Highlights

- Jindalee holds the McDermitt lithium project, and has signed an MOU with POSCO for further development

- The company has spun out its Australian critical commodities portfolio to become a pure-play Li company

- JRL and POSCO will jointly assess the commercialisation of McDermitt after testwork is completed

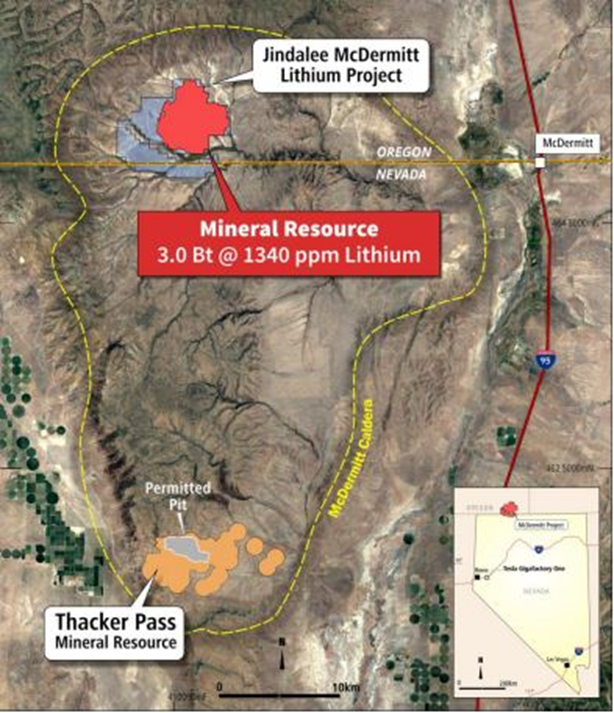

ASX-listed Jindalee Resources (ASX: JRL) -- which is predominantly focused on developing its fully owned Tier 1 lithium deposit (McDermitt) -- released its corporate presentation in February this year. The presentation highlighted JRL's activities at McDermitt, which is stated to have the potential to change the lithium supply dynamics in the US. Notably, after the spin out of its Australian critical commodities portfolio, JRL is now a pure-play Li company focused on the McDermitt Lithium Project.

Below are the key points covered in the corporate presentation with respect to the company’s McDermitt Lithium Project.

Developments across McDermitt Project

Source: JRL Corporate Presentation dated 27 February 2023

The project is in Malheur County, which has close proximity to the McDermitt town. It is pertinent to note that McDermitt is the largest Li deposit in the country, as highlighted by the company.

Jindalee finished a drilling program (four holes) back in September 2018. This intersected "broad widths of sediment host Li mineralisation". Following this, the company has now drilled as many as 62 holes (both RC and diamond drilling), and the Mineral Resource has shown an increase with each drilling program.

The claims area, which is fully owned by Jindalee, spans over 54 sq. km. JRL has also mentioned that the McDermitt Li project is a low-cost mining operation, with "excellent" metallurgical recoveries (flat sediments with low strip ratio). The ore is stated to be soft, meaning cost-efficient mining and crushing.

Source: JRL Corporate Presentation dated 27 February 2023

MOU with POSCO Holdings

Jindalee has a non-binding MOU with POSCO Holdings, a listed entity on the NYSE, for joint research activities for Li extraction at McDermitt. Notably, POSCO is a big Korean company and supplies cathode active materials to General Motors. Under the MOU, POSCO will provide funding for the testwork on a composite sample of McDermitt ore. Once the testwork is completed, both the companies will jointly assess the commercialisationof McDermitt.

It is pertinent to note that POSCO, a major steel producing company, is looking to become a strong player in the battery minerals sector. The company has deployed eco-friendly Li extraction technology and is developing products for solid-state batteries.

Highly encouraging metallurgical results

There are two main processing routes for sediment hosted lithium deposits: Acid Leaching (H2SO4 or HCl) and Alkali Salt (sulphation) Roasting.

Results achieved at McDermitt from both process routes

Data source: Company update

To know more about the company’s update on preferred extraction process for McDermitt Lithium Project, read here.

Separately, the corporate presentation of Jindalee also cites opportunities in the Li market, which has seen prices accelerating due to "significant" shortage in the supply of the material. The strong bipartisan support in the US for critical mineral projects has also been cited.