Summary

- BPH has concluded a Placement activity and plans to undertake a non-renounceable Rights Issue to primarily invest in investee, Advent Energy.

- BPH intends to raise its shareholding from 23 per cent to 36 per cent in Advent.

- About $2 million of the capital raised will be used by Advent to advance well planning, engineering and environmental approvals for drilling at the Baleen target in PEP 11 permit.

- The application submitted to NOPTA to enable the drilling of the Baleen drill target has also reached the final decision phase.

Australia’s diversified player, BPH Energy Limited (ASX:BPH) has concluded a Placement activity and plans to undertake a non-renounceable Rights Issue following the issue of shares under the Placement.

Following the key update, BPH’s stock traded at $0.021, with a rise of 23.5 per cent (2:17 PM AEST on 23rd July 2020).

BPH intends to use the funds raised from Placement and Rights Issue to primarily invest in oil and gas entity Advent Energy Limited, to raise its shareholding from 23 per cent to 36 per cent in Advent. While, an increase of BPH’s shareholding will be subject to any required approvals or via an underwriting of an offer by the Company.

BPH currently holds a significant interest of 22.7 per cent in Advent, which has amassed a robust portfolio of assets both onshore and offshore Australia, including PEP 11 permit in the offshore Sydney Basin and RL 1 in the onshore Bonaparte Basin.

Ins and Outs of Placement and Rights Issue

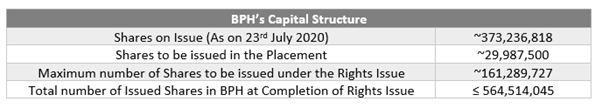

Managed by Sixty-Two Capital Pty Ltd, the Placement comprises of ~29.9 million fully paid ordinary shares at an issue price of $0.015 per share, along with 1 free attaching option for every 2 shares subscribed for and issued to professional and sophisticated investors. BPH’s current Placement raised $449,813.

Subsequent to the issue of shares under Placement, BPH will conduct a non-renounceable Rights Issue of two shares for every five shares held by shareholders at an issue price of $0.015 per share to raise up to $2.4 million, along with one free attaching option for every two shares subscribed for and issued to investors.

BPH notified that the shares issued under the Placement will have a holding lock placed on them until conclusion and lodgement of the disclosure document for the Rights Issue. Besides, the free attaching options will be granted under the Placement depending on the receipt of shareholder approval at a meeting to be held at the earliest possible date.

Purpose of Capital Raising

BPH intends to invest funds raised from Placement and Rights Issue in Advent to offer support in progressing with PEP 11 developments.

The funds will be used by Advent to advance well planning, engineering and environmental approvals for drilling at the Baleen target in PEP 11 permit. About $2 million of the capital raised is expected to be utilised towards this end.

Additionally, the application submitted to National Offshore Petroleum Titles Administrator (NOPTA) to enable the drilling of the Baleen drill target has also reached the final decision phase, with decision expected shortly.

To recall, Advent and its JV partner Bounty Oil and Gas NL (ASX:BUY) made an application to NOPTA in January this year to alter the existing PEP 11 permit conditions in order to proceed with the drilling at Baleen. Currently, the JV is also assessing rig availability for the drilling of well at Baleen drill target.

The major gas supply crisis emerging on the east coast of Australia is unfurling substantial opportunity for Advent to progress with well drilling at Baleen target. Moreover, Advent’s recent findings from literature review further bolster prospects of sizeable gas generation and migration within the PEP 11 permit.

Must Read! BPH Energy Reports Advent Energy’s Key Findings from PEP 11 Literature Review