Highlights

- Aguia Resources has announced that a meeting to discuss a written settlement proposal in the ongoing PCA relating the environmental licensing for its phosphate project is scheduled for 28 February 2023.

- The PCA was filed by the FPPO against AGR and the State Environmental Protection Agency regarding Environmental Impact Assessment for Aguia’s phosphate project.

Aguia Resources Limited (ASX: AGR) shares rallied on the ASX on 16 February 2022 with an uptick of over 15.5%. The trigger in the share price followed a company update regarding a possible settlement in the ongoing Public Civil Action (PCA) relating the environmental licensing for its phosphate project.

Aguia Resources has shared that a meeting to discuss a written settlement proposal has been scheduled for 28 February 2023. This comes after the first conciliation hearing was held by the trial court earlier this month on 02 February 2023.

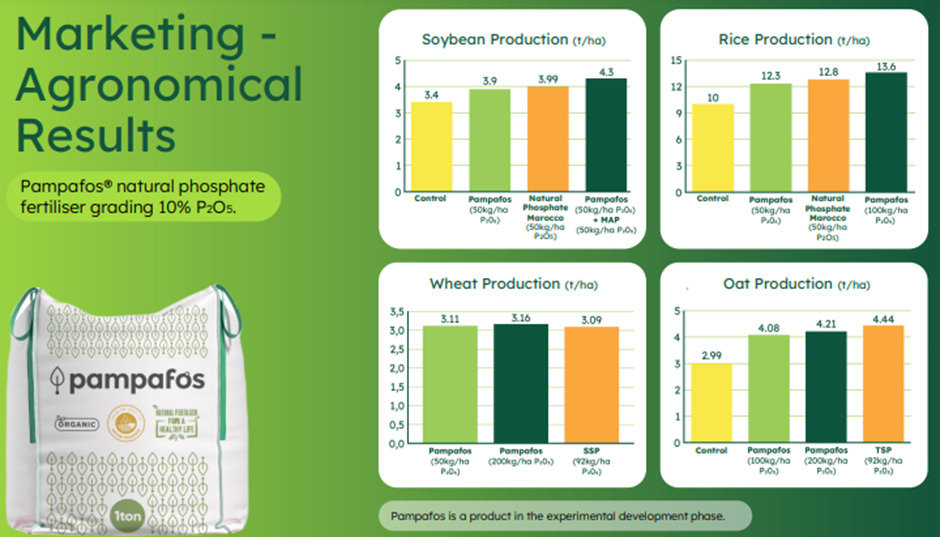

Image source: AGR PPT

Significance of PCA settlement

The PCA was filed in 2021 against Aguia Resources and the State Environmental Protection Agency (FEPAM) by the Federal Public Prosecutor (FPP) over the Environmental Impact Assessment for AGR’s Três Estradas Phosphate Project (TEPP).

After the company’s constant efforts, Aguia has been able to get the plaintiffs for a discussion over a possible settlement in the ongoing Brazilian legal battle. If the involved parties agree for a mutual settlement, the litigation will end. Consequently, the construction work will begin at the phosphate project.

Overview of Brazilian phosphate project

The company’s phosphate project is set to be the first phosphate mine in the South of Brazil.

Aguia has been involved actively in preparing for the construction, which is subject to the execution of a settlement in the case. The company has appointed Australian mining consultancy firm Harrier in an advisory role to the project and a highly experienced sales team with 35-year experience in agricultural sales and marketing.

Image source: AGR PPT

Moreover, the company is advancing work to finalise an updated Banking Feasibility Study in early March 2023.

Besides dealing with the ongoing legal proceedings relating this project, the multi-commodity company remains committed to develop its current projects into production whilst pursuing other opportunities within the industry.

AGR shares were trading at AU$0.052 in the early hours of 17 February 2023.