Highlights

- The September quarter saw lithium exploration reaching all-new heights at Alchemy Resources’ flagship Karonie Project.

- Assays from infill soil sampling on the Cherry, Hickory, and Pecan lithium prospects of Karonie showed significant lithium and coincident pathfinder element anomalism over all areas, following which drill programs have started.

- Two new prospects have been identified - Red Oak and Alder – which extend up to 60km along strike of the existing high-priority targets at Cherry and Hickory.

- Gold exploration results from the Gilmore, Karonie East, and KZ5 prospects have whetted the company’s appetite for follow-up drilling.

The September quarter of 2022 saw Alchemy Resources Limited (ASX:ALY) making significant advances on its flagship Karonie gold and lithium project in Western Australia. During the period, the company also won Tenement E28/3207, within the highly prospective lithium target “Goldilocks, by ballot.

Subsequent to the quarter, the company kicked off its maiden lithium-focused RC drilling at Karonie. Moreover, the company executed native title agreements at the Karonie and Lake Rebecca projects with the Kakarra A & B groups and the Nyalpa Pirniku People.

Alchemy held AU$1.44 million in cash at the quarter end and raised AU$5.5 million (before costs) subsequent to the reported period.

Major advances on Alchemy’s 100%-owned Karonie Project

The quarter saw completion of detailed mapping and rock-chip sampling at the flagship Karonie gold and lithium project, focused on the Cherry, Hickory, Mesquite, and Pecan prospects. The development led to delineating many additional pegmatites, boosting the overall mapped dimensions of the zone.

Moreover, with further ground truthing of lithium soil anomalies, the company reported additional outcropping pegmatites at the Hickory and Cherry prospects.

Infill soil sampling and rock chip sampling was conducted in late-June 2022 at the Pecan, Cherry and Hickory prospects. From the assay results, a coincident high-level lithium, beryllium, tantalum, and tin anomaly was highlighted in the Hickory prospect’s northern end. These elements are common pathfinder elements for LCT-pegmatites.

The Company mapped transported colluvial sands on the edges of the soil sampling areas. These areas seem to mask geochemical response on the outskirts of the prospect. This indicates that the anomalism is open to the north, south, east, and west under cover.

The Cherry and Hickory prospects show two trends, relatively distinct from each other and open in all directions.

RC drilling program at Hickory - The first phase of drilling was undertaken at the Hickory prospect in October, across 33 RC holes for a total of ~3,000-5,000m.

The drilling target was a strike length of 1,200m of the pegmatites identified by field mapping. The target of the program will be the UST pegmatites at the Hickory prospect’s northern end, where there is higher tenor lithium anomaly in soils. Notably, the UST-textured pegmatites also host the highest tenor pathfinder elements. Further, drilling is all set to test the pegmatites under the transported cover to north along strike.

Infill soil sampling at Pecan - Alchemy conducted infill soil sampling over the high-priority Pecan prospect. The soil geochemistry reported scattered but coincident common LCT pegmatite pathfinder elements, including niobium, rubidium, beryllium and gallium.

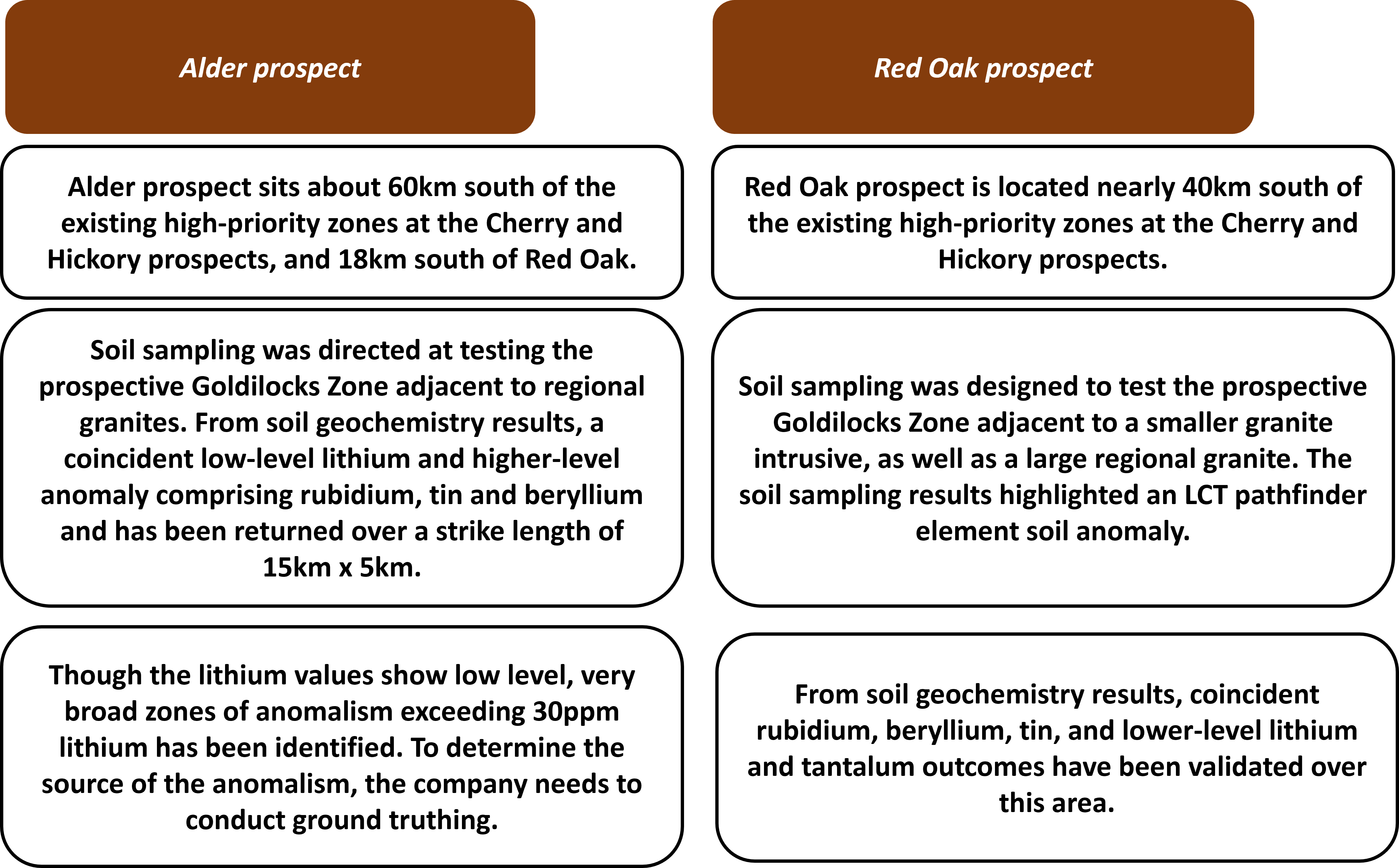

Red Oak and Alder – New prospects - At Karonie, regional soil sampling explored for indications of potential LCT pegmatite mineralisation. From the assay results, broad but coherent and coincident beryllium, rubidium, and tin anomalism was returned.

The new prospects have been christened ‘Red Oak’ and ‘Alder’.

Data source: company update

Gold exploration across Karonie – The company wrapped up reverse circulation at the Karonie East, KZ5, and Gilmore prospects in the first half of 2022 to test several prominent magnetic and structural features.

The results show low-level anomalism, which the company intends to follow up.

ALY shares were trading at AU$0.029 in the early hours of 15 November 2022.