Highlights

- During the September quarter, Bounty participated in two NFE wells and one P&A at Walter 1.

- Field operations to continue at Surat Basin to bring fields back into production.

- The operator of PEP 11, Asset Energy is looking for a rig for drilling Seablue 1 in 2024.

ASX-listed independent oil and gas explorer, Bounty Oil & Gas NL (ASX: BUY) manages oil production at Naccowlah in Queensland and two undeveloped oil and gas discoveries in the Carnarvon and Surat Basin. During the September quarter, BUY focused on advancing activities across its projects.

Oil production continues at the Naccowlah

ATP 1189(N) covers around 6% of 1,804km2 of the Naccowlah Block. In addition to this, the Naccowlah comprises one potential commercial area (PCA), three production lease (PL) applications and the remainder in 23 petroleum PLs.

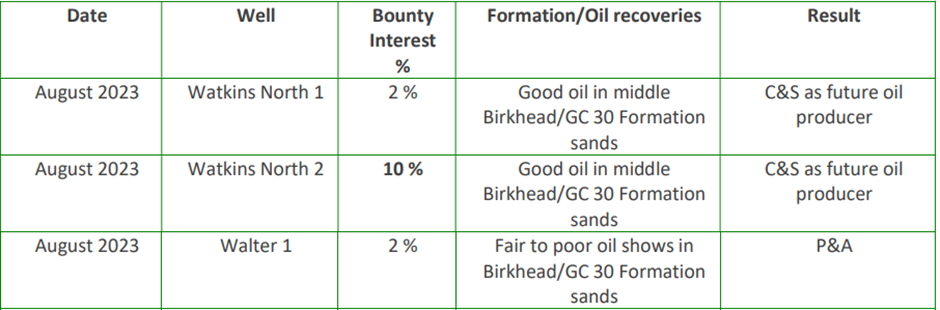

During the quarter, the company continued oil production and drilling three new exploration oil wells. The drilling results are as follows –

Data source: Company update

The drilling program has substantially expanded the Watson North complex. Moreover, the operator has located further development and near field exploration targets in the Naccowlah.

Field operations at Southern Surat Basin

Oil resources in the Southern Suat Basin, Queensland include light oil obtained from Permian coals. It provides 360k bbls 2C recoverable oil in pools for development and over 70k bbls in oil from present wells.

During the quarter, the company began field operations to convert two wells at Alton into production wells. Alongside, the company is generating a field development plan to commercialise 167k bbls of 2C contingent resource from the Evergreen Formation.

The company expects initial production of 100 bopd from the Evergreen Formation.

Advances at gas growth project - PEP 11

PEP 11 lies immediately next to Australia’s biggest gas market and is an untested gas play in the country.

Asset Energy, the operator of the project continued to advance the joint venture’s application for the change and suspension of the work program conditions and associated extension of the project.

Additional material was filed with National Offshore Petroleum Titles Authority (NOPTA) to assist the application including a commitment to drill an exploration well for gas, which might be the Seablue 1 well on the, Baleen Prospect. A suggestion on the joint venture applications has been made by NOPTA to the joint authority. The decision is expected soon.

The company has disclosed its ongoing efforts to procure a drilling rig and secure contractors as part of the preparations for the Seablue 1 well drilling.

Outlook

During the quarter, the company recorded oil revenue of AU$273,000 and in 2024, it expects to record oil revenue of AU$2.0 – 2.5 million.

The company informed that its Watkins North discoveries are efficient for further reserve growth by the end of 2023.

Later in 2023, the company anticipates a resolution of the PEP 11 extension. Moreover, the company is seeking to participate in the additional NFE and development drilling campaigns in Naccowlah Block. The joint venture has a minimum of nine sites for further appraisal and NFE wells in the Block’s Jackson and Watson areas.

Also, Bounty expects oil production growth from the projects which it manages in the Surat Basin.