Highlights

- High-purity quartz (HPQ), with a maximum contamination level of 50 ppm (99.995% SiO2), is in high demand for high-tech manufacturing, including applications in optics and telecommunications.

- The market value of IOTA® standard ultra-high pure quartz currently exceeds US$5,000 per tonne, highlighting its significant demand.

- A8G embarked on its maiden venture into the HPQ sector with the acquisition of the promising Dingo Hole HPQ project.

- The Dingo Hole project in the Georgina Basin covers 35.16 km² and boasts extensive silica mineralisation with significant exploration potential.

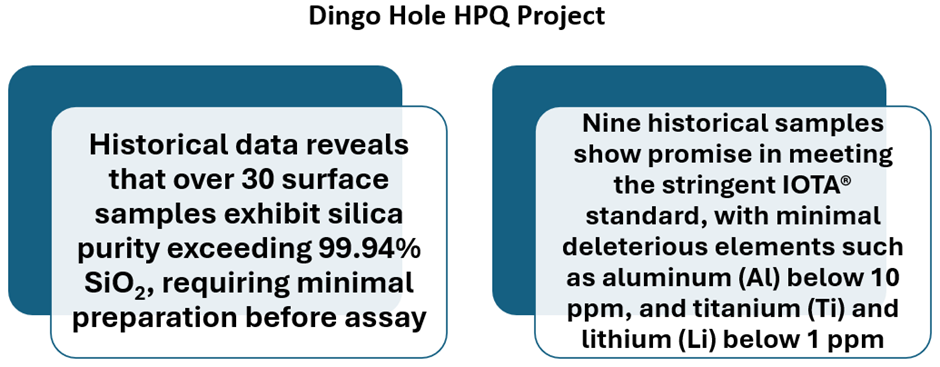

- Previous geochemical data from Dingo Hole reveal that over 30 surface samples demonstrate a purity surpassing 99.94% SiO2, requiring minimal preparation for assay.

Australasian Metals Limited (ASX: A8G) is poised to make significant waves in the high-purity quartz (HPQ) sector with its latest strategic move: the acquisition of the promising Dingo Hole HPQ project. This bold step comes at a time when the market value of IOTA® standard ultra-high pure quartz exceeds US$5,000 per tonne, with the global demand projected at around 100,000 tonnes annually.

Unlocking the potential of HPQ

HPQ, defined as silica with a maximum contamination level of 50 ppm (99.995% SiO2), is witnessing skyrocketing demand as a crucial raw material for high-tech manufacturing industries. Its applications, ranging from high temperature lamp tubing to telecommunications and optics, underscore its indispensability in modern manufacturing processes.

Ultra-High Pure Quartz is measured against a benchmark known as IOTA®, an industry standard characterised by containing less than 16.2 ppm aluminum and total impurities of less than 20 ppm, resulting in 99.998% SiO2 purity. The

IndustryARC forecasts the HPQ market size to soar to US$703.4 million by 2025, reflecting a compound annual growth rate (CAGR) of 6.5% from 2020 to 2025. The burgeoning semiconductor industry, coupled with the escalating demand for technological advancements and electronics, serves as a pivotal catalyst propelling the global HPQ sector forward.

Embarking on Dingo Hole High-Purity Quartz Venture

Australasian Metals Limited recently unveiled an option agreement with Verdant Minerals Limited, paving the way for the acquisition of the Dingo Hole HPQ project (EL31078), through its subsidiary company, Pure Mining Pty Ltd.

The strategic significance of this acquisition cannot be overstated. With global demand for HPQ intensifying, driven by AI-related semiconductor applications and the burgeoning photovoltaic solar silica market, the Dingo Hole HPQ Project emerges as a beacon of promise.

Nestled in the Georgina Basin, spanning 35.16km2, the Dingo Hole HPQ Project, harbours vast silica mineralization yet to be fully explored. Enhanced by convenient road access, the project's expansive potential positions it as a prime asset in A8G's portfolio.

Data source: Company update

Australia's Untapped Potential in HPQ Exploration

Despite Australia's inherent potential in HPQ exploration, the market remains underdeveloped, dominated by global providers primarily fromCanada, the United States, Norway, Russia, Brazil and India. Historically, Japanese trading firms have wielded control over the Australian silica marker, catering to the Southeast Asian markets.

Australasian Metals Limited's foray into the burgeoning HPQ sector signifies a paradigm shift. With Australia's untapped reservoirs of HPQ awaiting discovery, the company’s acquisition of the Dingo Hole HPQ project marks a pivotal moment in the company's trajectory, enabling it to tap the vast potential.

A8G shares up

A8G shares traded at AU$0.087 on 5 June 2024. The shares have gained 8.75% in the last one month.