Highlights

- Resolution Minerals has announced plans for a dual listing on the NASDAQ, aiming to boost visibility and attract U.S.-based investors and strategic partners.

- The move aligns with the company’s focus on critical defense metals, with its Horse Heaven Project positioned near the high-profile Stibnite Project in Idaho.

- The NASDAQ listing is expected in Q4 2025.

- Resolution has appointed Revere Securities and Dominari Securities to lead the NASDAQ listing process.

- RML shares surged over 10% on 29 July 2025.

Resolution Minerals Ltd (ASX:RML) saw its share price jump 10.13% to AUD 0.087 during the trading session on 29 July 2025, with nearly 27 million shares traded. The share price surge followed the company’s announcement of a planned dual listing on the NASDAQ stock exchange.

The move is expected to give Resolution Minerals access to the world’s most liquid capital market, creating opportunities for greater investor interest, increased funding, and enhanced support from major U.S. institutions, brokers, government entities, and potential corporate partners.

Dual-Listing to Tap Deeper U.S. Capital Markets

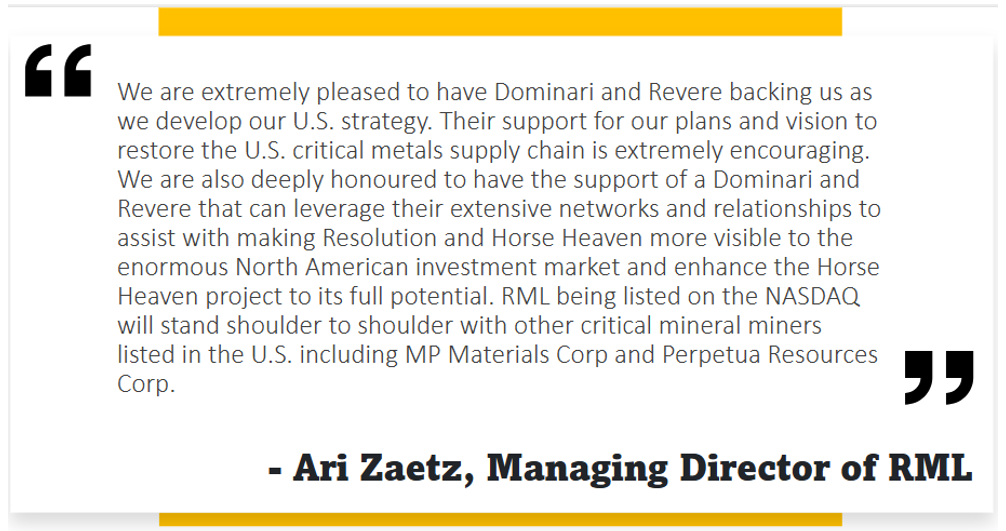

Resolution Minerals has appointed Revere Securities LLC and Dominari Securities LLC to lead the NASDAQ listing process, which is expected to be completed in Q4 2025. With an OTC listing already imminent, the NASDAQ uplisting is seen as the logical next step in the company’s growth strategy.

This development comes at a pivotal moment as the company accelerates work on its Horse Heaven project in Idaho, USA.

The listing is expected to strengthen Resolution’s position as a potential supplier of critical metals—particularly antimony and tungsten—vital for US defense and allied national security.

Given the rising recognition of antimony and tungsten within the U.S. investment community, the company views this as an opportune time to tap into the world’s most liquid capital market.

The company stated that its focus on the U.S. defense and national security metals along with the Horse Heaven project's proximity to the AUD 3 billion Stibnite Project, makes NASDAQ a natural fit for Resolution. Growing awareness among North American investors of the company’s potential to support the U.S. Government’s supply chain and national security needs further reinforces the case for the listing.

Key Advantages of NASDAQ Listing

- Greater liquidity and exposure to the largest equity market globally (~70% of U.S. trading volume).

- Access to a more diverse investor base focused on battery metals and critical minerals.

- Higher visibility to the US Federal funding programs, strategic investors and potential offtake partners

- Potential for M&A opportunities, joint ventures, and broader analyst and media coverage.

- USD-based pricing that simplifies investment by large North American institutions.

Advisory Engagement & Shareholder Approval

The company’s engagement with advisors is initially for six months and will extend upon NASDAQ listing.

As part of the listing process, Resolution will issue 79.4 million equity fee shares to Dominari and Revere Securities, subject to shareholder approval. These shares will be under voluntary escrow for six months. Additionally, 30 million unquoted options will be issued with an exercise price of AUD 0.1382 and a three-year expiry.