Highlights

- The Minister for Climate Change and Energy of Australia, Chris Bowen has designated an area of the Pacific Ocean area off the Hunter Region of NSW as apt for offshore wind energy development.

- The designated area would be available for industries to develop wind farms.

- Bounty and Asset Energy, a wholly owned subsidiary of Advent Energy Ltd, an investee of BUY and BPH Energy Ltd, welcomed this declaration.

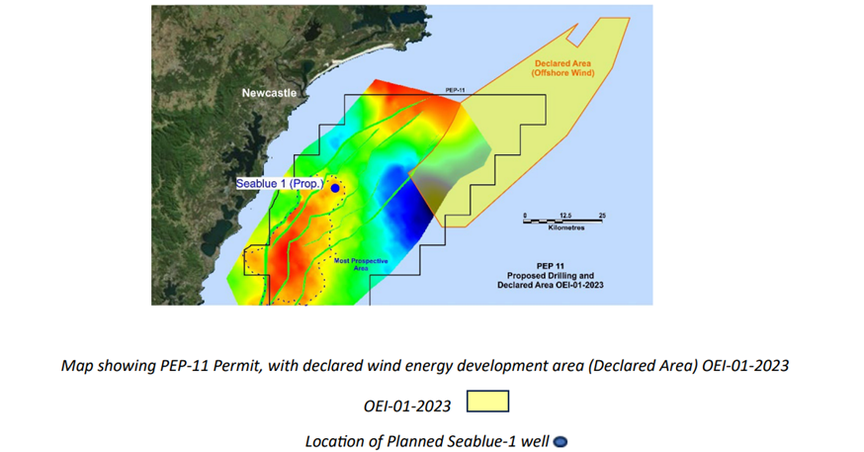

- The latest development has no material impact on the PEP 11 title or the main PEP 11 target areas.

As per the latest release, the Minister for Climate Change and Energy of Australia, Chris Bowen has designated an area of the Pacific Ocean area off the Hunter Region of New South Wales (NSW) as appropriate for offshore wind energy development. The new development area will be available for industry to develop wind farms. It will be the second official offshore wind energy zone in Australia.

Australian ASX-listed oil producer and explorer, Bounty Oil & Gas NL (ASX:BUY), and Asset Energy Pty Ltd, a wholly owned subsidiary of Advent Energy Limited, have welcomed this declaration. It is in line with their belief that a blend of technologies covering carbon sequestration, renewable energy resources, and natural gas will be needed for decarbonisation of the global energy system.

BUY reported that the latest development has no material impact on the PEP 11 title or the main PEP 11 target areas, as suggested by the reviewed PEP 11 seismic data and the drill data from the Seaclem 1 well.

Asset Energy is the operator of PEP-11 and holds an 85% interest. BUY holds the remaining 15% interest in the permit.

Advent’s submission for the development area

Earlier this year in April, Advent Energy had submitted on the proposed Hunter offshore wind development area to the consultation website of the Department of Climate Change, Energy, the Environment and Water.

Also, Advent has had preliminary talks with one of the wind technology companies to explore synergies. These firms are planning to tender for and develop part of the Declared area. Further consultation will be held.

Details of the PEP-11 permit

Asset Energy has been persistent in advancing the JV’s applications for the variation and suspension of work program conditions and related extension of PEP-11.

Additional updated details have also been submitted to the Commonwealth-NSW Joint Authority and Title authority (NOPTA). The availability of a mobile offshore drilling unit is being investigated so as to drill the proposed Seablue-1 well on the Baleen prospect. As per the company, it is likely to be completed in the coming 35 days.

Discussions are underway with drilling contractors and other operators to initiate work in the Australian offshore in H1 2024.

Shares gain on the update

BUY shares traded at AU$0.009 on the ASX on 21 July 2023, up 12.5% from the last close. The company has a market cap of 10.96 million.