Highlights

- A Scoping Study demonstrates that the KR1 and KR2 mineral resources will generate average annual cash flow of over AU$46 million.

- The average production rate of mineral resources is expected to be 3.0Mtpa, resulting in 12Mt of manganese concentrate over the Life of Mine (LOM).

- The expected pre-tax NPV of the mineral resources is AU$340 million, with an anticipated pre-tax internal rate of return (IRR) of 70%.

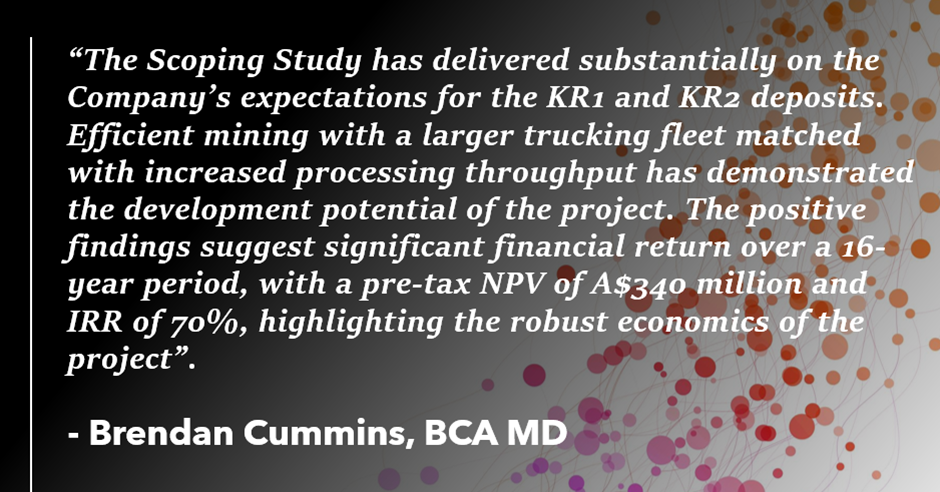

Black Canyon Limited (ASX: BCA), an Australia-based manganese explorer and developer, has released promising results from a Scoping Study on the KR1 and KR2 deposits. The Study highlighted significant financial returns over a 16-year period, with a pre-tax NPV of AU$340 million and an IRR of 70%, demonstrating the robust economics of the project.

The objective of the Scoping Study was to evaluate the development potential of the KR1 and KR2 combined MRE, located within the wider Balfour Manganese Field (BMF) in Western Australia.

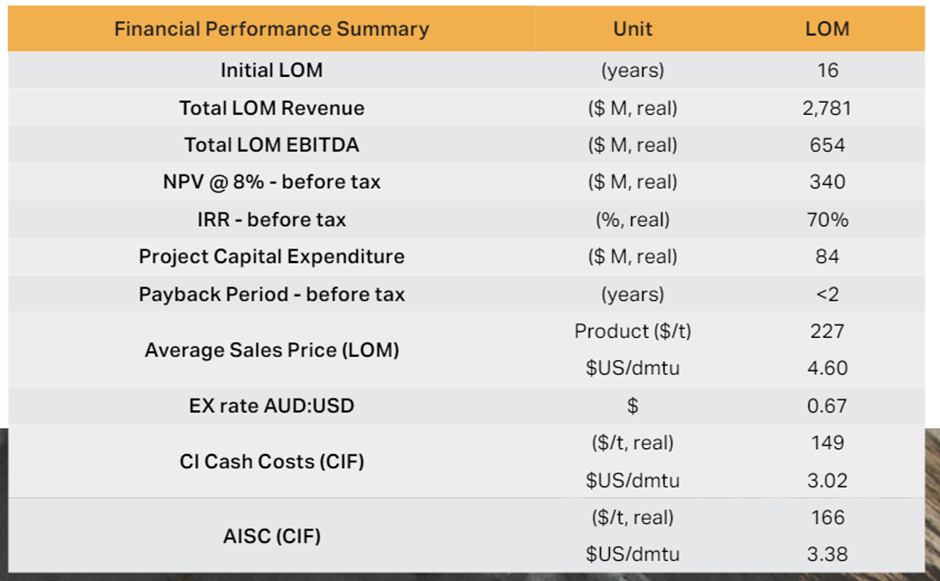

The expected mine life for these resources is 16 years, with an estimated low development capital cost of AU$84 million, including AU$25 million in indirect costs.

In terms of financial performance, the KR1 and KR2 mineral resources are expected to generate an average annual cash flow of over AU$46 million. Over the life of the mine (LOM), the projects are projected to yield total revenue of AU$2,781 million and an EBITDA of AU$654 million.

Robust economics for KR1 and KR2 deposits

The Scoping Study demonstrated that average mining production rate is expected to be 3.0Mtpa, producing 12Mt of manganese concentrate over the LOM. The estimated production target over the LOM is 48.2Mt at a grade of 10.9%Mn, with a low strip ratio of 0.56:1.

The company plans to produce a 33% Mn product, generating ~760,000tpa of manganese concentrate per year over the LOM, with a concentrate sales price of US$4.60 per dry metric tonne unit (dmtu).

The estimated C1 cash costs are US$3.02 per dmtu, and the expected all-in sustaining cost (AISC) is US$3.38 per dmtu on a cost, insurance, and freight (CIF) basis.

Additionally, there is potential to extend the mine life through expansion drilling and further exploration of substantial mineral resources discovered by BCA in the region.

Image source: Company update

The Scoping Study focuses on developing a mine around 115km NE of Newman. Majority of the manganese concentrate produced will be used by smelters to create non-substitutable alloys essential for steel manufacturing. Additionally, some of the concentrate may serve as feedstock for producing high purity manganese sulphate monohydrate (HPMSM), an important element for electric vehicle battery cathodes.

Investment in the project will facilitate the production of manganese concentrate mined from indicated and inferred mineral resource estimates (MRE), totalling 103Mt at 10.4%Mn, containing 11Mt of Mn. This includes a higher-grade subset of 29Mt @ 13.3%Mn across these two deposits.

Planned future studies

Further studies will focus on project enhancements, including the use of low-cost surface miners in conjunction with conventional truck and shovel operations and higher throughput. The company aims for high-grade ore and low strip ratios within a 20-30 km radius of the processing plant.

Future plans include metallurgical studies and related engineering design activities to prepare for the detailed feasibility study and baseline studies. These developments will pave the way for permitting and environmental approvals.

Metallurgical optimisation will focus on enhancing manganese grade by utilising additional density-based separation techniques.

BCA shares were trading at AU$0.079 apiece at the time of writing on 3 July 2024.