Highlights

- Aeramentum Resources owns 100% of 8 tenements in the Republic of Cyprus.

- The company’s Laxia, Pevkos and Apsiou projects are highly prospective for battery minerals including copper, cobalt, and nickel.

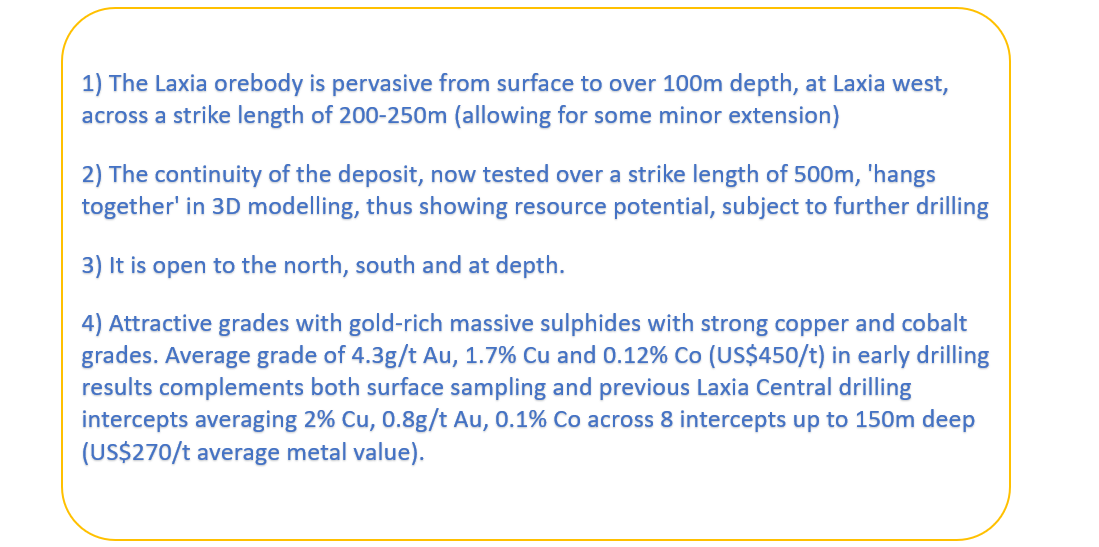

- Aeramentum recently completed a 500m diamond drilling campaign at Laxia project to demonstrate the scale and grade potential of the deposit.

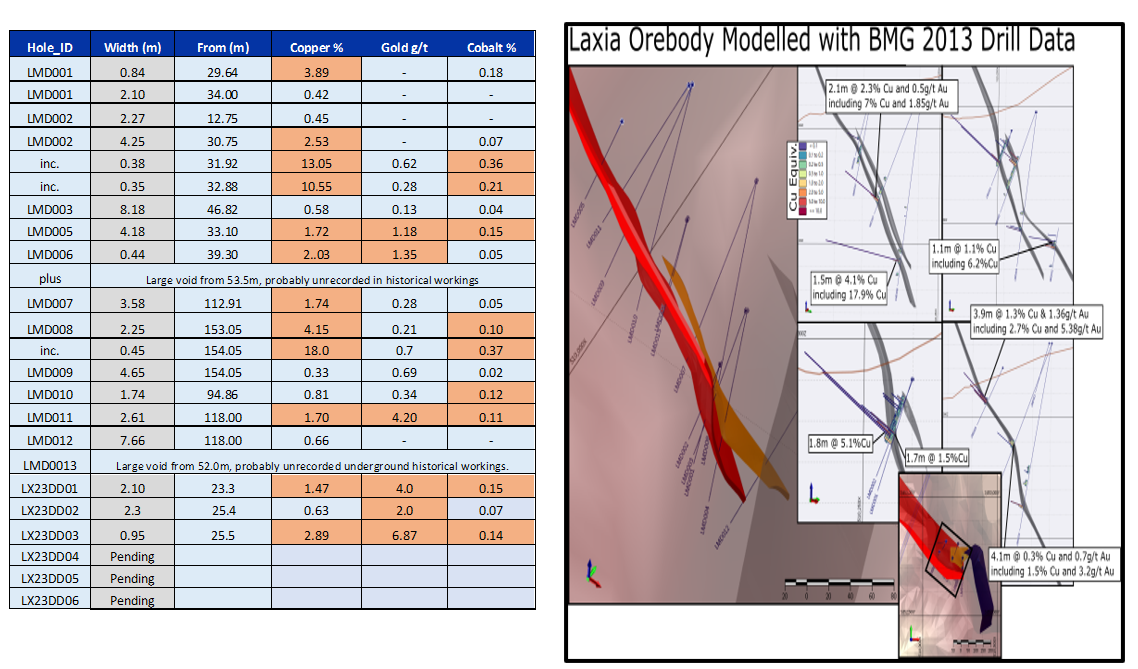

- Previous drilling showed average results of 3-4g/t Au, 2% Cu and >0.1% Co across modest widths (12/13 holes intersected mineralisation) of 2-4m.

- Preliminary results include shallow massive sulphides, such as 2.1m @ 4.0g/t Au and 1.5% Cu, 0.15% Co from 23m and 1m @ 3% Cu, 7g/t Au and 0.14% Co from 25m

- The company is expecting to receive additional assay results in coming weeks.

The massive sulphide orebody as viewed underground at Laxia West

Diamond drilling at Laxia Project

The project is in close proximity to coastal city of Limmassol, with up to 900m of underground adits completed historically at the Laxia Prospect. Grades of 8m @11.2% Cu and 4m @ 16.8% Cu were observed in historical mapping and sampling. The potential orebody has been delineated in outcrop over 1km in length, open along strike.

The historical drilling (2013/14) results included 4.2m @ 1.7% Cu, 1.2g/t Au and 0.15% Co (from 33m) and 2.6m @ 4.2g/t Au, 1.7% Cu, 0.1% Co (from 118m) and 1m @ 12% Cu, 0.3% Co, 0.5g/t Au from 32m.

Recent shallow results included 2.1m @ 1.47% Cu, 4.0g/t Au and 0.15% Co from 23m, 1m @ 2.9% Cu, 6.9g/t Au and 0.14% Co from 25m and 2m @ 2.0g/t Au and 0.64% Cu, 0.07% Co from 25m.

There was average grade of 3.8g/t Au, 0.73% Cu, 0.1% Co (6.0g/t AuEq) reported in the 2022 sampling (14 samples, 50kg) of surface exposures, stockpiles.

|

Core from drillhole LXD001_23 at Laxia, May 2023 |

The drill campaign demonstrated the following:

Data source: Company presentation

Battery metals gain traction in the EU

Formed in 2017, the European Battery Alliance (EBA) has 750 members from mining companies, manufacturers, and recyclers.

Aeramentum Resources refers to independent research studies suggests that the new battery market is forecast to hit EUR250 billion by 2025.

As the region is expecting a ban on internal combustion engines by 2035, potentially 80% of new cars would be electric vehicles by 2030. The EU Rules of Origin stipulate a minimum % of materials in batteries must be sourced from within the EU.

Amid the EU support and growing demand for battery metals, Aeramentum Resources is eyeing to tap the growth opportunities through project acquisition.

AERAMENTUM HISTORY

eramentum Resources Limited was founded in 2021 with the purpose of acquiring the ‘Treasure Project’, from Caerus Mineral Resources (LSE:CMRS) principally the Laxia Prospect. The acquisition was finalised late 2022.A team of 6 geologists were employed in mapping, sampling and a total of eight (8) tenements have now been acquired including one application. Over 40km of potential strike length, between the serpentinite and gabbro/intrusive rocks has been identified, some of which with known Cu-Au-Co in gossans and rock-chips. Geophysics is planned. Diamond drilling at West Laxia commenced in May, 2023, with the aim of following up surface mapping/sampling of massive sulphides, including a 7m wide zone of alteration/Breccia mapped in an adit (above) a sampled in 2021 (including 1m @ 15 g/t Au, 4.8% Cu). All 6 holes hit mineralisation with assays due by July’23. Drilling of the Pevkos Ni-Co prospect and the Apsiou Copper Prospect are planned in 2023.

EXPLORATION STRATEGY

- Resource Definition Drilling (A$1.5M) – Target is >2Mt JORC resource at a grade of >5g/t AuEq or 4% CuEq at Laxia, Indicated/Inferred (and formal ‘Exploration Target’ publication)- Drill down-dip to 200m vertical, in addition to shallower ‘infill’ type drilling.

- Geophysics, Diamond drilling at Pevkos (2m @ 3% Ni, 3 g/t Au) and at Apsiou (Cu) – RC or Diamond drilling

- Metallurgical testwork at Laxia with Pre-Feasibility Mining and Environmental studies commenced in 2024.

DEVELOPMENT POTENTIAL

- Bou Azzer (Morocco) is one of the highest grade cobalt mines in the world and has produced >100kt of cobalt and 10 tonnes of gold since the 1930’s – Typical grades 1% Co, 2-3% Ni and 3-4g/t Au, at >800m depth currently indicating depth potential at the Treasure Project. Recent cobalt offtake with Renault (Managem).

- At Pevkos high grade nickel (up to 11%) and cobalt (3%) have been identified in the adits. Drilling to date has focused on Laxia, with a recent 6-hole diamond program following up a 14 hole project in 2013/14. Diamond drilling at Pevkos is planned.

- At Laxia, drilling has now been carried out over almost 500m of strike, identifying a 1-4m wide ore zone containing Cu-Co-Au rich massive sulphides. The next drilling program is designed to delineate a JORC maiden Inferred resource >1Mt and/or Exploration Target, followed by a Scoping Study/Feasibility into a modest scale 250-350ktpa mostly underground mine. Average metal values to date at Laxia are around A$400-500/t, indicating potential for an economic project, with >85% of drillholes hitting mineralisation and grades up to 18% Cu, 0.4% Co and 10g/t Au. If you took 10Mt @ 0.1% cobalt1, that is 100,000t of cobalt, worth US$3.5B at current prices, hence cobalt is a key potential revenue component of any future mining operation.

- The prospect has a lot of positives, close to infrastructure (power, sealed roads, coastal ports, end users), orebody from surface (no expensive decline or pre-strip) favourable mining location (over 45 past mines on the island, long history of copper mining) and fiscal conditions (low corporate tax, EU benefits)

1 If you had an orebody 1km long, and 300m deep, average width of 3m, SG of 4.0, then there is 120kt per 100m strike/depth, hence 360kt per 100m strike at 300m depth, or 3.6Mt per km. 10Mt assumes both continuity at depth beyond 500m, and additional prospects containing cobalt to be brought into resources, thus is not currently suggested by the amount of exploration conducted, and is in no way to represent any forecast, estimate or calculation used for illustrative purposes only.

PROJECT LOCATION & SETTING

The Treasure Project is located in the South – Central of the Republic of Cyprus, approximately 15km north from the nearest city, Limassol. The region has maximum relief of approximately 1000m with topography generally steep with Forestry the dominant landowner in the area. All teneements accessible by road, with Paphos and Larnaca International Airports an hour or so away, close to shipping ports.

Top: Aerial Photo showing Conceptual orebody at Laxia, over 1.2km of strike, and historical drilling/ sampling locations. An additional 200m of strike identified to the north-west.

Top: Aerial Photo showing Conceptual orebody at Laxia, over 1.2km of strike, and historical drilling/ sampling locations. An additional 200m of strike identified to the north-west.

PROJECT HISTORY

Copper has been mined in Cyprus for thousands of years, with more than 45 opencut and underground mines operating up until the 1970’s and several since. In the 1950’s Hellenic Mining put in over 1.5km of adits, including around 1km at Laxia. Some shallow drilling (vertical) was carried out, along with mapping and sampling. This was continued into the 1970’s by Noranda Exploration, who conducted a geophysical survey prior to a drilling program comprising 4 shallow drill holes. Later, 13 drill holes up to 200m depth were completed by BMG (Brazillian Metal Group) in 2013-2014, in Central Laxia.