Highlights

- In 1HFY24, MTB had its focus on assessing the way forward for its Kihabe and Nxuu deposits.

- The potential to exploit known metal credits is being evaluated.

- The company aims at enhancing the potential for on-site beneficiation of metal production.

Mount Burgess Mining N.L. (ASX: MTB) is an ASX-listed base metals exploration and development firm which is presently focused on advancing its Kihabe and Nxuu and vanadium deposits. During the first half of the financial year 2024 (1HFY24), the company was engaged in evaluating the way forward for its Western Ngamiland, Botswana-based project. This includes assessing the potential to further exploit known metal credits and evaluating several metallurgical processes which could assist in improving the potential for on-site beneficiation of metal production.

At the end of six months, the company had cash reserve of AU$185,788.

Development across Kihabe and Nxuu deposits to date

On 17 January 2023, the company secured a two-year renewal to PL 43/2016, extending the access to 31 December 2024. PL 43/2016 covers 1000km2 of area and lies in a Neoproterozoic belt which is known to be prospective for precious, base, and strategic metals.

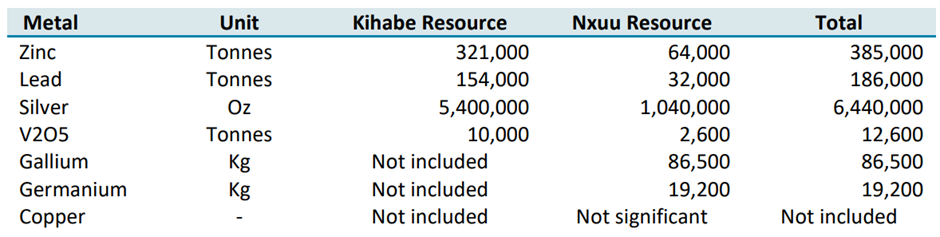

The company had already developed inferred and indicated mineral resource estimates (MRE) at the Kihabe and Nxuu deposits, which is compliant with the 2012 JORC code.

At the Kihabe deposit, the company had estimated mineral resource of 21 million at 2% zinc equivalent grade, following the application of 0.5% zinc equivalent low cut. Kihabe MRE includes vanadium pentoxide, silver, lead, and zinc and excludes copper, germanium, and gallium. To incorporate them in MRE, further assaying and drilling is required.

At Nxuu deposit, at 1.8% zinc equivalent grade, a 6 million tonne mineral resource was expected. In the MRE, 0.5% zinc equivalent was applied. Nxuu MRE contains zinc, silver, lead, gallium, germanium, and vanadium pentoxide. This deposit has capability to be an open-cut mining venture. 83.4% of the deposit’s mineralisation is included in MRE and remaining 16.6% includes 6.9% Kalahari sand cover and 9.7% barren quartz wacke.

Here's the summary of MRE:

Image source: company update

To obtain the MREs of both deposits, the company had evaluated and reviewed the probability of uncovering new findings through exploration. Moreover, MTB had examined the risk and rewards in comparison to exploration costs and values of the mineral under consideration.

MTB shares last traded at AU$0.003 apiece on 11 March 2024.