Highlights

- BPH and its investee Advent Energy acquired around 19% interest in Clean Hydrogen Technologies, which is advancing a turquoise hydrogen project.

- Asset Energy, a 100% subsidiary of Advent Energy, is focused on drilling the proposed Seablue-1 well within PEP-11.

- Prospective gas resources have been identified in PEP11 of 5.7 TCF across several structures along the continental shelf.

- BPH’s investee Cortical Dynamics is committed to commercialising its BARM™ system in the USA.

Australia-based BPH Energy Limited (ASX: BPH) is engaged in making investments in entities operating in the biotechnology and resources space. Recent developments by its investees such as Clean Hydrogen Technologies, Cortical Dynamics Limited and Advent Energy Limited are expected to pave its way forward on the growth trajectory in 2024.

As you read further, you will get to know the major activities undertaken by the ASX-listed entity and its investees in the past quarter ended 31 December 2023.

Clean Hydrogen Technologies advances turquoise hydrogen project

In 2022, BPH and its investee Advent Energy Ltd (BPH 35.8% direct interest) inked an agreement to acquire a 10% interest in hydrogen technology firm Clean Hydrogen Technologies Corporation for a consideration of US$1,000,000.

Furthermore, BPH and Advent executed a Loan Conversion Agreement with Clean Hydrogen, for buying additional 9.5% interest in Clean Hydrogen. Consequently, now BPH owns 15.6% and Advent owns 3.9% interest in Clean Hydrogen.

Under the agreement, Clean Hydrogen will issue 760 share options to BPH and 190 share options to Advent, with an exercise price of US$3,000 each. Clean Hydrogen has agreed to utilise the cash consideration to build and test a reactor capable of generating at least 3.2kgs and maximum 15kgs of hydrogen per hour.

Clean Hydrogen plans to submit minimum two new patents in an agreed geography, relating hydrogen production from proprietary technology.

The last quarter saw developments at Clean Hydrogen’s turquoise hydrogen project. Clean Hydrogen has developed a hydrogen production process that does not emit CO2. It has achieved on average a cracking efficiency of more than 90%.

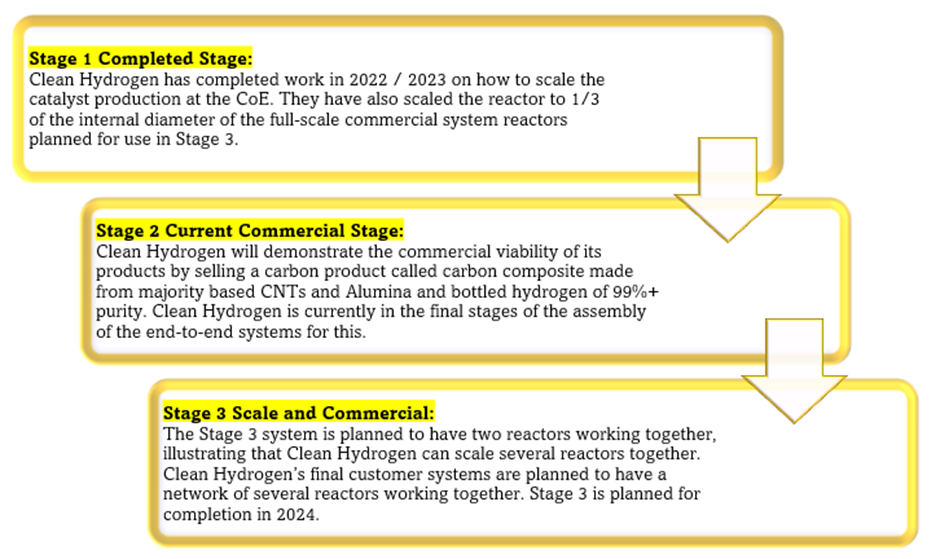

Clean Hydrogen is now planning to raise commercial production in 2024, which will be done in three stages as mentioned below.

Data source: Company update

JV PEP-11 continues in force

Asset Energy Pty Ltd, a 100% owned subsidiary of Advent Energy, is a part of the PEP11 Joint Venture with Bounty Oil and Gas NL (ASX:BUY). The parties hold strong belief in the project because of the gas market dynamics that suggests shortfall forecast in gas supply east coast.

In the Government’s Future Gas Strategy Consultation Paper, a gas supply and demand graph is published combining the analysis of AEMO and the Australian Competition and Consumer Commission (ACCC) which shows a shortfall of supply to demand beginning in 2027 and widening significantly after that.

According to the company, Advent Energy can serve a crucial part in energy transition and offer significant support in lowering energy costs. This is mainly because prospective gas resources have been identified in PEP11 of 5.7 TCF4 across several structures along the continental shelf.

Considering strong growth prospects in future, Asset Energy is advancing the JV’s applications for the variation and suspension of work program conditions and related extension of PEP-11.

In October 2023, NOPTA updated the NEATS Public Portal Application Tracking system which reflected that Asset Energy’s applications’ status is now ‘Under Assessment’.

In the meantime, Asset Energy is looking for a mobile offshore drilling unit to undertake the drill campaign at the proposed Seablue-1 well on the Baleen prospect. Discussions with multiple drilling contractors and other operators are underway.

Investee Cortical Dynamics

Australia-based medical device neurotechnology company, Cortical Dynamics is engaged in development of Brain Anaesthesia Response Monitor (BARM™), an industry leading EEG (electrical activity) brain function monitor. BPH Energy holds a 16.4% direct interest in Cortical Dynamics.

During the December quarter, Cortical finalised a capital raise of AU$10,000 via issue of 50,000 shares at AU$0.20.

Also, Cortical has received US FDA 510(k) clearance for the flagship technology. It will enable the commercialisation of the BARM™ system in the US.

BPH shares traded at AU$0.035 (market cap over AU$38 million) on 09 February 2024.