Highlights

- Black Canyon focused on metallurgical testwork and Exploration Target Estimate (ETE) across Balfour Manganese Field (BMF) in the latest quarter.

- The ETE demonstrates substantial upside exploration potential across the Balfour field.

- Metallurgical testwork indicated high-grade manganese concentrate production capabilities.

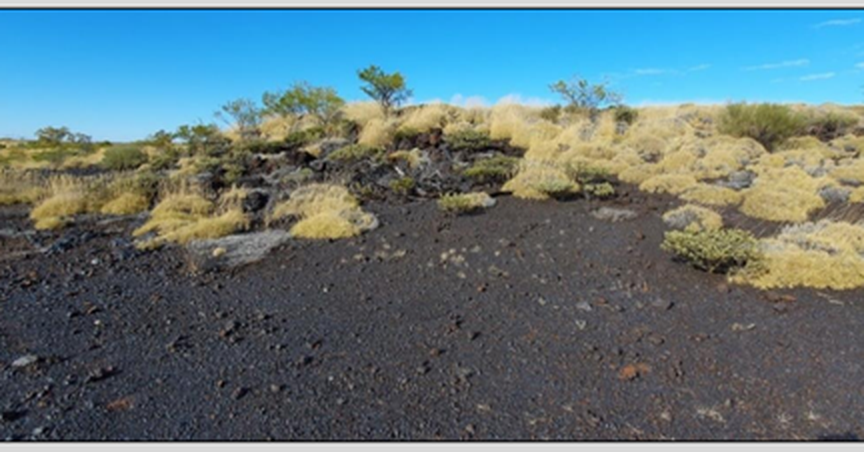

Australian manganese developer and explorer Black Canyon Limited (ASX: BCA) has reported promising exploration upside at the Balfour Manganese Field in its recently released quarterly activities report for the three-month period ended 31 March 2024.

During the reported period, the company focused on progressing metallurgical testwork on its 100%-owned KR1 & KR2 deposits and finalising a JORC 2012 Exploration Target Estimate (ETE) showcasing the significant potential for growth within the BMF.

Exploration Target Estimate across BMF prospects

During the March quarter, the company completed an Exploration Target Estimate (ETE) for the Pickering and Balfour East prospects. The ETE demonstrated substantial upside exploration potential across the BMF.

The Exploration Target is in addition to the existing Global Mineral Resource Estimate (MRE) of 314 Mt @ 10.5% Mn for 33.1 Mt of contained Manganese defined across the BMF.

Metallurgical testwork delivers high-grade manganese concentrate

During the quarter, the company conducted metallurgical testwork on the samples taken from the KR1 and KR2 Mineral Resource Estimate (MRE) areas. The initial sample preparation program was designed to produce a beneficiated manganese concentrate feedstock for use in the upscaled hydrometallurgical testwork to develop and optimise the HPMSM flowsheet.

The results confirmed the previous testwork that targeted a 30% to 33% Mn concentrate. The previous testwork utilised density-based separation as the major beneficiating technique.

The new results indicate the ability to deliver a product of higher than target grade, ranging from 35% to 37% Mn, from the coarser fraction.

Moreover, the enhanced liberation of manganese particles achieved through heavy liquid separation (HLS) and Wifley Tabling testwork has further verified the overall manganese recoveries.

Downstream Processing Site Location Evaluation

The company has continued to investigate sites for downstream processing locations in Western Australia, Queensland and Tasmania. Focusing on existing industrial precincts with established infrastructure, complementary industries, access to consumables/reagents and renewable energy sources.

The Company is pursuing an Australian based option to be compliant with the US Government’s Inflation Reduction Act (IRA) tax credit subsidies, while maintaining proximity to Asian based customers and with the potential to obtain Australian State and Federal Government Funding specifically designed for developing critical minerals projects.

The company plans to further continue the following activities in the June quarter :

- Manganese Concentrate Scoping Study update based on the expanded Mineral Resources Estimates

- Upscaled hydrometallurgical testwork on KR1 and KR2 manganese oxide ores to confirm manganese concentrate delivery flowsheet

- Review location options for an HPMSM facility within Australia with a focus on planned locations that provide synergistic advantages

- Engage with third parties interested in offtake or partnerships in producing HPMSM and manganese concentrate products.

As Black Canyon continues to advance its exploration and development efforts in the Balfour Manganese Field, the company remains focused on unlocking the full potential of its mineral resources.

BCA shares traded at AU$0.100 on 30 April 2024.