Highlights

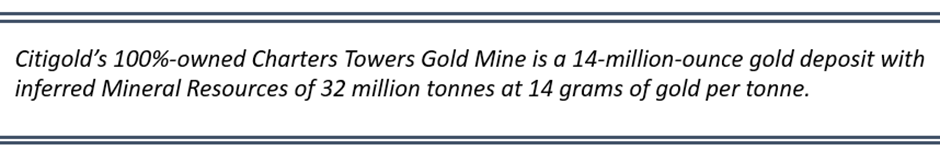

- Citigold’s major focus is the high-grade Charters Towers Gold project, a 14-million-ounce gold deposit.

- The Company’s exploration program is aimed at identifying new reefs for future drilling and potentially increasing resources and reserves.

- The latest round of rock chip sampling covered CTO’s exploration tenements to the southeast of Charters Towers.

- Of the total samples taken, 51% were regarded as anomalous.

- Three samples exceeded 3 g/t gold with a high of 7.99 g/t gold in surface rock samples.

Citigold Corporation Limited (ASX:CTO) has been busy at its high-grade Charters Towers Gold project with rock chip sampling.

Last month, the company provided results from this round of rock chip sampling at its exploration tenements nearly 8-10km to the southeast of Charters Towers. The sampling is a follow-up on previous stream sediment anomalies and aerial magnetic anomalies.

The campaign saw the collection of 43 samples, of which 22 (51%) were considered anomalous. Three samples exceeded 3 g/t gold with a high of 7.99 g/t gold in surface rock samples.

The company highlights that values above 0.1 g/t gold, 1 ppm (g/t) silver and 100ppm copper, lead and zinc are considered anomalous.

Citigold plans to follow up on areas with anomalous values, deploying ground traverses, mapping and, if necessary, geophysical surveys before drilling.

Image source: Company update

These additional areas are well away from the company’s production mining leases, and some are associated with aeromagnetic lows in granitic rocks that may represent areas of mineral alteration that may be caused by metal-bearing fluids.

Ongoing exploration program across Charters Towers

Citigold is advancing core activities, including mine design, and engineering, comprehensive regional exploration programs, and working towards restarting its world-class gold mine.

This active program is aimed at identifying strategic target areas for future intensive drilling programs aimed at increasing gold resources and reserves.

Data source: Company update

The current exploration program is following up on targets generated over the last two years. The campaign entails evaluating stream sediment geochemistry, geophysical surveys, satellite imagery and three-dimensional structural analysis.

Earlier the company recorded encouraging results with 18 sites identified returning anomalous gold results that have no historical known outcropping gold deposits.

The company has plans to follow up areas to the south with earlier sampling returning results indicative of volcanogenic massive sulphide (VMS) style of mineralisation.

Citigold aspires to become an ultra-low-cost gold producer, delivering more than 300,000 ounces per year. In its FY22 annual report, the company highlighted that it is well-positioned and production-ready to move promptly into gold production following the finalisation of the major project funding discussions.

The share price of Citigold was noted at AU$0.006 apiece on 15 February 2023.