Highlights

- Australasian Metals has progressed with exploration including sampling, geological mapping and drone digital terrain model (DTM) survey at the Dingo Hole High Pure Quartz (HPQ) project.

- Maiden target for Dingo Hole estimated between 10.4 Mt and 42.6 Mt with SiO₂ grade of 99.37% to 99.85%.

- Company Due diligence sample assays are pending to be released in August or September

- Once results were received on fieldwork samples, downstream sample testing will be under the way.

- A8G management is well connected with East Asia market.

- The company closed the quarter with a cash balance of AU$3.15 million.

The latest quarter has been eventful for Australasian Metals Limited (ASX: A8G), marking its entry into the rapidly expanding HPQ sector. In May, the company secured an option agreement with Verdant Minerals Limited for the Dingo Hole HPQ Project (EL31078). Since then, significant progress has been made at the project, as detailed in its recently released quarterly report for the period ended 30 June 2024.

As of 30 June 2024, the company held approximately AU$3.15 million in cash with no debt.

Exploration target defined at Dingo Hole

Exploration activities at the Dingo Hole Project, located in the Georgina Basin and spanning 35.16 km², were limited between 2012 and 2016 under Rum Jungle Resources Ltd. The area is known for its significant silica mineralisation outcroppings and accessible road infrastructure.

Recent efforts have focused on sampling and geological mapping during the latest quarter to evaluate the project's commercial potential.

Data source: Company update

Following the June quarter, a drone digital terrain model (DTM) survey identified the areas for resource delineation crucial for project development. Over 20 samples were collected to verify historical data and evaluate the geology and grade consistency of the silica unit.

On 23 July 2024, a maiden exploration target was announced for the project, estimating 10.4Mt to 42.6 Mt at a post-leached SiO2 grade of 99.37% to 99.85%. The exploration target spans approximately 1.16-1.7km2.

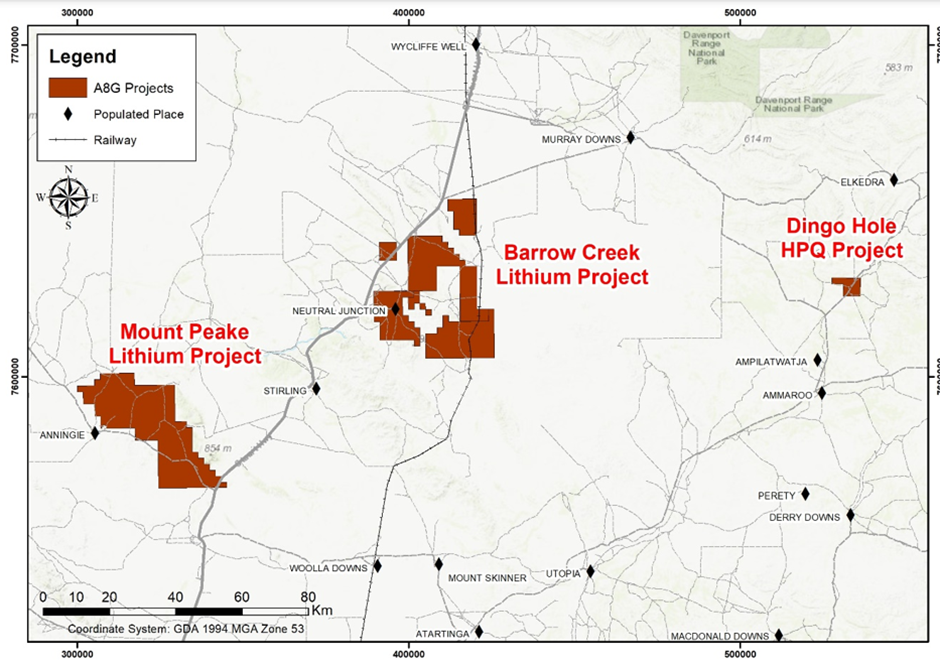

Project Location (Source: Company Update)

Plans for further exploration

Future plans include additional surface sampling and complete 57-element assays to better control the surface geochemical composition and locate HPQ areas while enhancing understanding of HPQ quality.

An aboriginal survey and renewal of AAPA certificate are planned to facilitate drilling and bulk sampling in the target areas. Subsequent activities would involve reverse circulation (RC) drilling to establish a mineral resource and gather samples for metallurgical testing.

Update on lithium projects

The company’s Mt Peake and Barrow Creek lithium projects are progressing well.

A reconnaissance diamond drill program at the Mt Peake project in the March quarter covered around 600m, with ongoing data reprocessing to guide future exploration strategies.

For the Barrow Creek Project, the company has secured the AAPA certificate to proceed with the RAD drilling campaign and negotiations with landholders are ongoing for an access agreement necessary to complete the approvals for the mining management plan.

Australasian Metals Limited views the Dingo Hole Project as a promising opportunity. The ongoing exploration efforts, including the recent announcement of a maiden exploration target and continued sampling and survey activities, reaffirm the company’s confidence in the project's potential for silica mineralisation.