Highlights

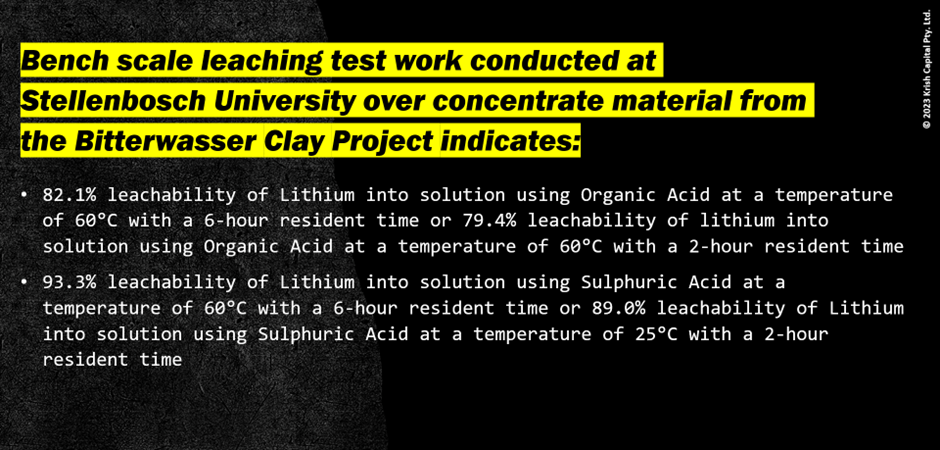

- Arcadia Minerals recently reported that it has received positive lithium bench-scale leach test results from its Bitterwasser lithium clay project

- The test using sulphuric acid delivered lithium recoveries of up to 93%, while with organic acid, it returned over 82% leachability of lithium into solution

- Organic acid further resulted in low recovery of calcium and magnesium in leachate

- Chemical composition of Bitterwasser Clay leachate using organic acid compares favourably to the leachate from similar operations in Clayton Valley, Nevada

- The company is expecting lithium clay mineral resource upgrade in the second quarter of 2023.

Diversified exploration company Arcadia Minerals Ltd (ASX:AM7 FRA: 8OH) has received positive lithium bench-scale leach test results from its Bitterwasser lithium clay project.

Data source: Company update

As per the results, leach temperatures seemed to affect the leachability of the Bitterwasser clays from Eden Pan more than the leach resident time (two hours compared to six hours).

The company claims these results to be of great significance in undertaking further test work for the possible production of a lithium carbonate product.

Leach Test Work Results

A sample of 800kg of Bitterwasser clays from auger drilling samples which represent the Eden Pan deposit, were used for cyclone test work at Multotec. The fines (-10 µm fraction) were subjected to bench scale leach test work at the Chemical Engineering Department, Stellenbosch University for measuring leachability with six organic acids and sulphuric acid. Two organic acids and sulphuric acids were subsequently selected for bench scale test work on the basis of the initial results of these tests.

Test work with sulphuric acid was done at different parameters and at intervals of two hours up to six hours leach time. Its result reflected that leach temperatures seem to alter the leachability of the Bitterwasser clays from Eden Pan more than the leach resident time (two hours compared to six hours). At bench scale, one of the organic acids became viscous and was rejected for performing further experiments, while the second organic acid (Organic Acid 1) proved to be amenable to further bench scale test work.

On relating the leach results from the Bitterwasser Clay deposit using sulphuric acid and organic acid, with the bench scale results using sulphuric acid by Century Lithium over its Clayton Valley deposit, the company found that similar leach results are obtained as it relates to most elements in the leachate.

It is apparent from the obtained results that there are a few preliminary benefits of Organic Acid 1 versus sulphuric acid over samples from Bitterwasser Clays. There is lower magnesium and calcium content in the leachate, and the use of an environmentally friendly and cheaper solution in comparison to sulphuric acid.

The upcoming test work will confirm the potential for the recovery and recycling of Organic Acid 1. Arcadia believes that the this would potentially lower the operational costs of any potential processing operation if found to be successful.

In addition, the commercial availability of Organic Acid 1 also needs to be checked to hold a costing trade-off with sulphuric acid. As a result, a trade-off study between the two acids is currently being conducted with the objective of comparing the economic and environmental advantages of organic acid 1 over sulphuric acid. Also, leach test work optimisation is in progress on both acids. The results are likely to be available during the second quarter of the year (Q2 2023).

Management commentary

Image and data source: Company update

AM7 shares were spotted trading at AU$0.210 on 20 March 2023, with market capitalisation of AU$18.38 million.