 07 August 2023, with ERL's market cap over AU$5.56 million.