Highlights

- Drilling is planned at the W2 prospect of the Wandanya project in the upcoming quarter, following the conclusion of a heritage survey.

- Drilling program will follow up on previously completed sampling at Wandanya.

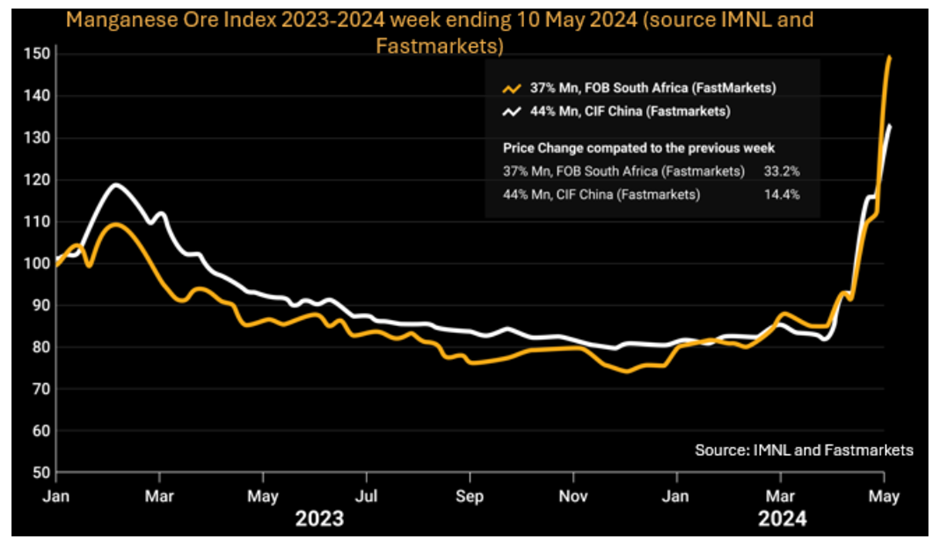

- Price of 44% Mn benchmark has increased to more than US$7.00/dmtu from US$4.20/dmtu at the end of March.

Black Canyon Limited (ASX: BCA) has released an update detailing its planned heritage and drilling campaigns at the W2 prospect, located within the Wandanya tenement.

At its wholly owned Wandanya tenement, the company plans to conduct heritage surveys in late June as part of preparations for drilling targeted to commence in the subsequent quarter. Drilling will follow up on a rock chip sampling campaign, which returned multiple high-grade manganese samples, with assays including-

- WDRC009 5% Mn

- WDRC011 9% Mn

- WDRC010 8% Mn

- WDRC008 3% Mn

The company aims to capitalise on the recent surge in manganese prices.

About the Wandanya tenement

The Wandanya tenement, located ~80km south of the Woodie Woodie manganese mine, is home to the W2 prospect, the primary mineralisation zone within the tenement. W2 spans nearly 300 metres in length and 150 metres in width, with an additional northern extension stretching approximately 1,750 metres.

No drilling activities have yet been conducted at Wandanya. The sampling results are significant for the company, as sample grades and geological characteristics closely resemble those found at the Woodie Woodie manganese mine.

Woodie Woodie boasts multiple orebodies ranging from 50k to 5Mt with an average deposit size of 500kt. The company believes that there is potential to discover smaller tonnage, medium to high-grade manganese deposits at the prospect and along the strike. Such discoveries would complement the existing manganese-enriched shale-hosted findings across the Balfour Manganese Field (BMF).

Manganese ore prices on the rise

Smelters are currently vying for scarce high-grade manganese ores, driving up prices for both the 37% and 44% Mn benchmarks. Further fuelling these price increases is the long-term suspension of operations at the South 32 Groote Eylandt operations, with production anticipated to resume by March 2025.

From the end of March 2024 to the week ending on 10 May, the price of 44% Mn ore has surged by 65%.

Image source: company update

BCA shares traded at AU$0.125 apiece on 22 May 2024.