Highlights

- Teodorico Project, a large field with 300,000 scm/day gas rate capacity, is fully owned by PVE’s wholly owned subsidiary

- PVE's near-term focus is on value realisation by either transitioning Teodorico to production concession status or a JV or outright sale

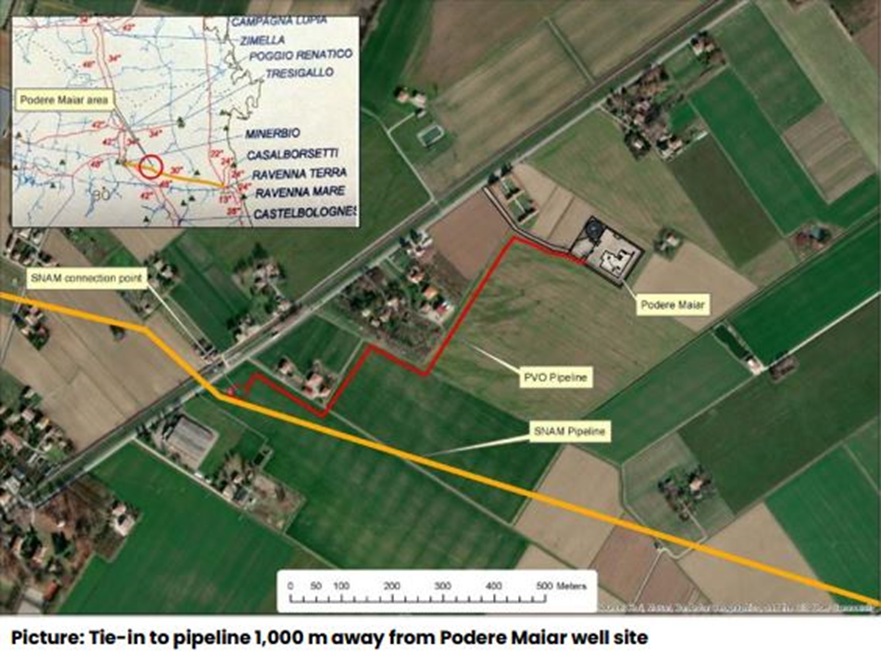

- At its Selva Malvezzi production concession in Italy, the company lately reported completion of Podere Maiar gas plant construction

Australian-listed natural gas exploration company Po Valley Energy (ASX: PVE) -- with focus on gas production and supply in Italy -- has a rich portfolio of gas assets.

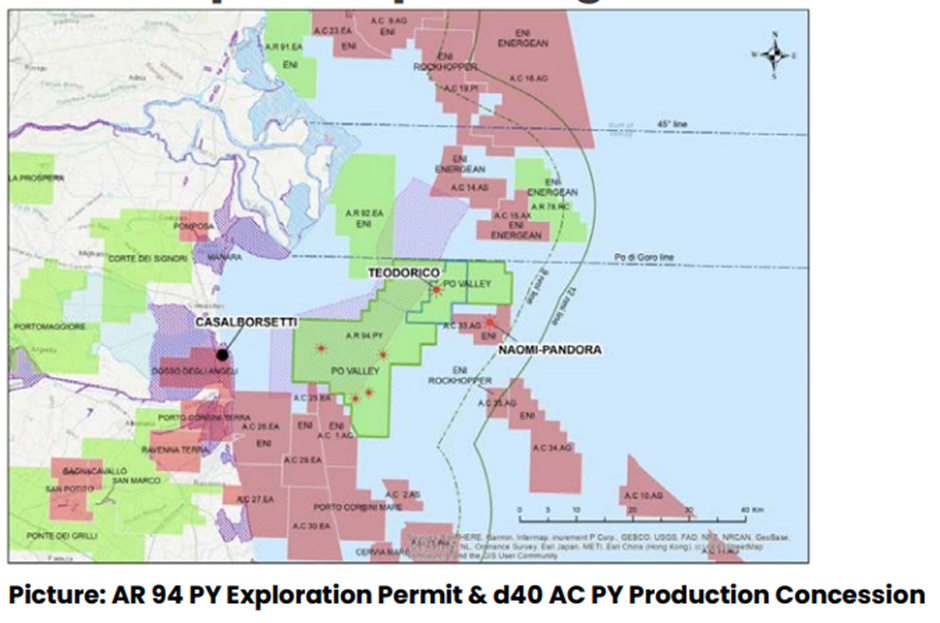

Notably, the company fully owns a 300,000 scm/day gas rate capacity field -- Teodorico (AR94PY) licence -- just 30km southeast of Venice (Italy). The offshore gas development asset located in the shallow waters of the Adriatic Sea covers an area of 65.9km2. The project has 2P reserves of 37 Bcf and 2C resource of 10.6 Bcf. The project contains two gas discoveries, drilled and tested by Eni S.p.A, the former operator.

The Environmental Approval for the Teodorico licence was granted in March 2021, with the company stating that gas from the site would be piped to the Casalborsetti gas terminal.

Another asset of PVE is the Selva Malvezzi production concession where the company lately completed the Podere Maiar gas plant construction. This means that the Podere Maiar-1 can begin supplying to the SNAM grid in Italy, where the company has been operating for over two decades through Po Valley Operations or PVO, which is its subsidiary that holds licences and permits.

Teodorico Project (AR94PY)

Source: Company presentation

The project is situated off the east coast of Italy (shallow waters of the Adriatic Sea) and is in close proximity to southeast of Venice.

Notably, Teodorico is a large field with 300,000 scm/day gas rate capacity. The environmental approval and a development plan for the licence is in place, PVE states, and the gas output from the asset will be piped to Naomi Pandora platform, which lies in proximity (12 km). From here, the gas will be supplied onshore to Eni’s Casalborsetti processing plant.

PVE states that the previously reported flow rates (drilling and testing by the former operator Eni) have the ability to generate "substantial revenues" at the current gas prices. Po Valley Energy's near-term focus is on value realisation through either transitioning Teodorico to production concession status or a joint venture (JV) or outright sale or a combination of these methods.

PVE's Selva Malvezzi PM-1

Source: Company presentation

PVE is looking to fill the gaps that exist in domestic production of gas in Italy, which has been heavily dependent on energy imports. The PM-1 gas facility is now ready for commissioning and gas delivery, and PVO already has a gas supply agreement (announced in February 2023) in place. The gas at this asset is dry and 99.5% Biogenic Methane. The non-existence of hydrocarbon liquids implies surface processing requirements are very minimal. Read more.

Source: Company update

PVE shares on the Australian Securities Exchange ASX traded at A$0.058 on 15 June 2023.